Bitcoin (BTC) Production Costs Rise Over 9% in Q2 2025, What Impact for Crypto Miners?

News Highlights:

- Bitcoin (BTC) production costs are expected to jump by more than 9% in the second quarter of 2025.

- Increased energy prices and network hashrate affect miners’ profit margins.

- Bitcoin mining companies with revenue diversification show better stock performance.

Jakarta, Pintu News – The cost of producing Bitcoin (BTC) is expected to rise significantly in the second quarter of 2025. According to a recent report from Bitcoin mining research firm TheMinerMag, the median cost of producing a single Bitcoin is expected to exceed $70,000 this quarter, signaling an increase of more than 9% compared to the first quarter of 2025.

This is due to two main factors: an increase in network hashrate which puts a heavy burden on miners and rising energy prices.

While Bitcoin price continues to show a positive trend, miners are facing challenges in maintaining their profit margins amidst ever-increasing operational costs.

Significant Increase in Bitcoin Production Cost

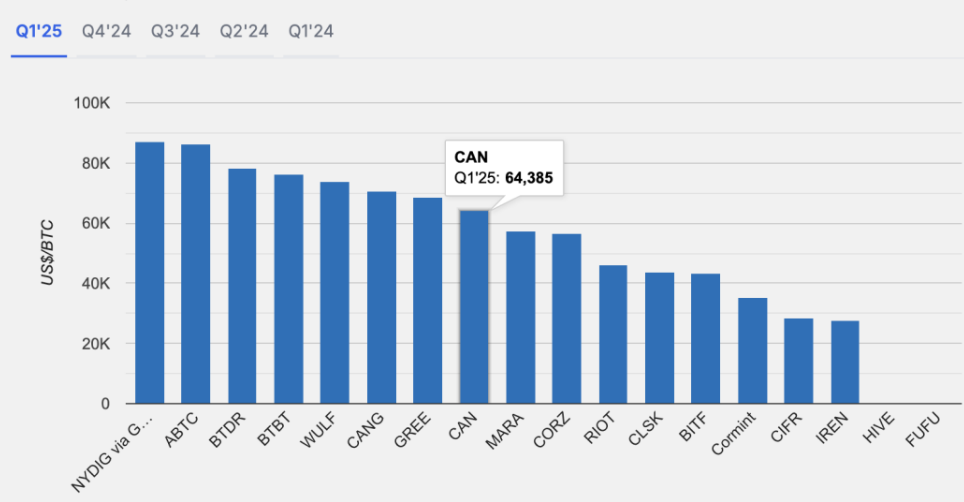

As reported by Cointelegraph, in the first quarter of 2025, the cost of producing Bitcoin (BTC) has increased quite sharply, rising from $52,000 (Rp846 million) in the last quarter of 2024 to $64,000 (Rp1.04 billion).

This increase is expected to continue, with production costs in the second quarter estimated at over $70,000 (approximately Rp1.14 billion). One of the main factors influencing this cost increase is the increasing network hashrate.

As more miners join, the difficulty of mining Bitcoin (BTC) increases, requiring more energy and computing power.

In addition, higher energy costs also have a major impact on operating costs. For example, the energy cost of mining Bitcoin at some mining companies such as Terawulf and Bitdeer has increased by more than 25%, largely due to a spike in energy prices to $0.081 (Rp1.32K) per kilowatt-hour (kWh) in the first quarter of 2025, almost double compared to the price of $0.041 (Rp0.67K) in the first quarter of 2024.

How Bitcoin (BTC) Price Affects Miners

Despite higher production costs, Bitcoin’s price of $107,635 (around Rp1.75 billion) gives miners some breathing room. However, there are concerns that the profit margins of less efficient miners could dwindle further if the price of Bitcoin does not continue to rise.

Also read: Brad Mills Predicts BTC Could Rise 100x in 10-20 Years, What’s His Analysis?

The more efficient miners may still be able to survive, but the less efficient ones may have to face greater financial pressure.

Exchange-listed Bitcoin mining companies, such as Core Scientific and Cipher Mining, have focused on keeping their operational costs efficient by utilizing the latest technology to lower hash costs.

One method is to continuously modernize mining machines to improve power efficiency. However, some companies like Terawulf have also seen their costs increase significantly, leading to a decrease in their profit margins.

Income Diversification Investments Boost Bitcoin Miner Stock Performance

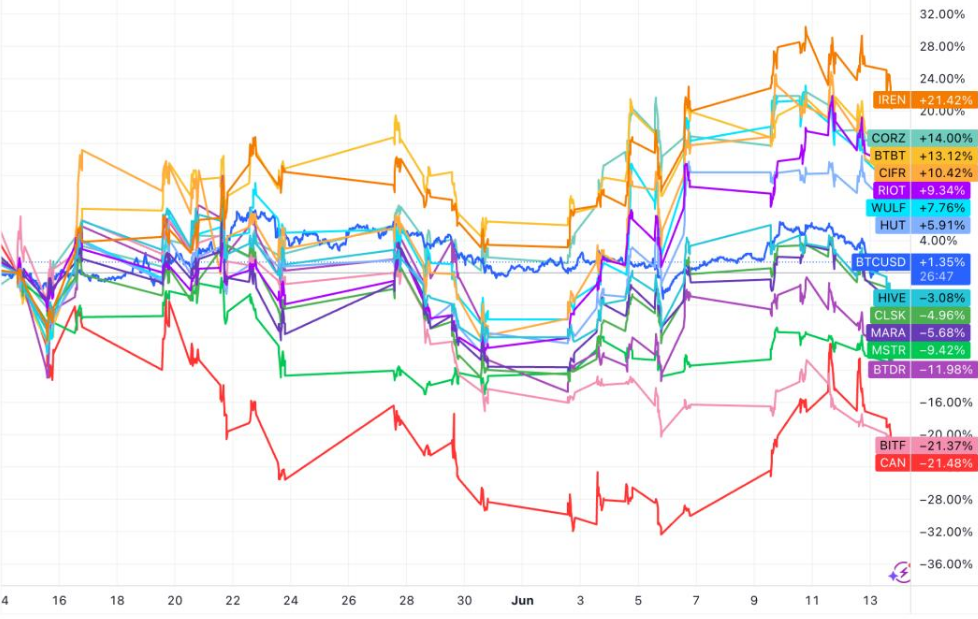

In the face of ever-increasing production cost challenges, investors are increasingly looking at Bitcoin mining companies with more diversified revenue streams.

While the shares of companies such as IREN (IREN) and Core Scientific (CORZ) recorded significant price increases – 21.4% since the beginning of May 2025, companies such as Canaan (CAN) and Bitfarms (BITF) experienced a sharp decline in stock performance, falling more than 21% each.

Revenue diversification is becoming an important factor for Bitcoin miners, especially for those who are developing revenue streams other than mining, such as AI hosting services and high-performance computing. This helps these companies to reduce their dependence solely on the Bitcoin price and protects them from the volatility of the crypto market.

Conclusion

The rise in Bitcoin (BTC) production costs in the second quarter of 2025 shows that despite the continued rise in Bitcoin price, miners are facing severe challenges in maintaining their efficiency and profit margins.

With more miners operating, higher energy costs, and increasing difficulty in mining, they must find ways to manage their operational costs.

In this regard, revenue diversification is becoming an increasingly important strategy for the long-term viability of mining companies. Investors are also increasingly looking at companies that have broader revenue streams, rather than relying solely on Bitcoin mining revenue.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin Production Costs Up 9% on Higher Hashrate, Energy Prices. Accessed June 17, 2025.

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.