Shiba Inu Set to Skyrocket 194%? Whales Snatch Up 1.3 Trillion SHIB Ahead of Massive Breakout!

Jakarta, Pintu News – Shiba Inu (SHIB) was briefly trading at $0.0000115 on June 19, 2025, a slight decrease of 0.3% in the last 24 hours.

The daily trading volume also fell by 19% to $121 million, indicating a decline in market interest in the token.

However, while interest from retail investors is waning, whales appear to be gearing up for a significant upward price movement, having bought 1.3 trillion tokens amid early signs of a double-bottom price reversal pattern.

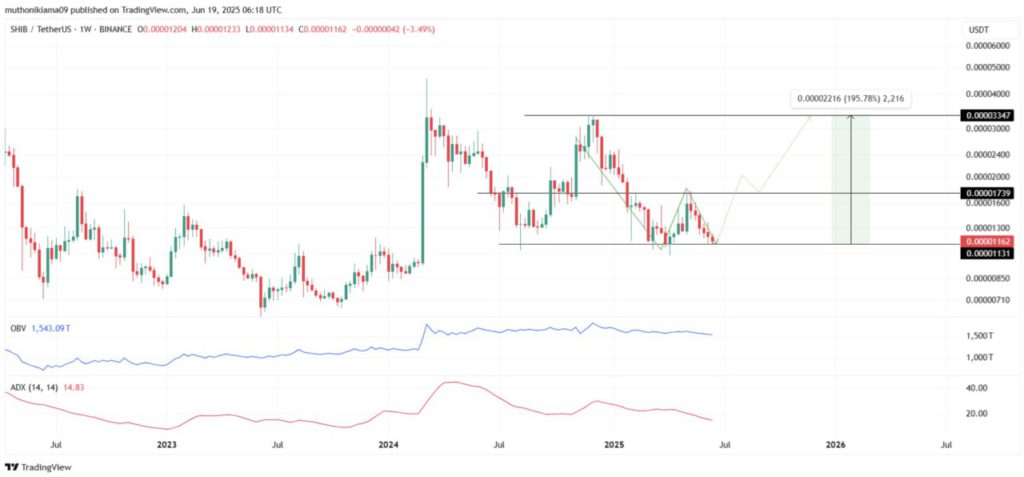

SHIB Rally Looms, Double Bottom Pattern Emerges

Shiba Inu (SHIB) is showing early signs of forming a double bottom pattern on the weekly chart, which could potentially trigger a major rally. This pattern indicates that after experiencing a sharp downward trend from November 2024 to April 2025, the price of SHIB found strong support at $0.0000113.

Read also: Is Shiba Inu About to Skyrocket 70%? Bullish Rebound Signals Flash as Open Interest Plunges!

SHIB price is currently testing the $0.0000113 support level for the second time since the downward correction started – a condition that forms a double bottom pattern.

However, to confirm this pattern, the price needs to bounce off this support level accompanied by strong buying volume, and then target the neckline resistance at $0.0000173.

If SHIB is able to break and close above $0.0000173 convincingly, and then test it again as a support level, then the price is expected to accelerate towards the target of $0.000033.

If this target is achieved, the SHIB price will jump by 194% from its current price of $0.0000116.

The ADX indicator, which is used to measure trend strength, also supports this bullish outlook. The declining ADX line indicates that the downtrend pressure that occurred over the past month is starting to weaken, opening up opportunities for price recovery.

This bullish technical structure is also reinforced by analysis from the CoinGape website, which predicts that SHIB prices could rebound by up to 70% as open interest falls, which could be an early signal of a healthy bull market.

However, this projection could be invalidated if the on-balance volume (OBV) indicator continues to decline, indicating gradually increasing selling pressure.

If selling pressure forces SHIB to drop below the $0.0000113 support level, then the crypto asset could potentially lose single-digit zeros and plummet all the way down to $0.0000090.

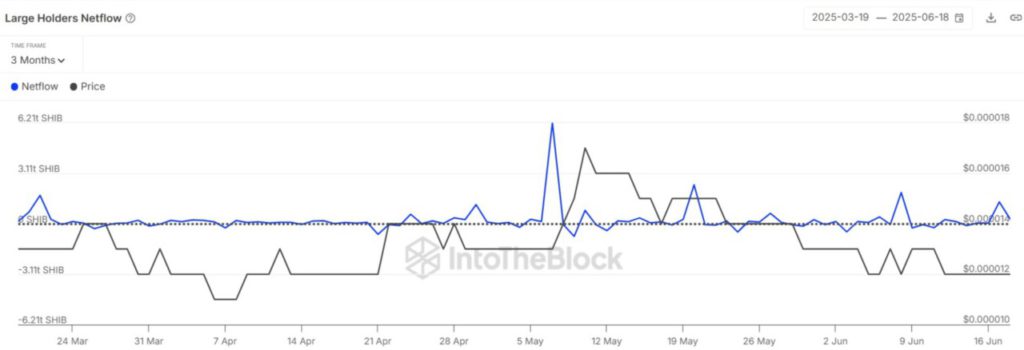

Whale Buys 1.3 Trillion SHIB Tokens

Whales holding at least 0.1% of the total SHIB token supply appear to be in an accumulation phase, most likely speculating early on a potential price bounce from support towards the double bottom pattern target of $0.000033.

Read also: Top 7 Crypto to Buy Before Altseason Starts!

As of June 19, these large addresses had purchased a total of 1.3 trillion SHIB tokens, as large holder netflows jumped from 31.56 billion to 1.34 trillion. This action supports SHIB’s bullish price projection.

Data from IntoTheBlock shows that whenever large owners start accumulating, this is often followed by a rise in SHIB prices.

If this pattern repeats, it is likely that the $0.0000113 support level will hold and open up significant upside opportunities for this meme token.

In conclusion, the price of Shiba Inu is now at a crucial point as it tests the important support level at $0.0000113.

If this level proves strong and the price starts to recover, then a double bottom pattern will be confirmed – which could trigger a rally of up to 194% towards $0.000033.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Shiba Inu Price Outlook: Whales Front-Run Double Bottom Pattern with 1.3 Trillion SHIB Buy. Accessed on June 20, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.