Pi Network Crashes 6% on July 1 — Is a Massive Comeback Just Around the Corner?

Jakarta, Pintu News – The price of Pi Coin plummeted by 5.2% on June 30, continuing a downward trend that began in May when it peaked at $1.6558.

Furthermore, technical analysis suggests that the Pi Network price is likely to see a recovery this week as investors capitalize on the price drop to buy.

Then, how will the Pi Network price move today (1/7)?

Pi Network Price Drops 6% within 24 Hours

On July 1, 2025, the price of Pi Network (PI) was recorded at $0.4939, a decrease of 6% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,188), then 1 Pi Network is IDR 7,995.

Read also: Pi Network Strikes Major Deals with Banxa and Onramper – So Why Is Pi Coin Crashing?

PI’s price range in the last 24 hours has been between $0.4931 (lowest) and $0.5243 (highest), indicating considerable volatility amid market selling pressure.

In terms of market capitalization, Pi Network has a market cap of $3.76 billion, while itsfully diluted valuation is around $5.79 billion.

The trading volume in the last 24 hours was also considerable at around $104.4 million – signaling significant buying and selling activity.

Pi Coin Price could Surge if Key Support Holds

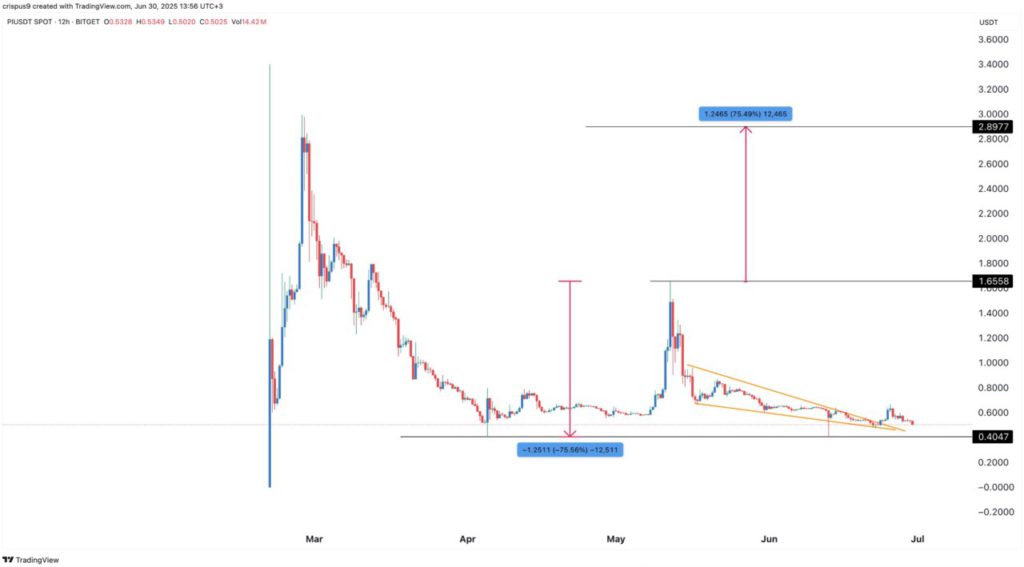

Although Pi Network has launched a variety of major features, Pi Coin is still under pressure. However, the chart in the 12-hour timeframe (30/6) shows a possible opposite direction for Pi Coin‘s price movement.

First, there are indications that the price has formed a double-bottom pattern at $0.4047 – which was the low point on April 5 and June 13. The neckline is at $1.6558, which was the highest point in May.

The double-bottom pattern iscontrarian and often signals a trend reversal. It shows that market participants with bearish positions are starting to hesitate to continue selling below that level.

If this pattern is fully formed, Pi Network’ s initial price target worth noting is at the psychological level of $1. If it is able to break $1, then the potential for an increase towards $1.65 will open up.

If the price manages to break the neckline, then further upside could occur, with a potential target of $2.8977. This target is calculated by measuring the distance from the neckline to the double bottom, then the same distance is applied from the neckline to the top.

Secondly, Pi Coin’ s price has also formed a falling wedge pattern, which is made up of two descending trend lines approaching each other. This pattern connects major resistance levels since May 25, as well as the lowest points since May 17.

Usually, a bullish breakout occurs when the two lines start to converge, and now that has happened.

Thirdly, the Pi Network’ s volatility has decreased in recent weeks, as seen in the Bollinger Bands and Average True Range (ATR) indicators. This drop in volatility could be a sign of the “calm before the storm”, which often precedes a major breakout in either direction.

Based on the double-bottom and wedge patterns formed, the breakout direction is likely to be bullish.

However, this positive prediction will become void if the token price drops below the double-bottom point at $0.4047.

Pi Network Latest News that Potentially Drives Prices Up

The Pi Network price has the potential to recover after a number of big announcements made by the development team at the Pi Day 2 event.

Read also: Vitalik Buterin Sounds the Alarm: Why Today’s Digital Identity Systems Are Failing Us!

During the event, they introduced Pi AI Studio, a platform that allows users to build and launch AI-based applications within the network. The product will benefit from Pi Network’s flagship innovations, such as the Pi Ad Network, a KYC process that has covered more than 13 million users, the .pi domain, and the Pi Wallet.

In addition, the developers also launched Pi Directory Staking, a decentralized way for pioneers to support and promote the ranking of applications and utilities in the Pi ecosystem.

All of these features will receive support from Pi Network Ventures, a $100 million fund aimed at supporting ecosystem development.

Pi Network’s price could also potentially rise if Bitcoin (BTC) experiences a surge, especially as fund flows to ETFs increase and supply on exchanges decreases. In many cases, altcoins tend to follow the price increase when Bitcoin enters a strong bullish phase.

Overall, the Pi Network price is still in a deep bear market phase after falling by double digits over the past two months.

However, there are signs that this downward trend is starting to lose its strength, which could open up further upside opportunities this week or in July.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Can Pi Coin Price Bounce Back This Week After Recent Drop? Accessed on July 1, 2025

*Featured image: Coinpedia

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.