Crypto Investments Experience Biggest Withdrawal, New Opportunities for Altcoin Buyers!

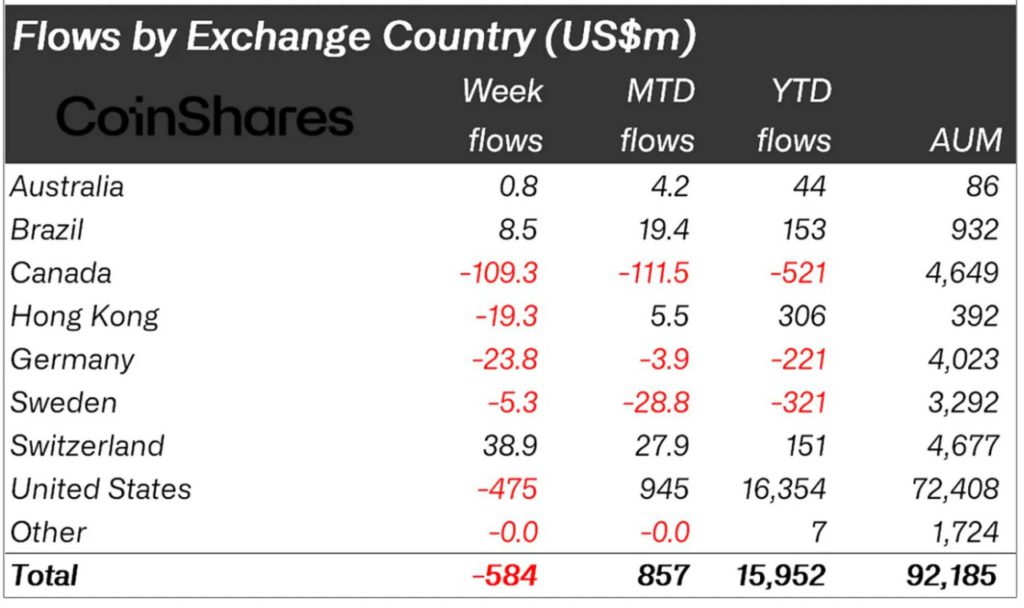

Jakarta, Pintu News – This week, cryptocurrency investment products saw another massive withdrawal of funds for the second consecutive period. The latest report from CoinShares shows that a total of $584 million was withdrawn from crypto-focused investment vehicles, bringing the total withdrawals in two weeks to $1.2 billion.

This comes amid investor uncertainty regarding the possibility of an interest rate cut by the US Federal Reserve this year. James Butterfill, Head of Research at CoinShares, attributes this withdrawal to growing skepticism towards macroeconomic policy changes, specifically interest rate reductions.

Bitcoin and Ethereum (ETH) Hit the Hardest

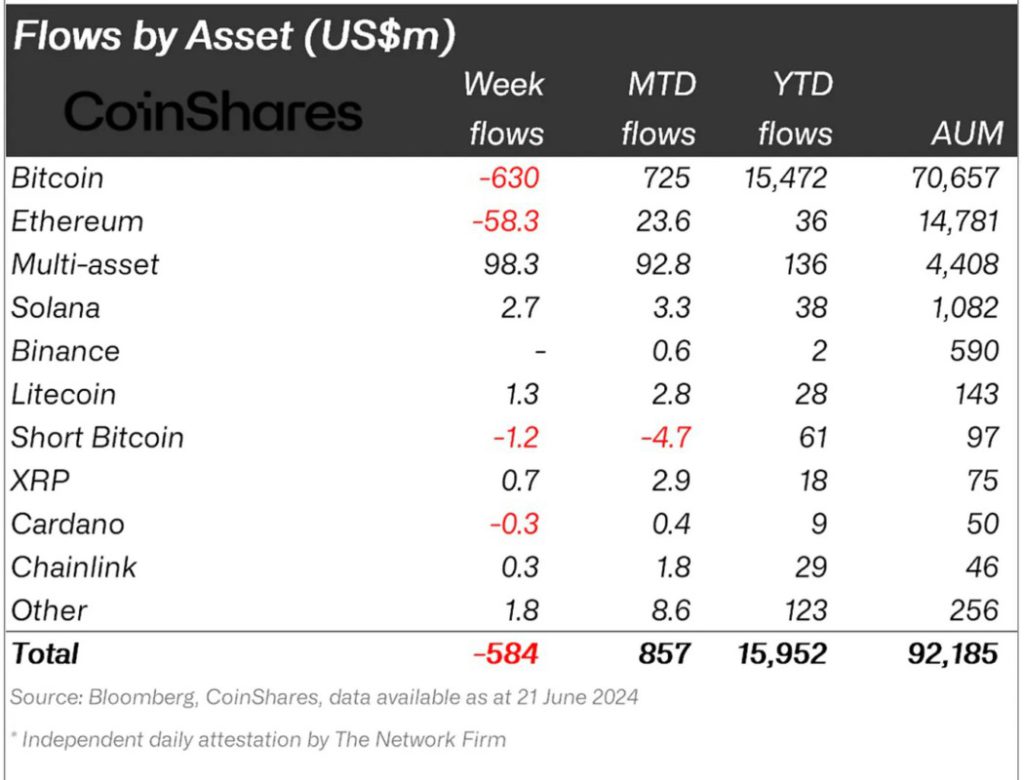

Bitcoin (BTC) was the most withdrawn asset this week, with $630 million leaving Bitcoin (BTC) investment products. While there was significant movement of funds from long-term Bitcoin (BTC) positions, short-term Bitcoin (BTC) products also recorded withdrawals of $1.2 million.

This suggests that investors are currently not betting much on downside exposure, choosing instead to wait on the sidelines amid uncertain market conditions. Ethereum (ETH) also experienced negative fund flow activity, with a withdrawal of $58 million, which continues to follow the trend of cautious investor behavior in major assets.

Also Read: Bitcoin (BTC) Hits a New Low, What’s the Impact on the Market? (6/18/25)

Altcoin Draws Selective Support

Although sentiment remains bearish for large-cap assets, some altcoins managed to attract fund inflows. Solana (SOL), Litecoin (LTC), and Polygon (MATIC) recorded modest but noticeable gains of $2.7 million, $1.3 million, and $1 million, respectively. These fund flows may reflect opportunistic positioning by investors seeking exposure to recently underperforming assets.

In addition, multi-asset investment products, which spread exposure across different cryptocurrencies, recorded inflows of $98 million. This indicates that some investors are using the recent price weakness to gain diversified access to the market rather than concentrating bets on a single token.

Crypto Market Remains Reactive to Global Monetary Policy

The continued divergence in fund flows highlights the complex sentiment currently affecting crypto markets. With macroeconomic uncertainty still dominating investors’ outlook, digital asset markets remain reactive to global monetary policy signals and evolving regional investment trends. The overview displayed with DALL-E and charts from TradingView add visual insights to the current market dynamics.

Also Read: Global Tensions Heat Up, Crypto Takes a Hit: What Really Happened? (6/18/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Crypto Funds Hit with Record Outflows, But Altcoin Buyers Smell Opportunity. Accessed on June 18, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.