Hot Debate: Are Bitcoin Miners Really the Ultimate Sellers?

Jakarta, Pintu News – Jameson Lopp, a Bitcoin (BTC) advocate and co-founder of Casa, recently sparked a debate in the crypto community by challenging the common belief that miners are the main source of selling pressure in the market.

Check out the full information here!

New Opinions About Bitcoin Miners

Jameson Lopp expressed a different view on the role of miners in the Bitcoin (BTC) market dynamics. Through a tweet, Lopp stated that large companies are actually buying more Bitcoin (BTC) than the amount mined every day.

This raises questions about the true source of selling pressure in the Bitcoin (BTC) market. However, Lopp didn’t stop there. He added that newly mined Bitcoin (BTC) has little effect on market depth and volume.

According to him, the amount of newly mined Bitcoin (BTC) is just like a drop in the ocean compared to the amount available on various trading platforms.

Also read: Luxxfolio Holdings Chooses Litecoin as its Main Financial Asset, What’s the Reason?

Debate on Selling Pressure from Miners

One user responded by pointing out that newly mined Bitcoin (BTC) remains a “natural selling pressure”. However, Lopp firmly rejected this view, stating that miners are actually hodlers who sell Bitcoin (BTC) as small as possible.

This raises more questions from other users who are skeptical about how miners cover their operational costs if they don’t sell their Bitcoin (BTC).

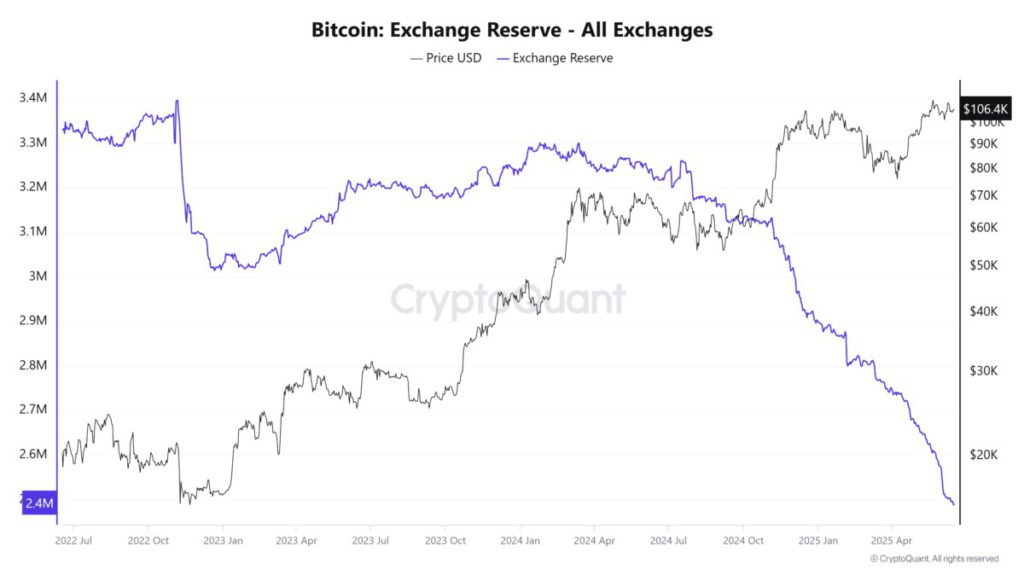

The discussion got even more lively when Bitcoin Capital shared a graph showing that miners seem to be slowly running out of Bitcoin (BTC). Lopp was quick to respond that the graph was deeply flawed and often adjusted afterward, making it unreliable for current data.

Also read: Bitcoin Is Getting Closer to ATH, Here’s Important Advice from Peter Brandt!

Broader Implications of the Debate

This debate is important as institutional demand for Bitcoin (BTC) continues to rise, with ETFs and corporate treasuries reportedly buying more Bitcoin (BTC) than they mine on a daily basis.

If it’s true that miners are actually holding onto their Bitcoin (BTC), this could mean there is less “natural” selling pressure than retail or institutional investors might expect.

With daily issuance already capped and supply cut events every four years, the bigger factor may be who is accumulating, not who is selling. Lopp’s views challenge common assumptions and invite market participants to consider supply dynamics in a different way.

Conclusion

Jameson Lopp’s comments have reignited the debate around miner behavior and selling pressure in the market. While some remain of the opinion that miners must sell to survive, Lopp insists that they are one of the strongest hodlers in the ecosystem.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Who’s Selling Bitcoin? Jameson Lopp Says Not the Miners. Accessed on June 18, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.