Altcoin Season Delayed? ETH/BTC Consolidation Sparks Fear of What’s Coming Next!

Jakarta, Pintu News – The ETH/BTC ratio, used by traders to measure the relative strength of Ethereum (ETH) against Bitcoin (BTC), has been in a narrow consolidation range since mid-May. This highlights Ethereum’s performance which continues to lag behind the market leader.

While this stagnation reflects declining investor interest in ETH, it also signals a delay in the start of the altcoin season as a whole.

Altcoin season delayed as ETH still struggles

Based on the daily chart (6/19), the ETH/BTC ratio has been moving in a narrow range since May 13. The ratio faces resistance at 0.026 and finds support at 0.023.

Read also: FET Skyrockets After $50M Buyback Reveal — Crushing Top AI Tokens in Surprise Rally!

This ratio measures the price performance of ETH relative to BTC, showing which asset is experiencing a faster increase in value.

Historically, a sustained rise in the ETH/BTC ratio is often a precursor to a broader altcoin rally, as ETH typically leads the movement of capital from BTC to other cryptocurrencies.

However, the current flattening trend suggests that traders are still risk-averse and choose to remain concentrated on BTC, especially amid ongoing geopolitical tensions.

This trend is important to watch as it raises concerns that the long-awaited altcoin season could see further delays.

ETH/BTC is the most important chart

In a post on X on June 18, an analyst named Crypto Fella emphasized that the ETH/BTC chart is “the most important chart to watch” for anyone anticipating the return of altcoin season.

A reading of the chart shows the ETH/BTC pair hovering around the 0.024 level-the area where the bottom of the previous cycle was formed. A similar structure in 2019 and 2020 showed that ETH briefly bounced strongly against BTC after a long period of lagging performance.

However, as highlighted by Crypto Fella, “we need to see some strength before a major reversal actually happens.”

As such, a convincing breakout above the 0.026 key resistance is crucial to mark the start of a broader altcoin revival.

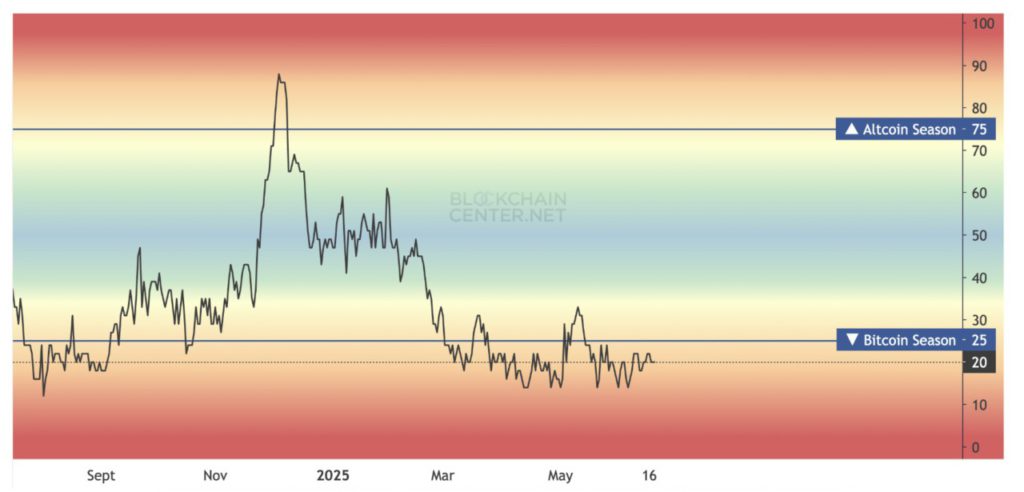

Furthermore, based on data from the Altcoin Season Index, the market is currently still in a BTC-dominated phase. An altcoin season usually begins when at least 75% of the top 50 altcoins outperform BTC within a three-month period.

Read also: Ethereum’s Pectra Upgrade Hits Layer-2 Arbitrum — Is This the Start of the Next Crypto Revolution?

However, only 25% have managed to do so in the last 90 days, which shows the lagging performance of altcoins and indicates that a true altcoin season is likely still quite a while away.

ETH Still Struggles Below 20-Day EMA

ETH traded at $2,521 on June 19, registering a slight gain of 0.15%. On the daily chart of ETH/USD, the altcoin is below its 20-day Exponential Moving Average (EMA), confirming the strength of bearish sentiment amid rising geopolitical tensions in the Middle East.

The 20-day EMA measures the average price of an asset over the last 20 trading days, giving greater weight to recent prices.

When the price moves below the 20-day EMA, it signals short-term bearish momentum and indicates that selling pressure is dominating.

If this trend continues, ETH is at risk of dropping to the $2,424 level.

However, if demand increases, ETH prices could potentially break above its 20-day EMA and bounce back towards $2,745.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. ETH/BTC Ratio Consolidation Delays Altcoin Season. Accessed on June 20, 2025

- CoinPedia. Altcoin Season Delayed, Bitcoin Dominance Holds Back the Rally. Accessed on June 20, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.