Bitcoin Stands at $100K Support Level, Can it Go Higher at the End of June 2025?

Jakarta, Pintu News – The conflict between the United States and Iran has sparked tensions in global markets, including cryptocurrency markets. Bitcoin (BTC) experienced a 1.17% drop, touching $100,979 before a $50 million short squeeze reversed the situation.

Despite the recovery, Bitcoin (BTC) market conditions still look fragile. With Donald Trump indicating that he will use “much greater force” if Iran retaliates, global uncertainty is increasing. The question is, will Bitcoin (BTC) continue to maintain support at the $100,000 level?

Market Reaction to Geopolitical Tensions

The US attack on Iran’s nuclear sites came at a time that could be said to be favorable to the markets as it happened on a weekend, so equity markets were spared from total panic. However, the cryptocurrency market was not so lucky. More than $711 million worth of leveraged positions were liquidated across exchanges, according to data from CoinGlass.

Although Bitcoin (BTC) is only down 1.17%, this drop is not the worst in June. Previously, a sharp drop of 3% had pushed Bitcoin (BTC) down to $100,424. This time, the drop was followed by a $50.8 million liquidity purge at $100,910, which eliminated late-entry short positions.

The result was a sharp surge of 2.4% from support, which reinforced the strength of the supply wall and kept the $100,000 level, at least for now. This is the second time Bitcoin (BTC) has touched the $100,000 support in June. The first recovery proved significant, with Bitcoin (BTC) surging nearly 10% in less than a week.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Market Dynamics After Macro Tensions

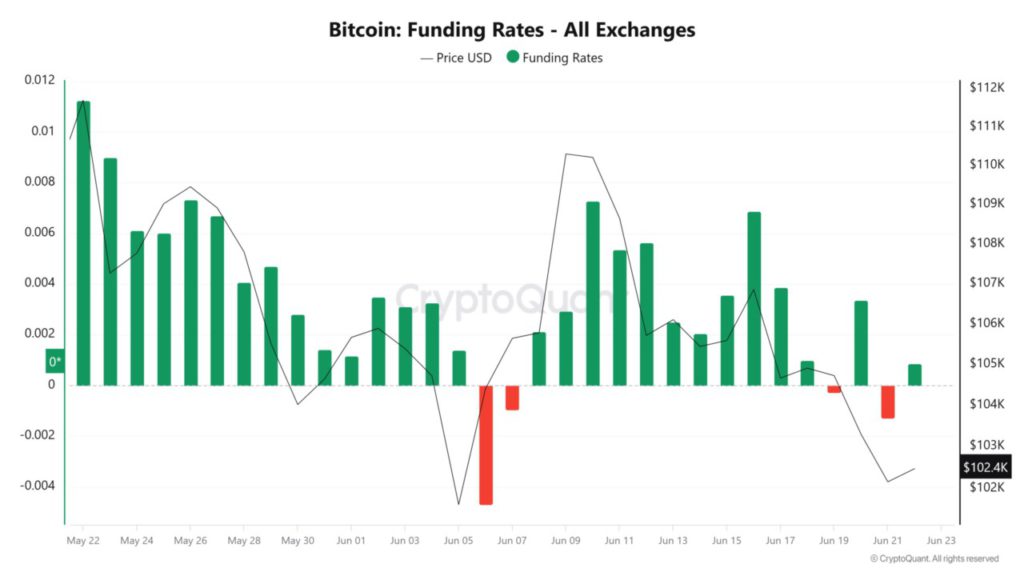

Market dynamics after macroeconomic concerns are critical. Short selling traders continue to look for structural weak points, which is evident from Bitcoin Funding Rates turning negative, similar to early June. This suggests a bearish bias in the perpetual market.

It pays for traders to maintain short positions while the price hovers around $102,400, giving room for a possible capitulation or rebound. The 12-hour liquidation heatmap shows a $62.63 million long cluster at risk if Bitcoin (BTC) retests $101,502, keeping the downside risk below $100,000 intact.

However, with bulls continuing to defend the $100,000 structural support despite significant macro headwinds, it is likely they will persevere. According to AMBCrypto, this systematic absorption of liquidity suggests a possible rebound a la early June, signaling resilience amid heightened volatility.

Consolidate and Anticipate the Next Market Direction

For now, Bitcoin (BTC) looks set to consolidate in a tight range as traders reduce risk and adjust their exposure around this critical psychological level. With global uncertainty on the rise and markets in constant flux, the next move for Bitcoin (BTC) will largely be determined by how traders respond to current conditions.

If Bitcoin (BTC) manages to hold support and initiate a rebound, it could be an early indicator that the cryptocurrency market may be ready for the next phase of growth. However, if support at $100,000 fails, we may see further declines that could test the overall resilience of the market.

Conclusion

With geopolitical tensions rising and markets fluctuating, Bitcoin’s (BTC) future at $100,000 will largely depend on how market participants respond to the uncertainty. Whether Bitcoin (BTC) will continue to hold its ground or see further declines, only time will tell.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin amid U.S.-Iran conflict: Can BTC hold $100k? If so, what next?. Accessed on June 23, 2025

- Featured Image: Bitcoinist

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.