Michael Saylor and Metaplanet Make a New Buzz in the Bitcoin Market! What’s up?

Jakarta, Pintu News – On Monday, Michael Saylor was back in the spotlight after posting the latest signals about Bitcoin (BTC), along with the announcement of Metaplanet’s purchase of 1,111 BTC.

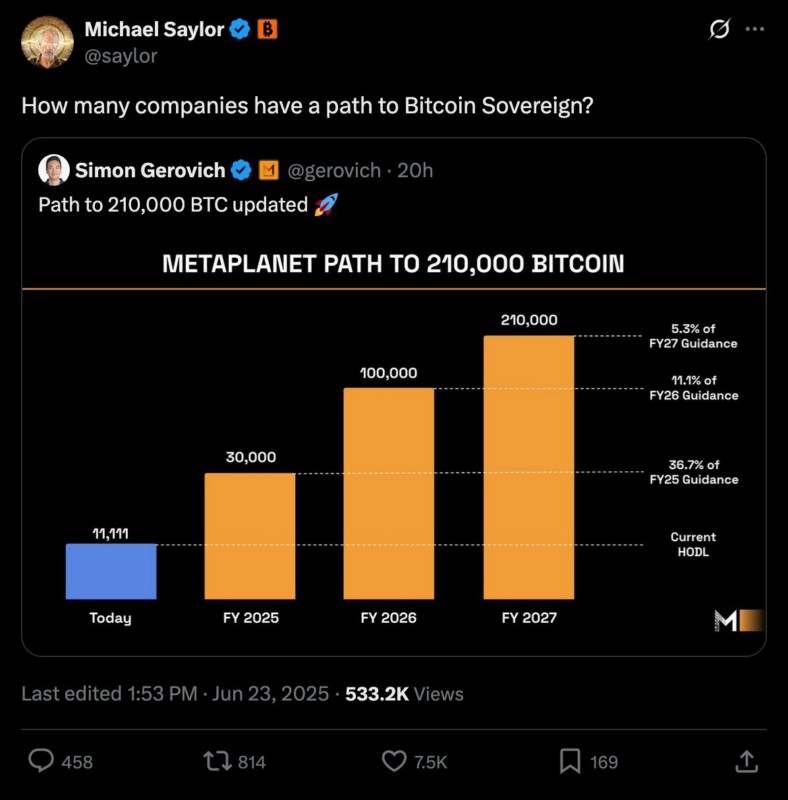

The Tokyo-listed company now has a total of 11,111 BTC, as part of their grand plan to accumulate 30,000 BTC by the end of this year. According to its updated roadmap, Metaplanet aims to have 100,000 BTC by 2026 and 210,000 BTC by 2027.

Bitcoin Accumulation Strategy by Metaplanet

With an average entry price of $94,695, Metaplanet’s Bitcoin position is now worth around $1.13 billion, representing an unrealized gain of 7.8%. The company’s BTC holdings account for 15.3% of the current market capitalization which stands at ¥982.1 billion, or about $6.7 billion.

Metaplanet shares, which trade under ticker 3350.T, cost ¥1,635 and continue to trade at more than six times the company’s net asset value – a multiple that has grown along with their Bitcoin reserves. If the company reaches their 210,000 BTC target, the stake would be worth over $20 billion at current prices.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Michael Saylor’s influence and Bitcoin Buying Strategy

The market is currently watching what steps Strategy will take next. The company often announces Bitcoin purchases on Mondays and has signaled activity through social media posts today. Last week, Strategy added 10,100 BTC to its balance sheet, spending more than $1 billion. Currently, the company owns 592,100 BTC, with an average cost base of around $70,664. The position is worth about $60.4 billion, which is 58.5% of their market capitalization of $103.3 billion.

Current Bitcoin Market Dynamics

Bitcoin (BTC) is trading slightly above $100,000 after dipping below $100,000 over the weekend. Despite the recent ups and downs, both Metaplanet and Strategy have continued to expand their presence, and there are no signs of them slowing down. Both companies continue to demonstrate a strong commitment to Bitcoin as a strategic asset in their portfolios, which has caught the attention of investors and market analysts.

Conclusion

With aggressive strategies in Bitcoin accumulation, Metaplanet and Strategy show strong faith in the future of this digital currency. These two companies, with support from figures such as Michael Saylor, continue to influence Bitcoin market dynamics and provide new insights into how digital assets can be integrated in the financial strategies of large corporations.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Strategy’s Saylor Suddenly Raises Bitcoin Sovereign Question. Accessed on June 24, 2025

- Featured Image: CryptoSlate

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.