Bitcoin price plummets below $102,000, look out for further support!

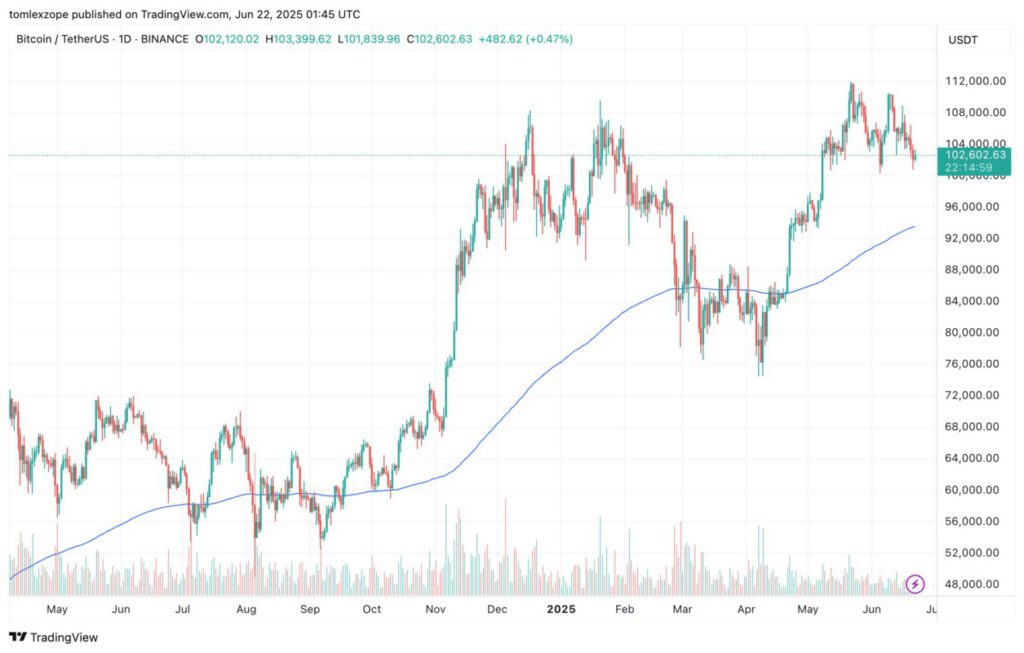

Jakarta, Pintu News – Bitcoin (BTC) experienced a sharp decline early this weekend, with prices dropping from a peak of $106,000 to just above $103,000 on Friday, June 20. The leading cryptocurrency then stabilized in that price zone, moving around $104,000 for most of the following day.

Bitcoin Price Analysis: Sudden Drop

On Saturday, June 21, selling pressure returned and the price of Bitcoin (BTC) dropped to around $101,500. This drop marked one of the critical moments for Bitcoin (BTC) in recent times. The price stability that had occurred above $103,000 did not last long, and crypto investors were again faced with market uncertainty.

In the following hours, Bitcoin (BTC) price attempted to recover, but only to return to around $103,000. At the time of writing, the Bitcoin (BTC) price is hovering around $102,845, representing a 0.4% drop in the last 24 hours. These fluctuations show that volatility is still an integral part of the cryptocurrency market.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Next Support Level: $100.000

According to a crypto analyst popularly known by the pseudonym Titan of Crypto, Bitcoin (BTC) might retest critical support areas if the selling pressure continues. Based on the weekly price chart analysis, the next significant support level is in the range of $99,000 to $100,000. This zone is important because of the confluence between the Fair Value Gap (FVG) and the rising Tenkan-sen line.

The Tenkan-sen line, which is an important component of the Ichimoku Cloud indicator, is often considered an important line in analyzing short-term trends. It is considered a key support and resistance level, as well as a signal line for potential trend reversals. With the FVG and Tenkan-sen in the same region, it signals that the zone may be a support cushion for the price of Bitcoin (BTC).

The Importance of Maintaining $100,000 Support

If Bitcoin (BTC) manages to maintain support above $100,000, this could be key to its long-term trajectory. Since May 8, the price of Bitcoin (BTC) has never traded below $100,000, and it has reached the $110,000 mark twice in that time span. Maintaining this support is not only important for current price stability but also for investor confidence in the long run.

Maintaining these levels will be an important indicator of market strength and the likelihood of future price recovery. Investors and analysts alike are watching closely to see if Bitcoin (BTC) can maintain momentum or if there will be further declines that could test the overall resilience of the market.

Conclusion

With the ever-changing market situation, monitoring the Bitcoin (BTC) price is more important than ever. Investors and market watchers will keep a close eye on key indicators and support levels to predict the next direction of the Bitcoin (BTC) price.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Price Slips Beneath $10,200 – Here’s the Next Support. Accessed on June 23, 2025

- Featured Image: The image created by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.