Pi Network Price Jumps 4% Today (July 7) — But With Sellers Still in Control, Is a Crash Coming?

Jakarta, Pintu News – Reporting from BeInCrypto (6/7), based on the PI/USD daily chart, it can be seen that this altcoin experienced a brief consolidation between July 1 and 4, facing resistance at $0.50 and support at $0.47.

However, bearish pressure strengthened on Friday, pushing the token down past its short-term support area.

Since then, PI has continued to show a downward trend, which increases the likelihood of retesting its all-time low of $0.40.

Pi Network Price Up 4.2% in 24 Hours

On July 7, 2025, the price of Pi Network was recorded at $0.4694, having risen 4.2% in the last 24 hours. If converted into today’s rupiah ($1 = IDR 16,240), then 1 Pi Network is IDR 7,623.

Read also: Pi Network 2030 Price Prediction: Can Pi Coin Skyrocket to $1,000?

Based on data from CoinGecko, the price of PI moved within a range of $0.4475 – $0.4783 over the past day, indicating significant volatility despite the uptrend.

With a current market capitalization of $3.58 billion and a fully diluted valuation of over $5.5 billion, PI shows great potential for further growth.

Moreover, the highly active 24-hour trading volume of $91.7 million indicates high interest from investors and traders.

PI Sales Deepen as Bullish Momentum Weakens

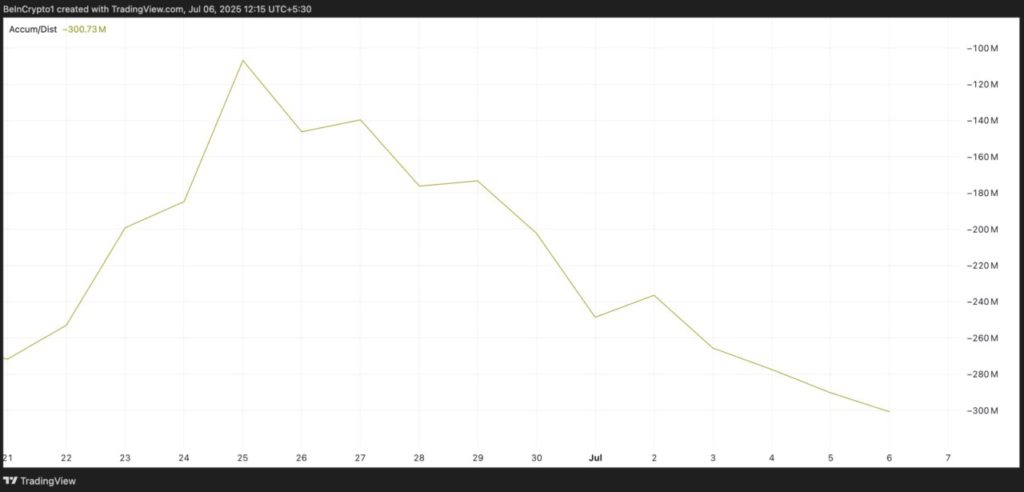

PI’s Accumulation/Distribution (A/D) line has fallen sharply in the past two weeks, signaling a major drop in buying volume and weakening investor confidence. To date, the metric stands at -300.73 million, down 82% since June 25.

The A/D line measures the buying and selling pressure of an asset by analyzing its price movement and trading volume. When this line rises, it indicates strong accumulation, meaning that buyers are driving demand and causing prices to rise.

Conversely, as was the case with PI, the falling A/D line indicates that selling pressure outweighs buying interest. This suggests that traders are selling PI more than accumulating, which is a sign of weakening confidence in the token’s short-term recovery prospects.

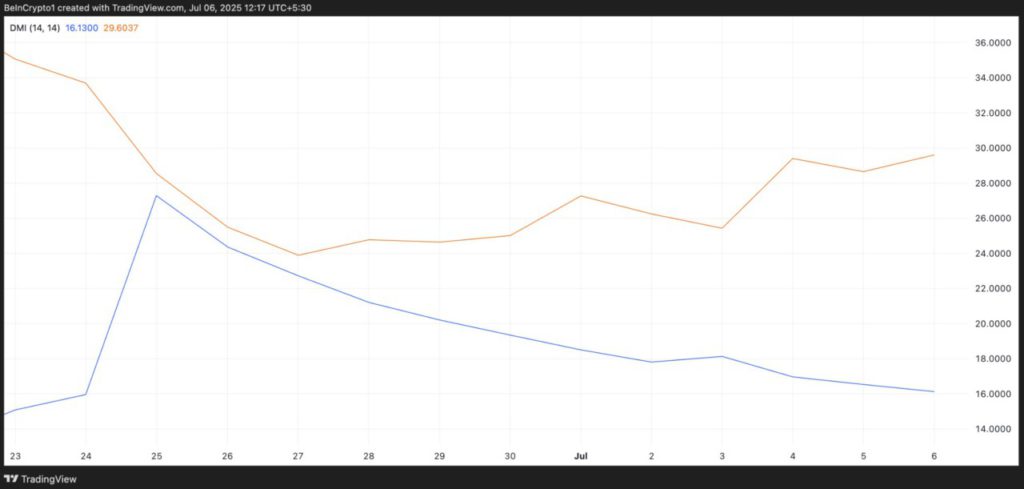

Additionally, the settings on PI’s Directional Movement Index (DMI) are also in line with this bearish narrative. The token’s positive directional index (+DI, blue) is currently below the negative directional index (-DI, orange), indicating a strengthening negative trend.

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: +DI which represents upward price movement, and -DI which shows downward price movement.

Read also: Pi Network July 2025 Price Prediction: How High Can Pi Coin Fly?

A market is considered bullish when +DI is above -DI. This means that buying pressure is dominant, and the asset is in an uptrend.

Conversely, when +DI is below -DI, the downward price movement is stronger. This is a bearish sign, indicating that PI sellers have more market control than buyers.

Sellers Dominate the PI Market, but Buyers Can Turn the Tide

As of July 6, PI was trading at $0.44, with the next major support level being the all-time low of $0.40.

With sellers still in control and building bearish momentum, the possibility of prices testing this low again remains open.

However, if demand from buyers picks up again, this bearish outlook could be invalidated. In such a scenario, the price of PI could potentially rebound, break the new resistance at $0.47, and continue its rise towards $0.50.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Will PI Coin Slip Toward Its All-Time Low This Week? What the Charts Reveal. Accessed on July 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.