Ethereum Slides 3% Today (June 18) — Are Whales Gearing Up for the Next Big Rally?

Jakarta, Pintu News – An Ethereum (ETH) “whale”, who has been inactive for the past two years, just sold 501 ETH – worth about $1.29 million – on June 17, 2025.

Nonetheless, the wallet still holds 8,052 ETH, which is worth around $20.43 million, according to a tweet from a well-known analyst. This activity is in line with the broader trend of accumulation by whales.

While the price of ETH has remained within a limited range over the past month, recent moves by large holders could signal preparations for a potential price spike.

Before discussing further, let’s take a look at Ethereum’s current price movements first!

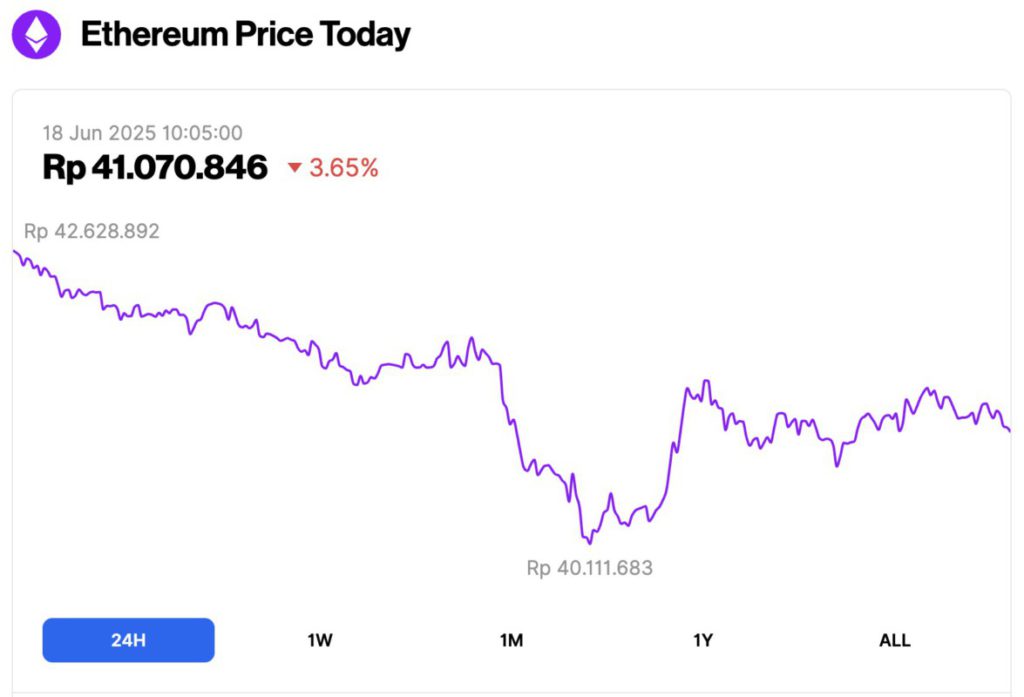

Ethereum Price Drops 3.65% in 24 Hours

As of June 18, 2025, Ethereum (ETH) was trading at approximately $2,514, or around IDR 41,070,846 — marking a 3.65% drop over the past 24 hours. Within that timeframe, ETH reached a high of IDR 42,628,892 and dipped to a low of IDR 40,111,683.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $303.65 billion, with daily trading volume falling 3% to $24.41 billion in the last 24 hours.

Read also: Bitcoin Plunges to $104,000 — Is This Just the Beginning of a Bigger Crash?

Ethereum Whales Accumulate as Short Position Liquidation Explodes

On-chain metrics report a surge in whale buy orders in recent days. This accumulation pattern is in line with the increasing short liquidation in the derivatives market-a signal that short sellers are under pressure.

On June 13, Ethereum experienced the largest short liquidation of the month-$1.7 billion worth. This momentum continued on June 16 with an additional short liquidation of $753.72 million.

This wave of forced closures has created ideal conditions for a potential short squeeze. When these positions are liquidated, the resulting surge in buying pressure could push ETH prices higher.

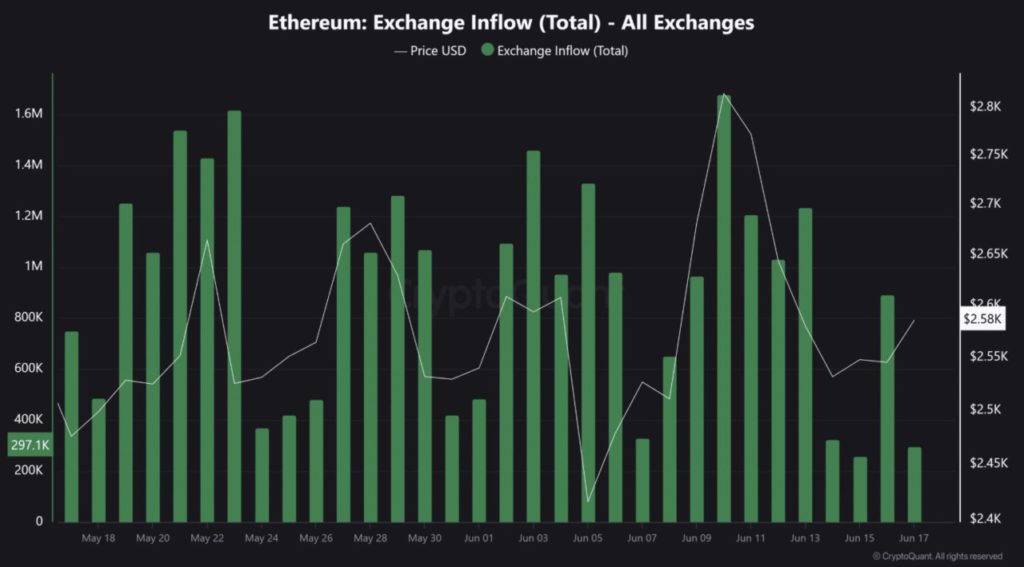

Inflows to Exchanges Decline as Selling Pressure Eases

Another positive signal is the decrease in Ethereum inflows to centralized exchanges, which suggests that selling pressure is easing. This trend could signal a return of investor confidence, especially as whales further strengthen their accumulation.

Read also: Donald Trump’s Truth Social Takes Bold Step, Files for Both Bitcoin and Ethereum ETFs!

This decrease in inflows also reduces selling pressure in the short term, providing additional impetus for a potential price breakout if demand continues to increase.

A previously inactive whale begins to realize profits, which triggers broader whale activity and market liquidation-a signal that a possible rally is in the making.

The combination of increasing short liquidation, decreasing inflows to exchanges, and growing accumulation by large holders suggests that Ethereum may be preparing for a breakout.

As ETH remains in a consolidation phase, market watchers are asking: Is this the calm before the next big move for Ethereum?

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Analyzing Ethereum’s $1.29M whale action – A short squeeze in sight, IF… Accessed on June 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.