Crypto Stocks: The Future Investment that Shakes Up Financial Markets

Jakarta, Pintu News – Investors are now starting to look at the crypto world as a promising investment alternative. Stocks related to the crypto industry, once only of interest to early adopters and digital daredevils, have now transformed into mainstream financial vehicles.

On social media, crypto stocks are trending, and many investors are looking for stocks related to cryptocurrency businesses.

Check out the full information in this article!

Why are crypto stocks becoming more popular?

Crypto stocks offer an innovative bridge between conventional and digital finance. Investors who are wary of owning digital assets directly, perhaps due to regulatory uncertainty, storage risk, or technical complexity, can gain exposure to the sector by investing in shares of crypto-focused companies. This is a familiar, organized, and often less volatile way to go.

These stocks are listed on major exchanges and are subject to normal financial regulation, so they can be held in retirement accounts and institutional portfolios. The main advantages of cryptocurrency stocks are diversification, regulatory clarity, and operational leverage. They provide access to crypto market expansion without the need for direct exposure to tokens.

Read also: EURAU Stablecoin: Germany’s First Regulated Digital Financial Innovation

Crypto Stocks: A New Alternative to Altcoins

Many now see these stocks as the new altcoins: liquid, regulated, and strongly linked to the success or failure of the crypto economy. They are influenced by conventional market forces as well as the explosive use of blockchain.

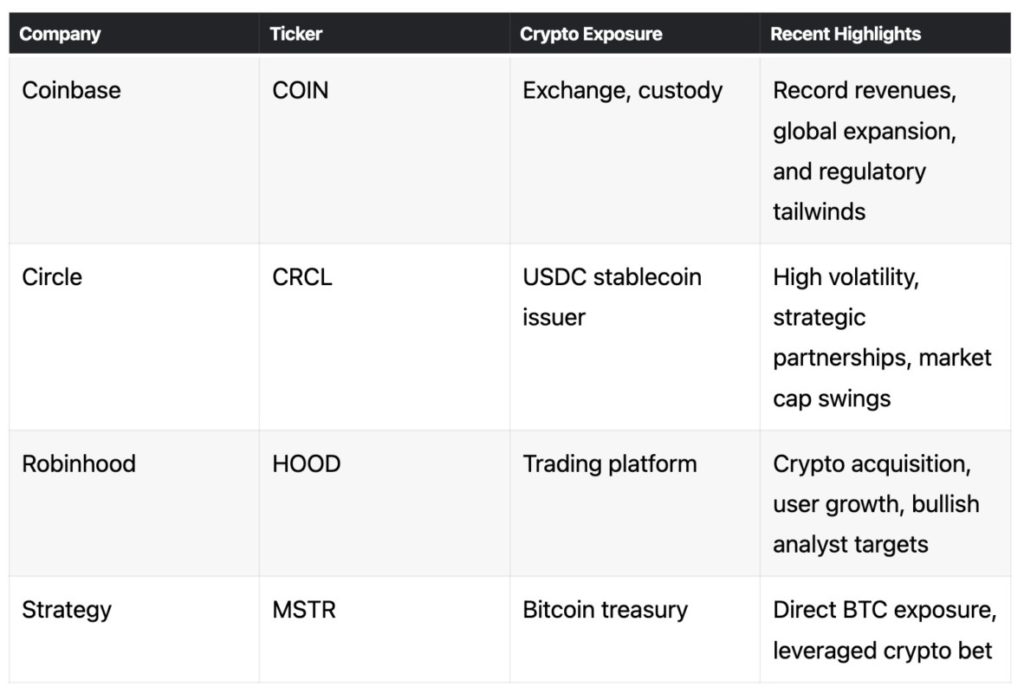

For example, Coinbase shares closed at $335 in the last trading session, delivering a return of over 47% in the past year. On the other hand, Circle had a successful IPO recently. CRCL stock debuted at $69 per share and closed at $192.53 on Tuesday. The stock also hit a recent record high of $298, marking the largest IPO in crypto history.

Read also: Ethereum Community Foundation’s New Breakthrough: Mission to $10,000!

Crypto Stock Performance and Outlook

Robinhood shares closed at $92.33 on Tuesday with a surge of 8.5% in the last five days, and delivered a return of over 70% to investors in a year. Meanwhile, MicroStrategy’s share price closed at $373.30, giving investors a return of over 182.76% during the year.

With the growth of tokenized assets and on-chain trading, these crypto stocks could become the “altcoin” of choice for risk-averse investors who want diversified exposure to the cryptocurrency revolution without the hassle of owning tokens directly.

Conclusion

The transformation of crypto stocks into mainstream investment instruments represents a significant change in the way investors gain exposure to digital assets. With the promise of regulatory compliance, reduced volatility, and familiar trading mechanisms, companies such as Coinbase, Circle, Robinhood, and MicroStrategy have successfully brought together the traditional and digital worlds of finance.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Crypto Stocks Are the New Altcoins: Check Out Top 4 Expert Picks. Accessed on July 4, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.