Bitcoin Is Getting Closer to Its ATH — Here’s Some Important Advice from Peter Brandt!

Jakarta, Pintu News – Peter Brandt, a veteran trader known for his accurate predictions, recently provided valuable advice for new investors and traders amidst the rising price of Bitcoin (BTC).

With global markets in a state of uncertainty, Brandt suggests diversifying investment portfolios through the purchase of Bitcoin (BTC), as well as the S&P 500 and Nasdaq 100 Index ETFs. This advice comes as Bitcoin (BTC) approaches an all-time high, fueled by the pro-crypto policies of the Trump administration.

Check out the full analysis here!

Peter Brandt’s Investment Strategy

According to Peter Brandt, an investment combination of Bitcoin (BTC), the S&P 500 Index ETF, and the Nasdaq 100 ETF is an ideal strategy to deal with the current market volatility. This year, Bitcoin (BTC) has risen by 15%, while the Nasdaq 100 and S&P 500 have only gained 4.59% and 2.80% respectively.

This rise was mainly fueled by the pro-crypto policy support from the Trump administration which encouraged many companies to hold Bitcoin (BTC), Ethereum (ETH), and other altcoins.

With the crisis in the Middle East ongoing, Brandt emphasizes the importance of diversification to reduce risk. Investments in ETFs provide exposure to the broader economy, while Bitcoin (BTC) offers significant growth potential and protection against inflation.

Current Bitcoin Price Dynamics

Bitcoin (BTC) recently reached $106,884 after rallying towards $109,000. Price fluctuations in the past 24 hours show a low of $106,219 and a high of $108,915. Bitcoin (BTC) trading volume has also increased by 32% in the last 24 hours, signaling increased interest from traders.

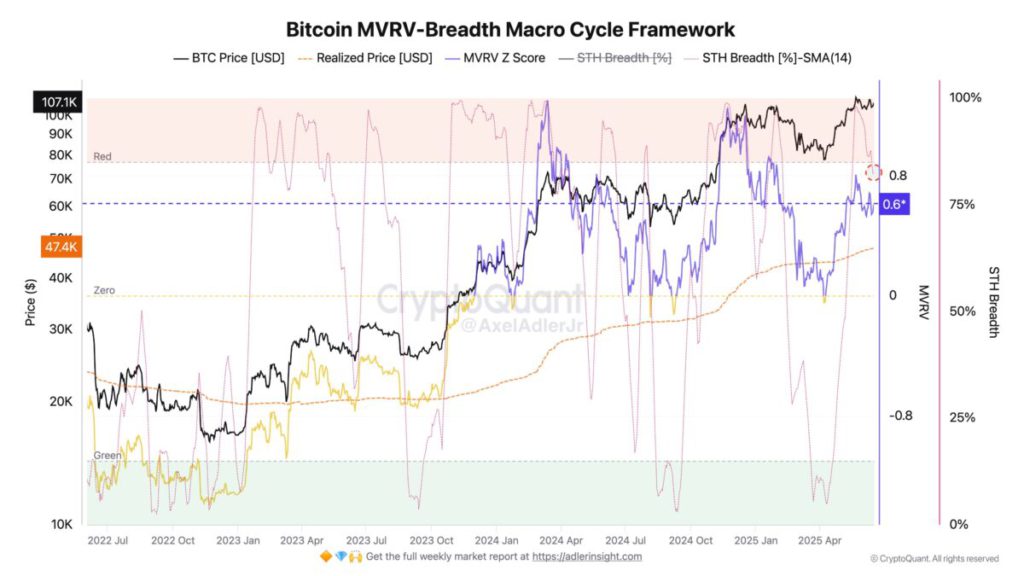

Despite predictions from Peter Brandt about a potential parabolic top and a possible major correction, on-chain analyst Axel Adler Jr. pointed out that Bitcoin’s (BTC) MVRV-Z score still shows strong buying power without overheating.

This suggests that while some short-term holders may start taking profits, current market conditions still favor further growth.

Also read: 3 “Hidden Gem” Airdrops Purchased by Whale in the Third Week of June 2025

The Impact of FOMC Meeting on Bitcoin

With the upcoming Federal Open Market Committee (FOMC) meeting, crypto markets are showing caution. Although the CME FedWatch Tool shows a 99.9% chance that the Federal Reserve will keep interest rates between 4.25% to 4.5%, Bitcoin (BTC) price movements could still be affected.

Market analysis shows that Bitcoin (BTC) is currently in the range of $104,000 to $110,000. If the price manages to break the resistance at $107,200 and $110,000, it could trigger a rally in Bitcoin (BTC) price to new highs. However, investors and traders should remain wary of a potential short-term correction.

Conclusion

With market conditions constantly changing and the potential for crisis increasing, Peter Brandt’s advice to diversify through Bitcoin (BTC) and ETFs could be a wise strategy. Despite the risks, the growth opportunities offered by Bitcoin (BTC) in the long term remain attractive to many investors.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Veteran Trader Peter Brandt Gives Golden Advice as Bitcoin Nears ATH. Accessed on June 18, 2025

- Featured Image: Coinnounce

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.