After 10 Years of Silence, Ethereum Whale Awakens to Unbelievable 787,000% Profit!

Jakarta, Pintu News – An Ethereum (ETH) whale recently “woke up” after a decade since its Initial Coin Offering (ICO) by making a test transaction of 1 ETH.

The whale wallet, which originally held 1,000 ETH purchased during the Genesis event for only $310, today moves 1 ETH. With the current ETH price of $2,502, the wallet’s profit has reached about 787,000%.

This development sparked speculation among the community whether there would be a whale dump in the near future.

ICO-era Ethereum Whale Rakes in 787,000% Profits

An early Ethereum Initial Coin Offering (ICO) participant holding more than 1,000 ETH recently “woke up” after a decade, sparking discussion among the community.

Read also: Ethereum Holds Strong at $2,400 — Is a Massive Surge to $5,000 Just Around the Corner?

This Ethereum whale wallet earned its ETH during the Genesis event, with just a small investment of $310, according to data from Etherscan.

At current market prices, the wallet holdings are worth around $2.44 million-describing an incredible return of 7,870 times the initial investment.

ETH whale activity has indeed increased in recent weeks, exhibiting diverse behavior. Last week, one whale entity even bought $10 million worth of ETH.

In addition, Ethereum whales from the Genesis era also started to become active again, as the ETH price entered a long consolidation phase around $2,500. In mid-June, another Ethereum whale also rose after 10 years of inactivity.

The wallet initially received 2,000 ETH during Ethereum’s Genesis event, with only a $620 purchase.

Today, the value of his holdings has jumped to around $5.03 million, highlighting the tremendous appreciation in Ethereum’s value since its early days.

ETH Profit Taking on the Horizon?

ETH price has been fluctuating around $2,500 for quite some time, and this latest whale activity has sparked conversations about potentialprofit booking on ETH.

Read also: These 3 Major Crypto Token Unlocks Could Shake the Market in Early July 2025!

Currently, the whales of the ICO era have only made small-scale transactions; however, if the price goes higher, they will most likely exert selling pressure.

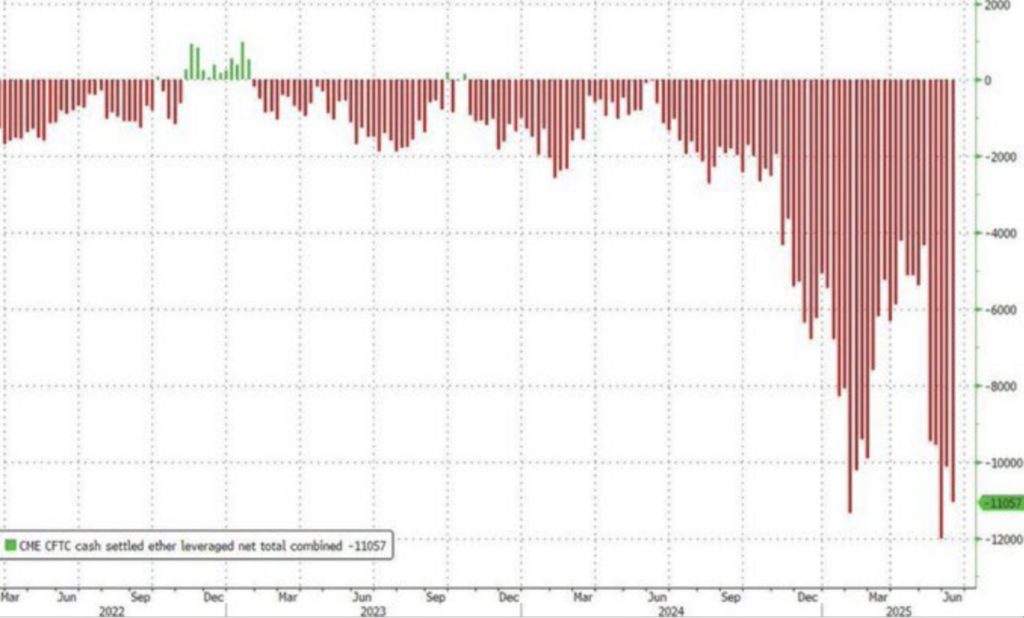

In addition, on-chain data also shows that the number of short positions against ETH is now at a record high. If ETH prices rise, this could trigger a massive short-squeeze.

During the second quarter of 2025, the ETH price recorded an increase of almost 35%. This rise was supported by strong fund flows into the spot Ethereum ETF.

Last week, spot Ethereum exchange-traded funds (ETFs) reported weekly net inflows of $283 million, led by BlackRock’s ETHA, marking seven consecutive weeks of positive growth.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Sleeping Ethereum (ETH) Whale Wakes Up with $787,000 Gains. Accessed on July 1, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.