XRP on the Edge: Can Ripple Smash Through the $2.35 Barrier? Key Levels You Need to Watch!

Jakarta, Pintu News – Ripple’s (XRP) Social Dominance has increased to 2.92%, while Weighted Sentiment turned positive at 0.166 after being in the negative zone for most of June.

At the same time, 76.34% of accounts on Binance hold long positions, indicating strong upside expectations among traders.

Despite this optimism, on-chain activity is still inconsistent, and price action remains stuck in a bearish structure, making the next move crucial for the bulls.

XRP Price Action Stable at $2.14: Can the Bulls Break the Downtrend?

XRP has bounced off the $2.00-$2.10 demand zone and is currently consolidating around $2.14. Despite the recovery, the asset is still within a descending wedge structure that limits upside attempts.

Read also: Bloomberg Predicts XRP & Cardano ETFs Have 90% Approval Chance — Is a Massive Rally Coming?

In the event of a confirmed breakout above $2.35, the short-term trend could turn bullish and push XRP to the $2.60 range.

However, a continued rejection at the upper limit of this structure risks pushing the price back to $2.00, even up to $1.80.

Unless the bulls are able to seize control above $2.35 with strong volumes, the medium-term structure remains skewed towards the bears.

Why On-chain Activity Doesn’t Live Up to the Hype

Although sentiment towards XRP experienced a significant recovery, on-chain participation weakened.

The number of Daily Active Addresses dropped to 17,400, reflecting low network engagement. The number of transactions also declined after a spike in early June, without a stable usage pattern.

This discrepancy between market enthusiasm and on-chain data suggests that much of the current excitement is speculative.

To trigger a real rally, real demand needs to support market sentiment. Otherwise, this mismatch could pull the price momentum back into a consolidation phase.

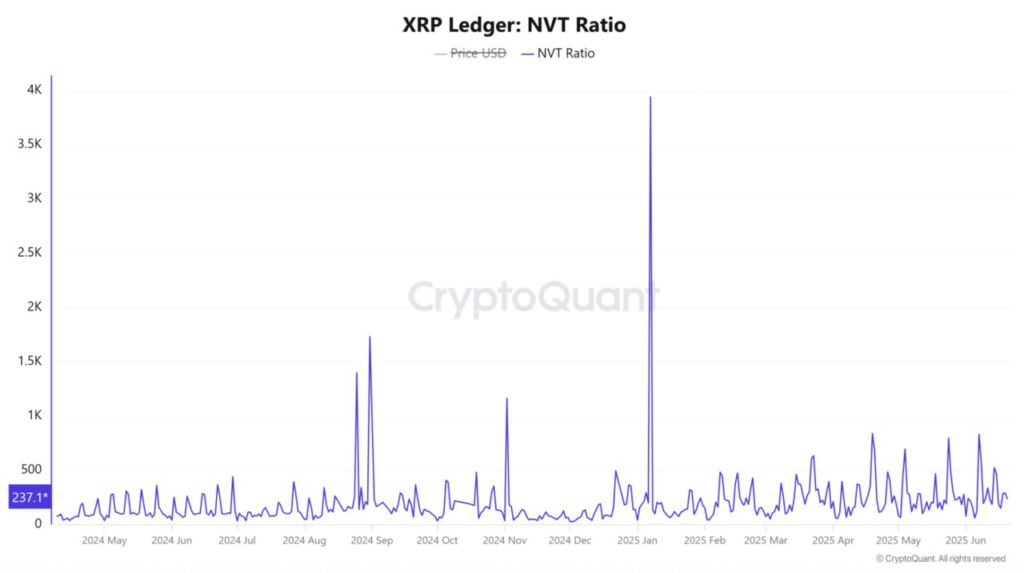

NVT Ratio Signals Undervaluation, However…

XRP’s NVT ratio declined sharply by 18.43% in the last 24 hours (22/6), down to 237.16. This method compares market cap to transaction volume and usually indicates undervaluation when the value decreases.

However, without consistent growth in Daily Active Addresses or sustained transaction volumes, this drop may not be significant.

The decline may reflect price and volume fluctuations only, not increased network usability. Significant changes in the NVT ratio need to be supported by broader on-chain power to be reliable.

Read also: Fartcoin Whale Drops $2 Million Right Before $6 Million Crash – Is a Major Dump Incoming?

Long-Term Holders remain Profitable, but Will They Start Selling?

The Long/Short MVRV differential stood at +20.99% on June 22, indicating that long-term holders enjoyed significantly greater gains than short-term participants.

This profit gap often creates the risk of selling pressure if prices fail to break higher.

With XRP now hovering near key resistance levels, holders may be tempted to secure profits, especially if momentum starts to weaken.

The sustainability of the current structure will largely depend on whether long-term holders remain patient or start realizing profits when signs of price rejection appear.

Can XRP Bulls Break Resistance and Confirm Sentiment?

Bullish market sentiment, increased social chatter, and dominance of long positions signal a potential breakout. However, this potential is weakened by the fragile on-chain activity and the risk of liquidation in the area near the current price.

A decisive move above the $2.35 level is needed to confirm the strength of the trend and attract further volume.

If bulls fail to break resistance or sustain prices above $2.10, sentiment could quickly reverse, pushing XRP back into a consolidation phase. Without a confirmed breakout, optimism alone is not enough to sustain a price rally.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Mapping XRP’s road to $2.35 – Bulls, watch THESE levels next. Accessed on June 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.