Attention Investors: Dogecoin on the Brink of Collapse, Check out the Latest Analysis!

Jakarta, Pintu News – Dogecoin (DOGE) is at a tipping point again. Currently, the popular cryptocurrency is testing the $0.168 area for the second time since mid-April. If the price manages to break below this level, there could be a sharp decline. Market participants, both optimistic and pessimistic, are watching every price movement closely.

Key Support Analysis

Ali Charts, a crypto expert, notes that Dogecoin (DOGE) has seen a decline of about 30% from its peak in mid-May. The decline brought the price back to the $0.168 mark which was previously a strong support back in April. If the price closes the week below that level, there will be few bids that can slow the decline.

Below $0.168, there is an area of less interest from past buyers, which could accelerate the price drop. This area of support is crucial as the lack of past buying activity could exacerbate the decline if the price continues to fall. Investors and traders should watch the weekly close very carefully, as this will be an important indicator of the next direction of Dogecoin (DOGE).

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

Cup and Hold Pattern

Based on recent analysis, the current chart shows a cup and hold pattern that has been forming for four years. The lower boundary of the symmetrical triangle is right where the hold meets the cup. If the price manages to break above the upper trendline of the triangle, this could indicate a price target near $0.75.

This pattern shows significant upside potential if Dogecoin (DOGE) manages to break resistance. An increase to $0.75 would mean a gain of about 350% from the current price level, a scenario that optimistic investors are hoping for.

Momentum Indicators and ETF Decisions

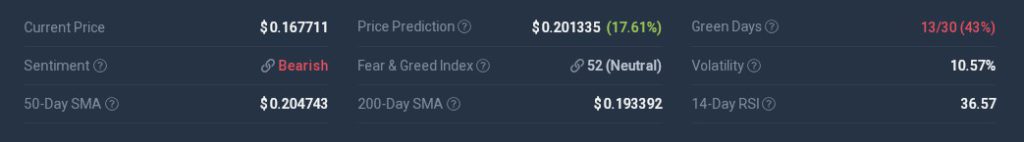

Momentum indicators are currently showing signs of weakening. After experiencing a brief golden cross in May, the 50-day moving average has dropped below the 200-day moving average in early June. The MACD line is widening below its signal, indicating long-term selling pressure. The RSI stands at 42, below the neutral 50 mark, and continues to decline.

This suggests that sellers are more dominant than buyers at the moment. In addition, all eyes are on the US regulator’s decision on June 15 regarding the spot Dogecoin (DOGE) ETF. Approval will allow large funds to flow into Dogecoin (DOGE), while rejection or delay could trigger renewed selling. This decision is crucial and could determine the next direction of Dogecoin (DOGE) price movement.

Conclusion

This week is critical for Dogecoin (DOGE) as it will determine whether the currency can maintain its stability. Investors and traders are advised to pay attention to trading volumes, weekly closes, and upcoming ETF decisions. If the support at $0.168 holds, we may see a recovery. However, if that support is broken, further declines could happen quickly. This is a pivotal moment for Dogecoin (DOGE), and the crypto market is waiting for further clues.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Dogecoin Danger: A Dip Under $0.16 Could Trigger a 30% Crash – Analyst. Accessed on June 20, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.