Bitcoin Skyrockets to $106,000 Today (June 25) — Analysts Say $110K Breakout Could Be Next Big Boom!

Jakarta, Pintu News – The price of Bitcoin (BTC) surged back past the $106,000 mark on Tuesday until today, after previously falling sharply over the weekend to touch below the crucial $100,000 level.

This recovery comes amid easing geopolitical tensions and continued demand from institutions, which has strengthened Bitcoin’s resilience despite recent volatility.

Then, how is the current Bitcoin price movement?

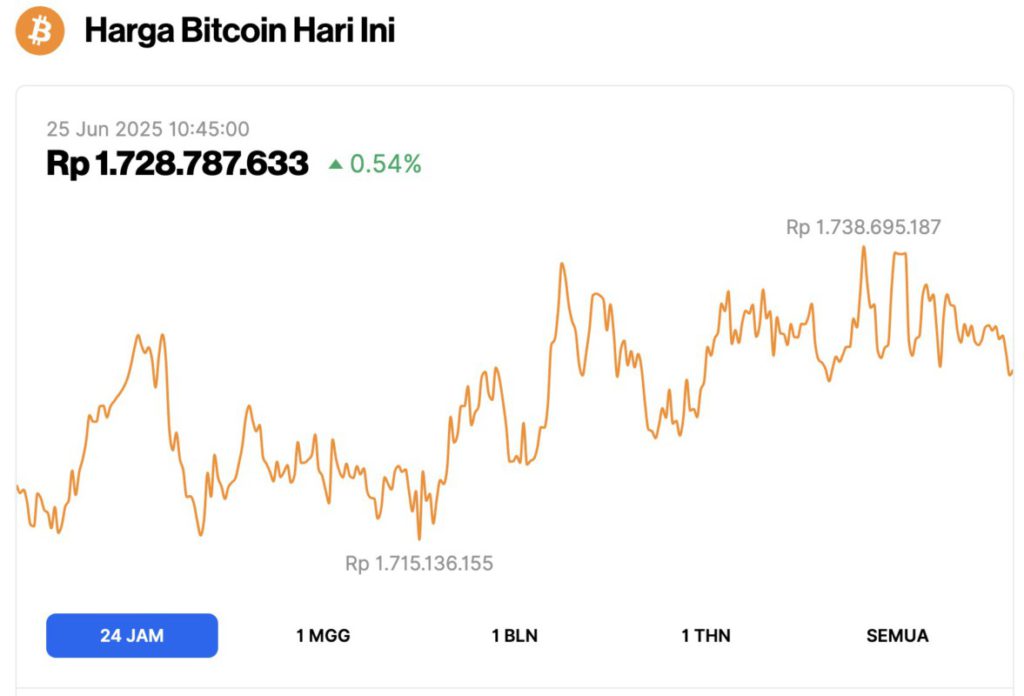

Bitcoin Price Up 0.54% in 24 Hours

As of June 25, 2025, Bitcoin was trading at $106,371, equivalent to approximately IDR 1,728,787,633 — marking a 0.54% gain over the past 24 hours. During the same period, BTC dipped to a low of IDR 1,715,136,155 and climbed to a high of IDR 1,738,695,187.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.11 trillion, with trading volume in the last 24 hours falling 24% to $49 billion.

Read also: These 3 Altcoins Could Explode to New All-Time Highs by the End of June 2025 – Don’t Miss Out!

Bitcoin price recovers after market turmoil

Over the weekend, the price of Bitcoin dropped to $98,500 – the first drop below the six-figure mark in over 45 days – due to concerns over escalating conflict in the Middle East.

As of June 24, 2025, data from CoinGecko shows that Bitcoin is trading at around $106,026, having risen 5.7% in the last 24 hours. This one-day price fluctuation reflects a high level of volatility, but also shows strong support at lower price levels.

Data from TradingView confirms that Bitcoin price briefly hit a local low around $102,650 on Binance on Friday before recovering.

On Monday, this recovery coincided with the announcement of a ceasefire between Israel and Iran by US President Donald Trump, which helped ease investor anxiety in global markets.

Institutional Fund Flows Support Bitcoin Price

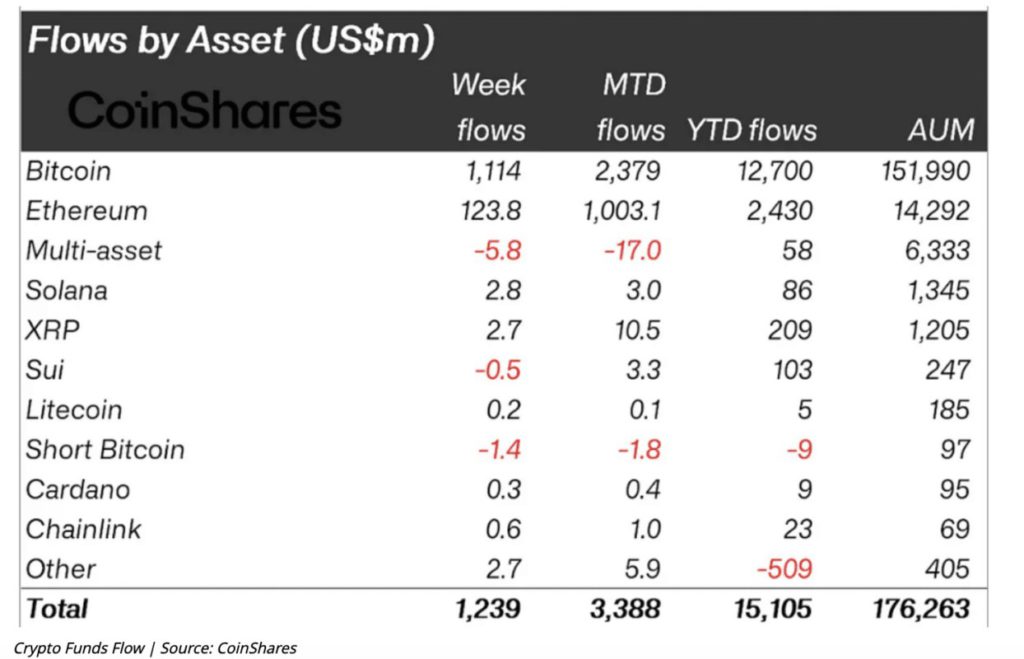

Crypto investment products recorded stronginflows last week. According to CoinShares’ June 20 report, crypto ETPs (Exchange-Traded Products) posted net inflows of $1.24 billion, with $1.1 billion of that going into Bitcoin funds.

BlackRock’s spot Bitcoin ETF (codenamed IBIT) led the surge, pushing total crypto fund inflows since the start of the year to more than $15.1 billion.

These fund flows reflect continued institutional interest, even as Bitcoin’s price approaches all-time record highs.

Read also: Ethereum Holds Steady at $2,400 — Is a Breakout to $3,000 Just Around the Corner?

With the value ofassets under management in Bitcoin ETFs continuing to rise, and over 126 publicly traded companies now holding BTC in their coffers, the foundations for long-term demand appear to remain solid.

Despite the sell-off over the weekend, the Bitcoin derivatives market showed resilience. Data from CoinGlass revealed that total open interest in the futures market held at around $68 billion.Long liquidations only amounted to $193 million – around 0.3% of the total.

The options market on Deribit also reflected the upbeat sentiment, with a concentration of open interest at strike prices of $110,000 and $120,000 for the upcoming expiry.

Data from Santiment showed that retail investor sentiment declined to its most bearish level since April, while on-chain metrics from Glassnode indicated accumulation by Bitcoinwhales.

The combination of negative sentiment from small investors and buying from whales is often the first signal of a bullish reversal, supporting Bitcoin‘s price recovery.

Bitcoin mining hashrate drops 8%

Bitcoin mining hashrate rate dropped by 8% in the past week, from 943 million to 865 million terahashes per second.

Analysts attributed the decline to temporary power disruptions, rather than systemic problems. Meanwhile,exchange outflows increased, suggesting that holders opted forself-custody rather than panic selling.

Read also: Robert Kiyosaki Warned Bitcoin Would Crash — You Won’t Believe What Happened Next!

Glassnode ‘s cost basis data also reinforces the optimistic fundamental outlook. At the time of writing, Bitcoin is trading above itsshort-term holder cost basis of$105,200.

And long-term metrics show that the majority of holders are still making profits, lowering the risk offorced selling.

$110,000 Resistance in Focus

With Bitcoin prices starting to recover from the weekend lows, analysts are now turning their attention to the $110,000 resistance zone. This level is considered a significant psychological and technical barrier.

If there is a breakout above this level, it could trigger the next wave of gains. Conversely, failure to reclaim this level could lead to a continued consolidation phase.

QCP Capital emphasized the importance of the range between $100,000 and $110,000, noting that a move outside this range could “reawaken interest in the market more broadly.”

Strategist from IG Markets, Tony Sycamore, has also previously highlighted $110,000 as the next major resistance level.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinRepublic. Bitcoin Price Rebounds to $106K After Sell-Off, Analysts Eye $110K Resistance. Accessed on June 25, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.