Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

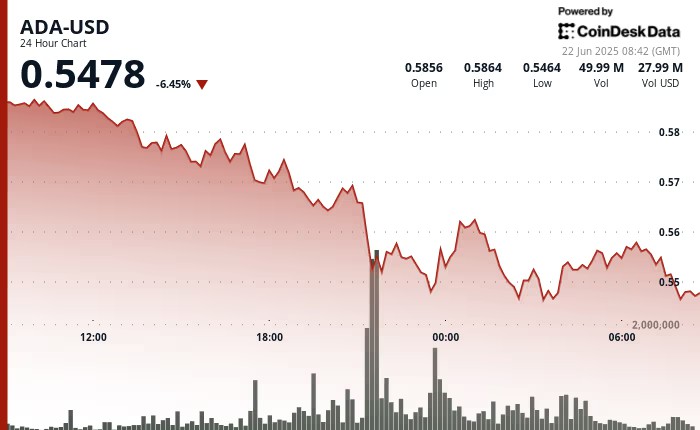

Jakarta, Pintu News – Cardano (ADA) experienced a significant drop to $0.5478, down 6.45% in the last 24 hours. This decline comes amid heightened geopolitical tensions in the Middle East, fueling anxiety in the crypto market. In the same period, ADA’s trading volume increased sharply by 37.37% above the last 30-day average. Despite facing volatility, Cardano is still attracting long-term interest from large investors.

Technical Analysis and Market Reaction

According to the technical analysis model from CoinDesk Research, ADA experienced a sharp drop from $0.586 to $0.5464, with the biggest drop occurring at 21:00. During that hour, ADA fell by 3.2% with trading volume reaching 126 million. This decline reflects the market’s quick reaction to geopolitical uncertainties that could potentially affect global economic stability.

ADA withdrawals from centralized exchanges reached nearly $1 billion throughout 2024, suggesting that many investors are choosing to keep their assets in private wallets, which could be a precautionary measure amid market uncertainty. In addition, more than 310 million ADA tokens were raised by large holders in June alone, signaling strong confidence in Cardano’s long-term prospects.

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

Strategic Collaboration with Ford

In an effort to expand the applications of blockchain technology, Cardano is collaborating with Ford Motor Company on a pilot project that also involves Iagon, a decentralized storage platform, and Cloud Court, a legal technology firm. The project aims to test the ability of Cardano’s blockchain infrastructure to support secure legal data management systems.

Ford served as an advisor on the project, leveraging its internal experience in managing large-scale legal data operations. The proposed hybrid architecture-where sensitive legal documents are encrypted and stored off-chain, while access and verification logs are handled on-chain-is expected to address issues such as fragmented records, inefficient collaboration, and lack of auditability. This initiative not only demonstrates Cardano’s potential in the enterprise environment, but also opens up application opportunities in other sectors such as healthcare, finance, and public administration.

Conclusion: Cardano’s Future Prospects

Despite facing challenges in the form of high market volatility, Cardano continues to demonstrate its resilience as one of the most innovative blockchains. With backing from large entities such as Ford and new initiatives constantly evolving, Cardano has great potential to strengthen its position in the global market.

Going forward, Cardano will probably continue to attract more attention from both institutional and retail investors as the ecosystem further develops.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. ADA Takes a Hard Fall as Traders Feel the Heat of War in the Middle East. Accessed on June 23, 2025

- Featured Image: Crypto Rank

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.