Geopolitical crisis triggers altcoin market crash! Crypto Market Liquidation Surges at the End of June 2025

Jakarta, Pintu News – The crypto market experienced a sharp drop following the United States’ attack on Iran which marked a major escalation in the Iran-Israel conflict. The attack was carried out at night and immediately affected the exchange rates of various cryptocurrencies.

Direct Impact of US Attack on Iran

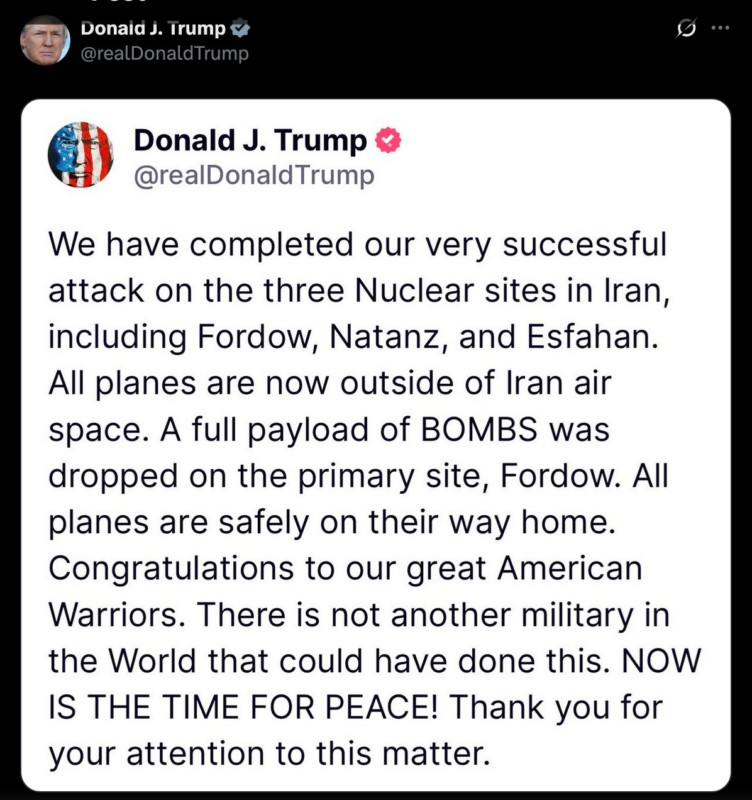

According to a statement from President Trump, the US has targeted a critical nuclear facility in Iran, which is the first US military action in this conflict. The crypto market reacted negatively with Ethereum (ETH) falling more than 5%, reaching a value below $2,300 for the first time in a month.

This decline reflects investor uncertainty over the long-term impact of the conflict. In addition, Cardano (ADA) also saw a decline, nearing its lowest point in the past three months with a drop of around 6% today. Coins based on AI agents such as VIRTUAL and Fetch.ai (FET) were hit the hardest, with a drop of nearly 10%.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Bitcoin still holding its own, but vulnerable to pressure

Although Bitcoin (BTC) is still holding above $102,500, there are indications that the currency could fall below the psychological $100,000 level if there is further escalation over the weekend. Analysts from BeInCrypto have previously predicted that the price of Bitcoin (BTC) could drop by around 10% if the US gets directly involved in the Iran-Israel war.

These concerns are growing as tensions continue to build. Markets will continue to monitor the response from Iran to this attack. President Trump has stated that any retaliation from Iran will be followed by more action from the US. This situation adds to the uncertainty in an already volatile crypto market.

Crypto Market Liquidation Surges

Today, liquidations in the crypto market have surpassed $670 million, signaling the potential start of a short-term bearish cycle. Crypto investors and traders around the world responded quickly to the news of the attack, leading to massive selling in almost all crypto assets.

This incident shows how sensitive crypto markets are to geopolitical changes. The long-term impact of this conflict on the crypto market is unclear, but what is certain is that volatility is likely to persist. Investors are advised to exercise caution in making investment decisions amidst this high uncertainty.

Conclusion

With the situation continuing to evolve, the crypto market looks set to face more tests. This incident is a reminder of the importance of diversification in investments and the need to be prepared for uncertainty. Market participants are now waiting for the next move, both from the Iranian side and further response from the international community.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoin Crypto Market Dips as US Strikes Iran. Accessed on June 23, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.