Ethereum (ETH) Prepares for a Surge: Bullish Signs Strengthen

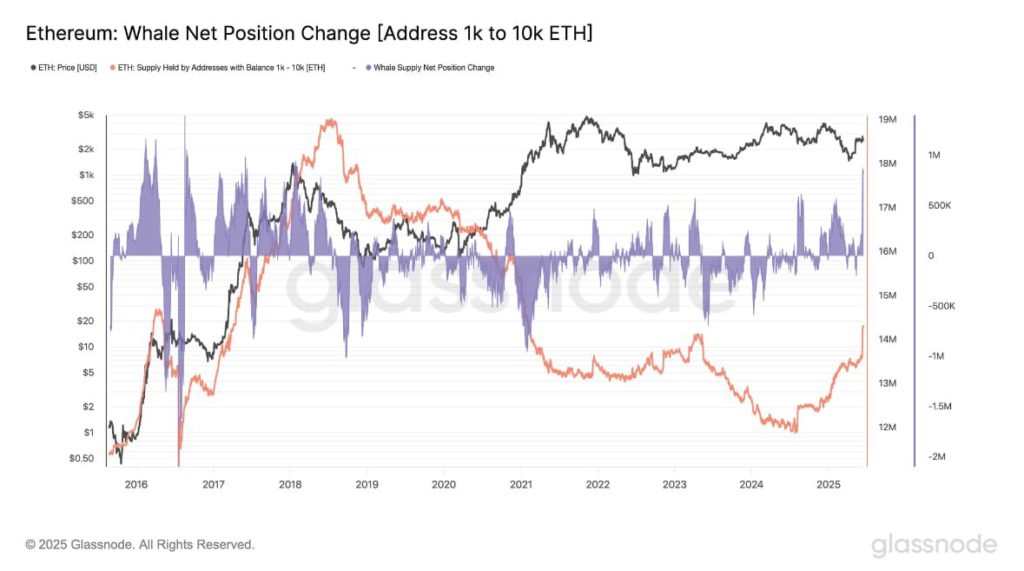

Jakarta, Pintu News – Massive buying by whales and increased fund flows into Ethereum (ETH) ETFs as well as institutional adoption point to a potential surge in Ethereum (ETH) prices in the near future.

Increased Fund Flow and Institutional Adoption

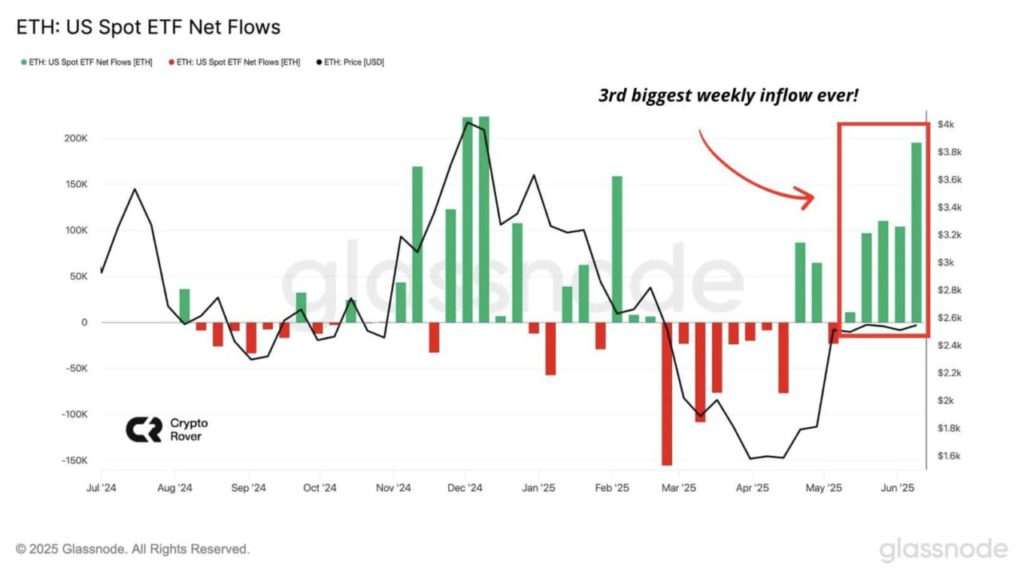

Last week, Ethereum (ETH) recorded net inflows of more than $450 million into spot ETFs, which was the third largest weekly flow since August 2024. This signaled a strong wave of institutional buying, which often occurs during quiet market periods as an accumulation phase for banks, institutional investors, and other savvy market participants.

This interest comes as the price of Ethereum (ETH) hovers near key support levels, while fund inflows increase-a classic indication of bullish divergence. After experiencing bearish fund outflows in March and April 2025, the tide turned in May and June with two consecutive weeks of strong inflows. This change signaled increased market confidence and a potential turning point for Ethereum (ETH) momentum.

Also Read: Bitcoin (BTC) Hits a New Low, What’s the Impact on the Market? (6/18/25)

Bullish Setup Formed

A bullish setup seems to be forming for Ethereum (ETH), driven by a decrease in supply on exchanges and a surge in inflows. This dynamic does not signal a market top, but rather a consolidation phase that may precede a breakout. Since early 2025, data from Token Terminal shows a parabolic rise in managed assets tokenized on Ethereum (ETH).

Large institutions such as BlackRock, PayPal, and Franklin Templeton have contributed to this growth, signaling a significant increase in institutional confidence in the Ethereum (ETH) infrastructure. Ethereum (ETH) has further established itself as a financial hub, now holding over $4 billion in tokenized real-world assets (RWAs).

Real-World Asset Adoption and Price Revaluation

Historically, strong capital flows and the adoption of RWAs often precede major price revaluations. If this trend continues, Ethereum (ETH) may be on the verge of a significant breakout. This growth not only demonstrates the wider acceptance of blockchain technology, but also the potential of Ethereum (ETH) as an investment tool and a stable store of value.

With more and more institutions integrating Ethereum (ETH) into their operations, expectations for long-term growth are rising. This signals a new era for Ethereum (ETH), where it is not only considered as a digital currency, but also as the underlying platform for future financial applications.

Conclusion

With all these indicators, the opportunities for Ethereum (ETH) are not just limited to a short-term price increase. The current accumulation phase may very well be the jumping-off point for sustained and steady growth, making Ethereum (ETH) an increasingly attractive investment option for institutional and individual investors.

Also Read: Global Tensions Heat Up, Crypto Takes a Hit: What Really Happened? (6/18/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum: Here’s why ETH could be set for a bullish move soon. Accessed on June 19, 2025

- Featured Image: Tech Daily Feed Mail

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.