Bitcoin Dips to $101K — But Holders Stay Strong as Peak Warning Signs Flash!

Jakarta, Pintu News – The price of Bitcoin (BTC) fell by 30% after reaching a record high in November 2024. However, the price surged again in April 2025 and reached a new record high in May.

On-chain indicators relating to long-term and short-term holders show that long-term holders have not made distributions despite prices reaching all-time highs.

The market activity of the Long-Term Holder (LTH) and Short-Term Holder (STH) gives an idea of the direction Bitcoin will move in 2025.

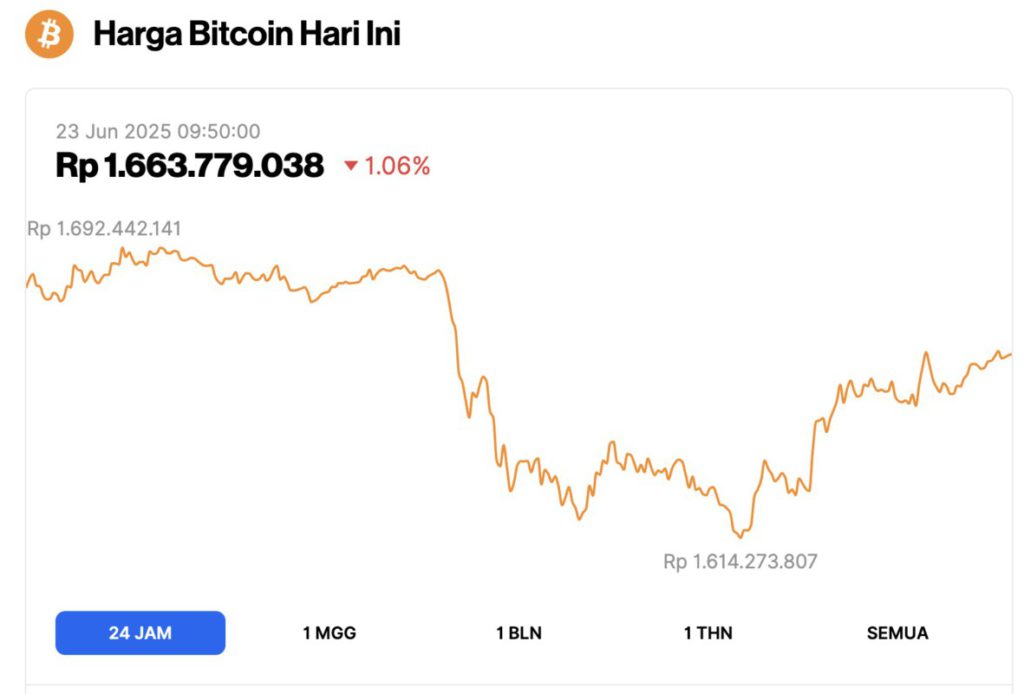

Bitcoin Price Drops 1.06% in 24 Hours

On June 23, 2025, Bitcoin was trading at $101,300 (around IDR 1,663,779,038), marking a 1.06% drop over the past 24 hours. During that time, BTC reached a high of IDR 1,692,442,141 and dipped to a low of IDR 1,614,273,807.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.01 trillion, with trading volume in the last 24 hours up 37% to $61.84 billion.

Read also: While the Market Burns, These 3 Made in USA Cryptos Are Heating Up!

Bitcoin Long-Term Holder Behavior

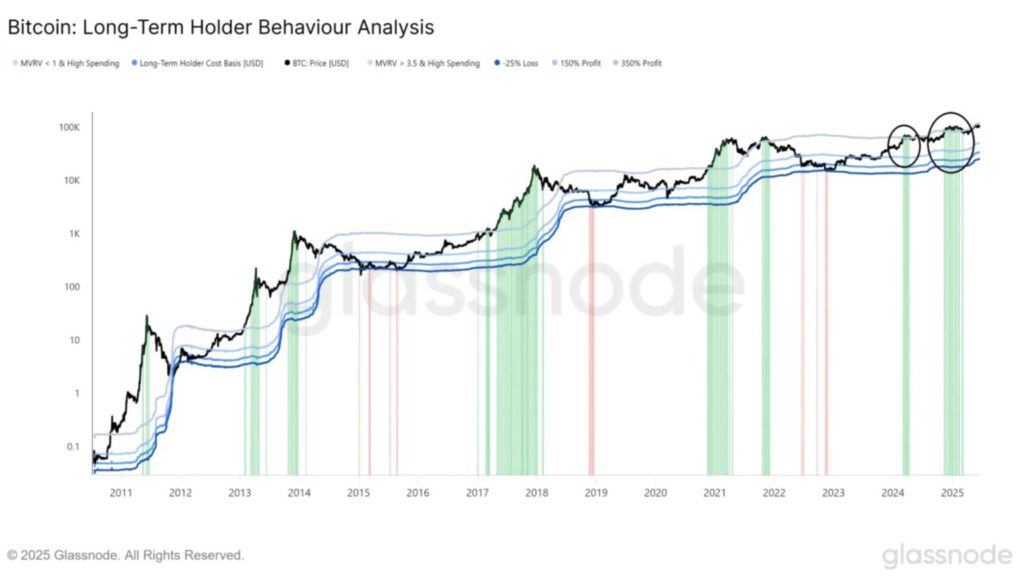

The Long-Term Holder Behavior Analysis indicator on Bitcoin can help determine when the market cycle will end.

Historically, periods where spending activity and Market Value to Realized Value (MVRV) ratios are high (marked in green), usually coincide with the peak of the Bitcoin market cycle.

Long-term holders generally make distributions a maximum of twice a cycle, after which the BTC price begins to decline.

However, the current cycle is the first to break this pattern. There have been two clear periods of LTH distribution, in March 2024 and November 2024 to April 2025 (black circles).

However, instead of experiencing a decline, Bitcoin price reached a new record high in May 2025, breaking the previous historical pattern.

The supply ratio between Long-Term Holder (LTH) and Short-Term Holder (STH) shows that the LTH supply is currently at an all-time high of more than 14 million coins, while STH only holds less than four million coins.

This is in stark contrast to conditions at the peak of previous market cycles, where LTHs usually do the distributing and STHs do the buying.

Read also: Here’s Why These 3 Crypto Tokens Could Be Game-Changers for Your Portfolio

In conclusion, these two on-chain indicators related to holder distribution suggest that the peak of the Bitcoin market cycle has likely not yet been reached.

Realized Cap HODL Wave

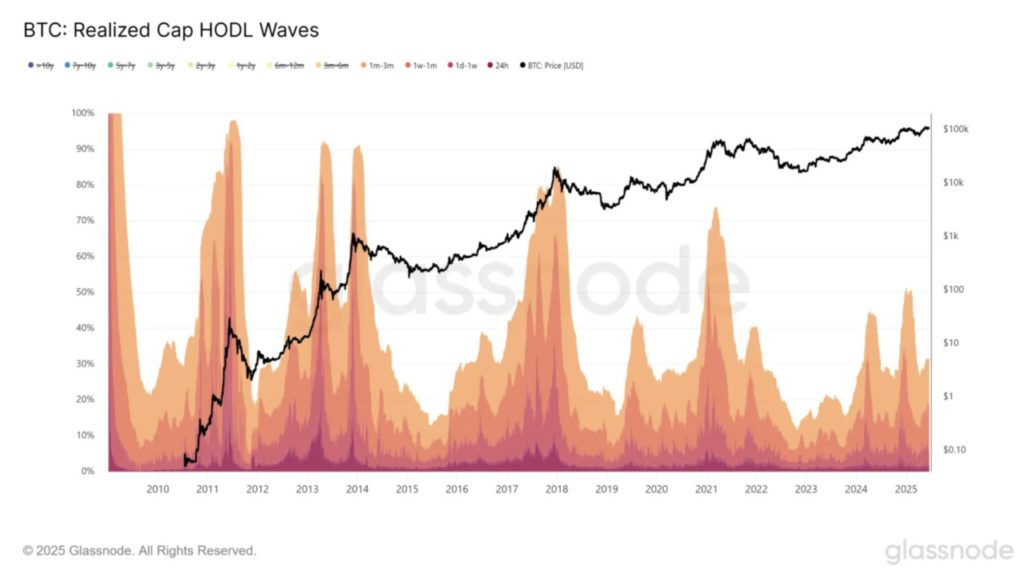

Realized Cap HODL Wave is an on-chain indicator that shows the age of Bitcoin transactions. Like the previous indicator, the end of a market cycle is characterized by the absence of long-term holders (LTH) participation in market activity.

More specifically, a transaction age band below three months-which typically accounts for 70% of market activity-signals that the Bitcoin market cycle is over.

Currently, however, the bands only cover about 30% of market activity, well below the values seen at the peak of previous market cycles.

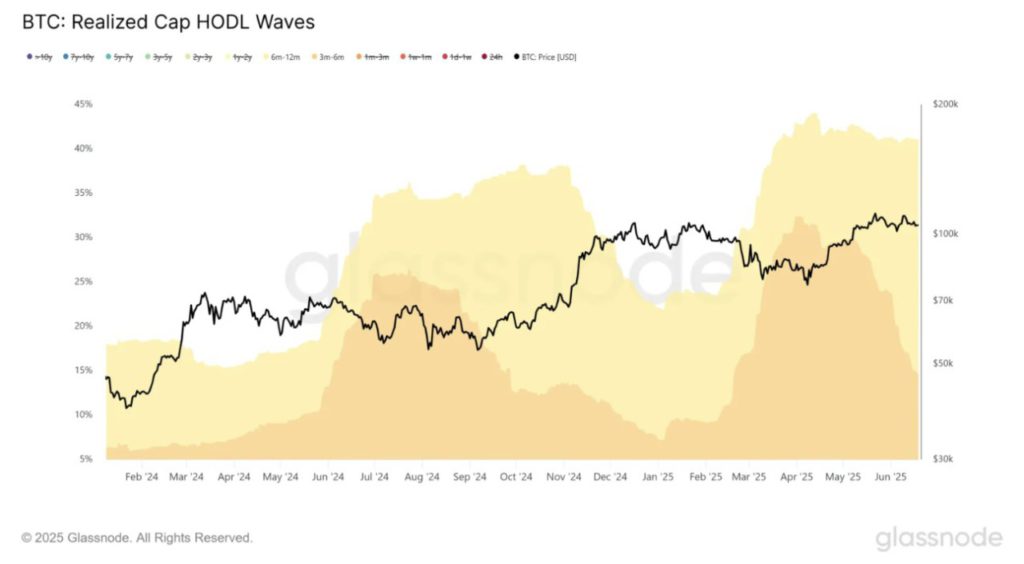

Another interesting development that indicates the accumulation phase is the shift from the transaction age band of 3-6 months (orange) to 6-12 months (yellow).

This means that market participants who bought between January and March 2025 have not made any sales, even though the Bitcoin price has reached new record highs.

Instead, they choose to hold their assets, which is reflected by the enlarged 3-6 month trade age band. This absence ofprofit-taking is a strong sign of market confidence, and does not reflect the conditions that usually occur during the peak of the BTC market cycle.

Read also: Bitcoin Hyper: The First Layer-2 That Actually Solves Bitcoin’s Core Issues!

No Distribution Yet

According to CCN, long-term holders of Bitcoin made a distribution in November 2024, but they are currently inactive despite the price being at its highest level.

In addition, market participants who bought when prices fell between January and April have not yet takenprofits.

The current LTH behavior is different from the pattern usually seen at the peak of the previous Bitcoin cycle.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Bitcoin Holder Patterns Show Strength Even as Cycle Top Signals Appear. Accessed on June 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.