Metaplanet invested $118 million in Bitcoin, now has over $1 billion in assets

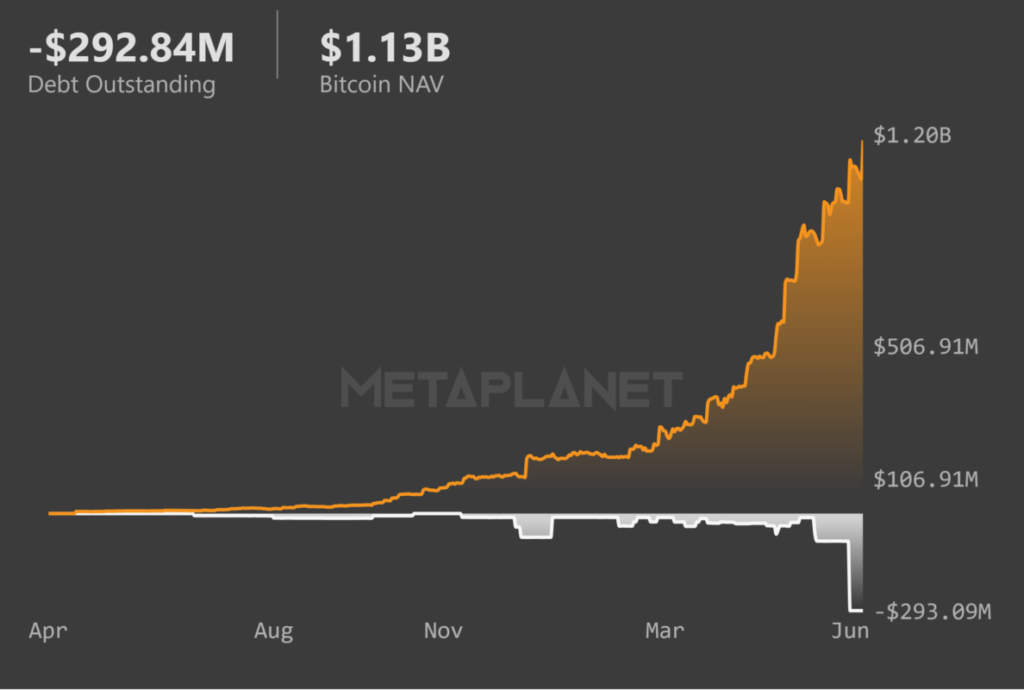

Jakarta, Pintu News – Japanese company Metaplanet recently made big news with a $118 million purchase of Bitcoin (BTC) during the price drop, increasing their total holdings to over $1 billion or approximately 11,111 coins.

This purchase was funded through the issuance of $210 million worth of new bonds. This strategy is similar to that employed by Michael Saylor with his company formerly known as MicroStrategy, which also used debt and share sales to fund Bitcoin (BTC) purchases.

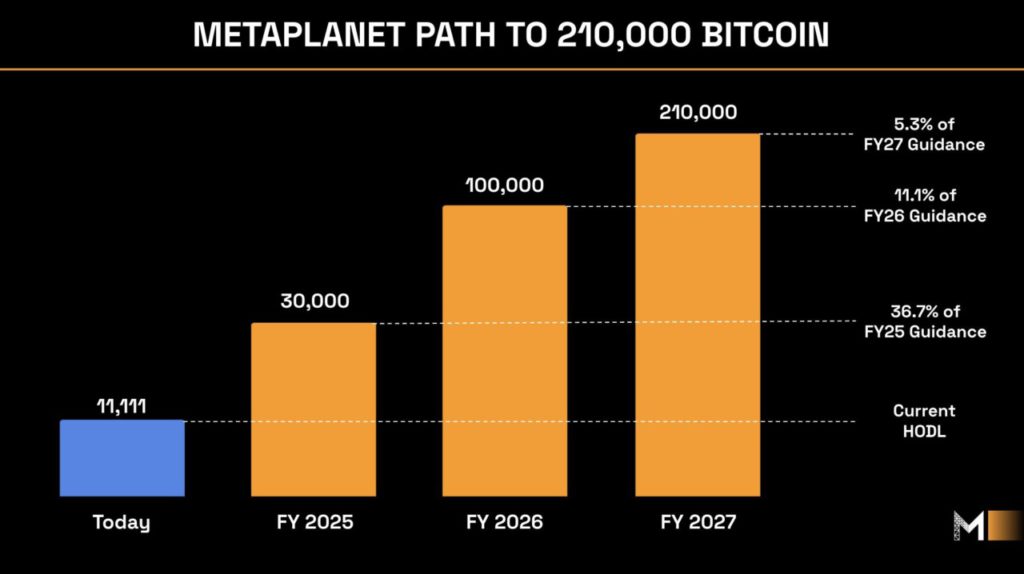

Metaplanet’s Ambitious Target for 2025

Metaplanet has set a new target for their Bitcoin (BTC) holdings by 2025, which is 30,000 coins from the previous target of just 10,000 coins. Currently, the company has reached 36% of that target, with another 64% to fill.

If the Bitcoin (BTC) price remains stable, Metaplanet will need about another $2 billion to reach this target. These ambitious plans don’t stop at 2025, as the company plans to have 100,000 Bitcoin (BTC) by 2026 and increase that number to 210,000 coins by 2027.

Read More: Israeli Spy Arrested in Iran: Crypto Motives Behind Digital Espionage?

Comparison with Other Strategies and Future Prospects

Metaplanet’s plans to expand their Bitcoin (BTC) holdings are very ambitious compared to other companies such as Strategy which has over $8 billion in debt due starting in 2027. Although Metaplanet’s net asset value (mNAV) decreased slightly to 6.15, it still shows that investors remain optimistic about the company’s Bitcoin (BTC) plans. When the price of Bitcoin (BTC) was above $110,000, this indicator was above 7. As long as mNAV remains above 1, Metaplanet is considered to be on the right track.

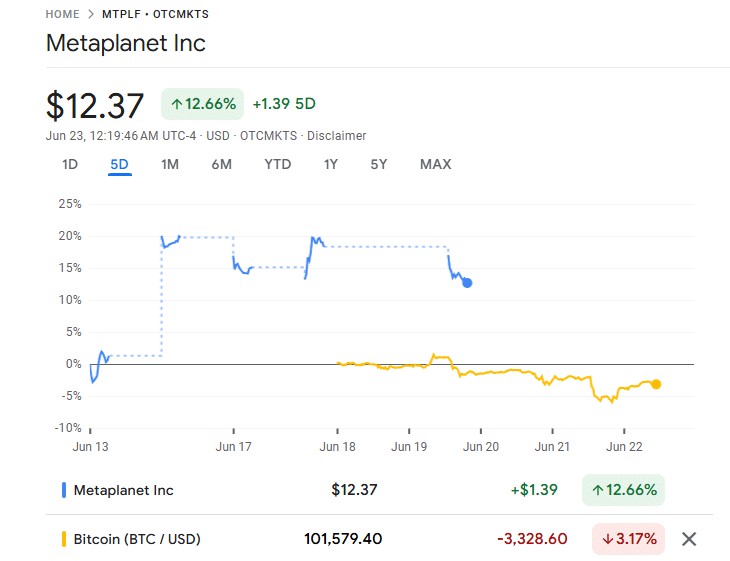

Metaplanet Stock Performance Compared to Bitcoin

In the last five trading days, Metaplanet shares have shown better resilience compared to the Bitcoin (BTC) price decline. At the time of writing, Bitcoin (BTC) has decreased by 3% to $101,000, while Metaplanet stock has increased by 12% over the same period. This suggests that investors may see Metaplanet as a more stable and profitable investment compared to directly investing in Bitcoin (BTC) itself.

Conclusion

With an aggressive buying strategy and ambitious targets, Metaplanet demonstrates a strong commitment to Bitcoin (BTC) as a key asset in their portfolio. The significant increase in targeted Bitcoin (BTC) holdings and impressive stock performance indicate significant growth potential for the company in the future.

Also Read: Dogecoin Continues to Slump: Is this $480 Utility Coin the Wiser Choice in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Ambcrypto. Metaplanet buys $118M in Bitcoin during dip, now holds over $1B in BTC. Accessed on June 25, 2025

- Featured Image: U Today

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.