Large Dogecoin (DOGE) and Solana (SOL) Token Releases: Expected Impact

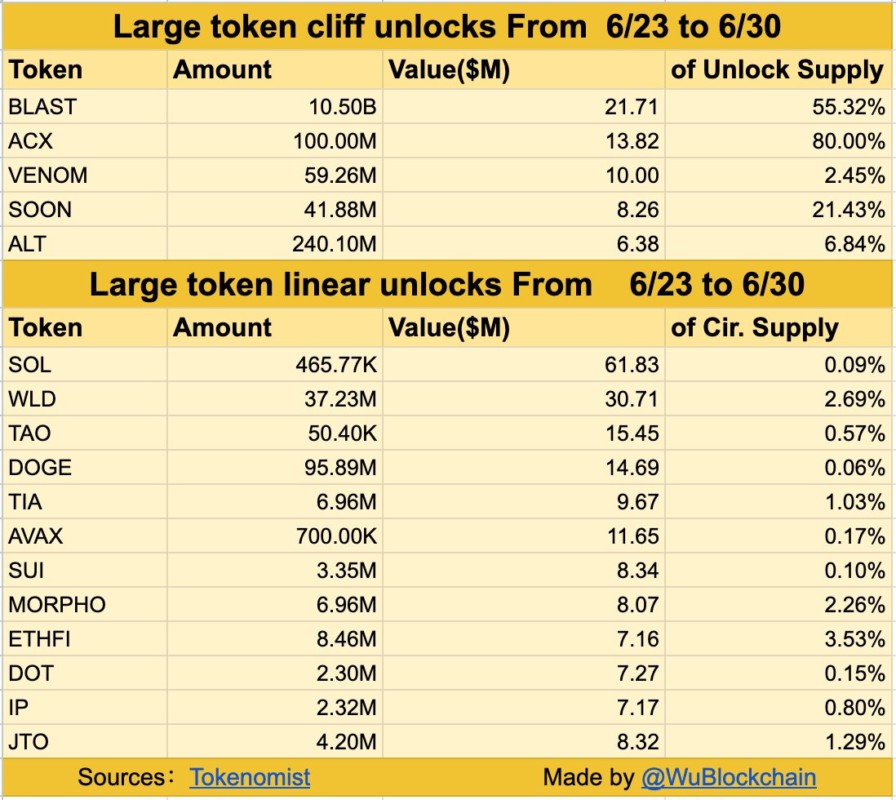

Jakarta, Pintu News – The crypto market is looking forward to the release of more than $250 million worth of tokens in the next seven days. Dogecoin (DOGE) and Solana (SOL) are in the spotlight due to their volatile market structures. According to data from Tokenomist and WuBlockchain, Solana (SOL) will see a token release of $61.83 million (465,770 SOL), while Dogecoin (DOGE) will release $14.69 million worth of tokens (95.89 million DOGE).

Effect of Token Release on Price

Dogecoin (DOGE) is currently hovering around the price of $0.145, slightly above key support. All major moving averages (EMA 50, 100, and 200) are above the current price, indicating a slight rebound in recent price action but an overall bearish trend. With the RSI around 31, this indicates a heavy oversold condition and may indicate a short recovery.

However, risks remain with the arrival of new token releases. If supply increases in a market that already lacks bullish sentiment, DOGE may fall below $0.145 and possibly retest the $0.12 level. The situation with Solana (SOL) is similar. Currently trading around $134, SOL has fallen below its 200 EMA and is struggling to hold the $130 range.

The momentum is weak, and the RSI is in the mid-30s. Further downside risks are introduced by the large token release of $61 million planned in the next few days. Without a strong recovery above $150-155, SOL may fall to the $120s range, which would lower the overall market mood.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Impact on the Crypto Market at Large

Although these token disposals are partially predicted and known in advance, risks increase when they coincide with bearish price action and low market confidence. Dogecoin (DOGE) and Solana (SOL) may experience faster selling if current support levels collapse in the face of increased token circulation. Traders are advised to keep an eye out for volume changes and brief volatility spikes during the release window.

Strategies for Investors and Traders

In the face of large token releases, investors and traders should consider effective risk management strategies. Monitoring technical indicators such as RSI and EMA can provide insight into potential turning points or further declines. In addition, paying attention to news and updates from the market can help in making the right decisions at the right time. With volatile markets, flexibility and speed in making decisions can be key to minimizing losses or maximizing profits.

Conclusion

With this large token release, the crypto market may experience some turbulent days. Investors and traders should be prepared for the possibility of sharp price fluctuations and prepare appropriate strategies to deal with market conditions that may change rapidly. Understanding the dynamics behind the token release and its impact on supply and demand will be key in navigating this uncertain market.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Massive Dogecoin (DOGE) and Solana (SOL) Unlocks Imminent: What to Expect. Accessed on June 24, 2025

- Featured Image: Bitcoin Sistemi

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.