Bitcoin (BTC) hits a new low, what does it mean for the market? (6/18/25)

Jakarta, Pintu News – In recent times, Bitcoin (BTC) price movements have shown interesting dynamics. The decline in inflows to exchanges reached a new low, signaling a significant change in investor behavior.

This trend is not only seen among large investors or “whales” but also retail investors who choose to hold their Bitcoin (BTC) over the long term. This analysis will delve deeper into what this phenomenon means and how it affects the price of Bitcoin (BTC) in the market.

Decrease in Inflow to the Exchange

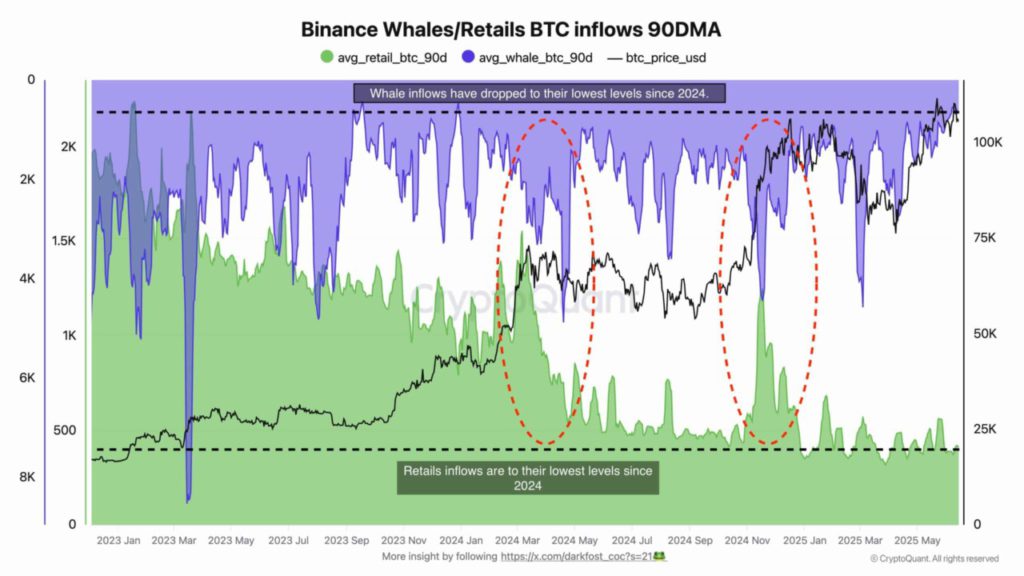

According to analysts from CryptoQuant, Darkfrost, Bitcoin (BTC) inflow to Binance Exchange from whales and retailers has reached a historical low. This decline indicates that both groups of investors prefer to hold their coins rather than sell them. This behavior, often referred to as HODL, indicates a positive expectation of future Bitcoin (BTC) value increases.

When inflows to exchanges decrease, it usually signals that investors are not looking to offload their assets anytime soon. This happens amid heightened geopolitical uncertainty, where Bitcoin (BTC) is often considered a “safe haven” asset. This decline in inflows is not just limited to Binance, but has also been seen on various other exchanges, suggesting a similar trend across the market.

Read More: Company’s Bitcoin Accumulation Strategy Threatened, Stock Falls!

Accumulation Behavior by Whales

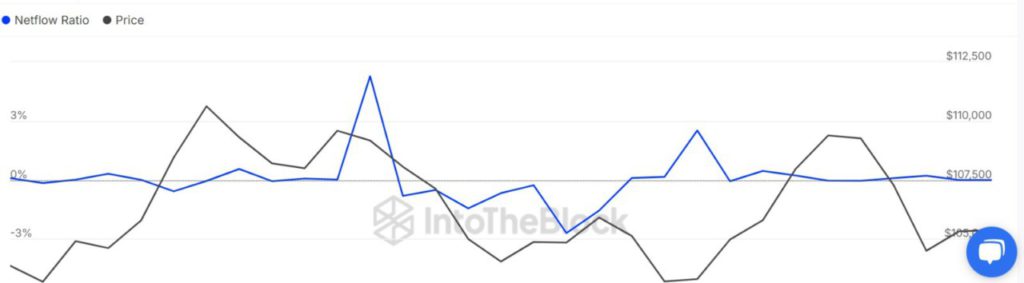

Furthermore, the data shows that there is not only a decrease in inflows, but also significant withdrawal activity by whales from exchanges. This signifies that they are not only holding the coin, but also actively accumulating it. The ratio of Large Holder Netflow to Exchange Netflow has shown a significant decline, reaching zero in the last two days, signaling massive accumulation.

The alignment between the behavior of whales and retail investors indicates a strong belief in the prospects of Bitcoin (BTC). In previous market cycles, similar patterns have been seen when inflows to exchanges were synchronous and reached market peaks. This time, with low inflows, it could be a strong indicator that the market may see further price increases.

Impact on Bitcoin (BTC) Price

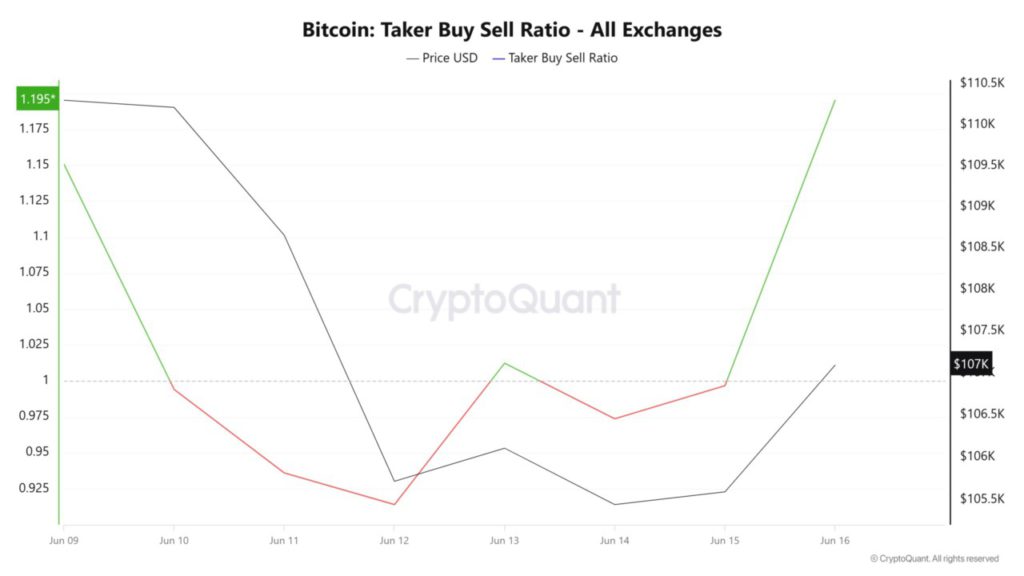

The impact of this decreased inflow is clearly visible on the price movement of Bitcoin (BTC). In the daily chart, Bitcoin (BTC) experienced a significant price spike, reaching a new peak of $107,251. This spike came after three days of consolidation, indicating increased demand in the market.

In addition, the Buy-Sell Ratio by Takers on Binance also showed an increase, reaching a monthly high. This signals that buyers are starting to dominate the market, replacing sellers. If this trend continues, Bitcoin (BTC) has the potential to reach the $109,000 level again. However, in case of profit-taking, Bitcoin (BTC) price might return to the consolidation range between $103,000 and $105,000.

Conclusion

The decline in inflows to exchanges and accumulation behavior by whales as well as retail investors indicate a new phase in the Bitcoin (BTC) market dynamics. Given these indicators, investors may need to adjust their strategies in anticipation of a possible further rise in Bitcoin (BTC) price. Understanding these trends will be crucial to making the right investment decisions in the future.

Also Read: Metaplanet Reaches 10,000 BTC Target: What Does It Mean for the Future of Cryptocurrency?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin: What this new historical low means for BTC’s price action. Accessed on June 18, 2025

- Featured Image: The image created by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.