Ethereum (ETH) is Strengthening: Will the Momentum Last? Here are 3 Key Signs!

Jakarta, Pintu News – Ethereum (ETH) is now showing signs of significant momentum gains. With increased social dominance and returning interest from short-term holders, many are wondering if this is the beginning of a sustained bullish trend. However, some data shows a decline in trader participation which could affect the continuation of this trend.

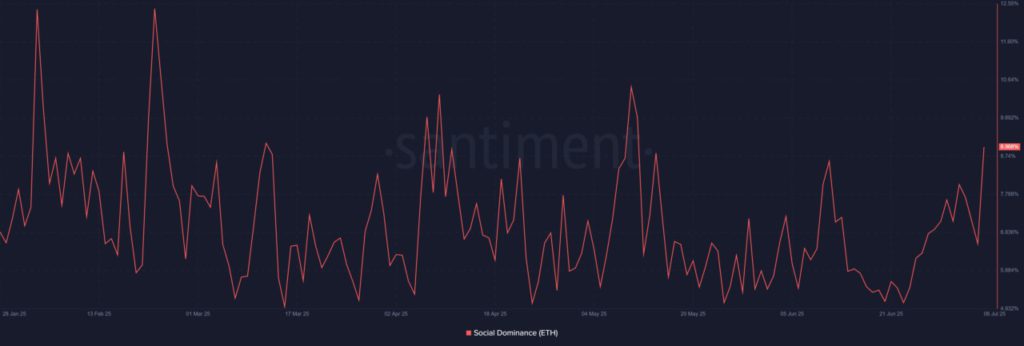

Ethereum’s Surge in Social Dominance

Ethereum (ETH)’s social dominance recently reached 8.96%, the highest figure since May, signaling a significant increase in public interest. This indicates that more discussion and attention is focused on Ethereum (ETH) across various social media platforms. This increase could be due to investors looking for investment alternatives amid a volatile market.

However, the question that arises is whether this increased interest will turn into action in the market. While there is an increase in talk, it does not necessarily follow that this will immediately lead to a significant increase in buying or selling. Investors and analysts will have to observe whether this trend will continue and transform into higher trading volumes.

Also Read: Can XRP Soar 35,000%? Check out the Supporting Factors!

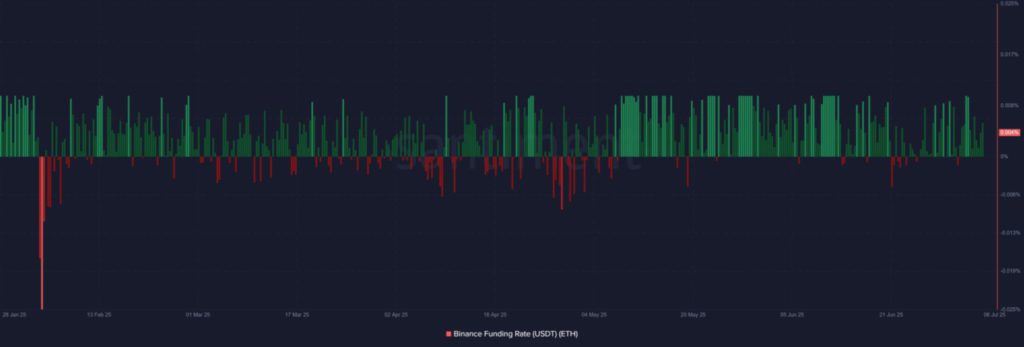

Positivity in Funding Rates

Despite growing uncertainty on the on-chain, Ethereum (ETH) funding rate remains in positive territory with +0.004%. This shows that traders are still bullish on Ethereum (ETH). A positive funding rate usually indicates that there are more long positions being opened compared to short positions.

This situation could provide additional support for Ethereum (ETH) price in the market. However, it is important to remember that stable funding rates alone may not be enough to sustain an uptrend if not supported by other factors such as solid trading volumes and wider adoption.

Short-Term Holders Re-engage

Short-term holders are starting to re-engage in the Ethereum (ETH) market. The realized cap for 1-7 day holders rose to 2.35, indicating a recovery from the previous low point. This is a small but important indicator showing that short-term investors are starting to become active again.

However, Ethereum (ETH) derivatives data showed a sharp decline of 58.9% in trading volume and a 1.05% drop in Open Interest. This signals a decrease in participation from active market participants, which could be a sign of a lack of sustainability in the bullish momentum if not addressed soon.

Conclusion

While there are some positive indicators in favor of Ethereum (ETH), there are still uncertainties to watch out for. Increased social dominance and stable funding rates provide some reason for optimism, but decreased trader participation and on-chain uncertainty could hamper further upside potential. Investors should remain vigilant and monitor various factors before making investment decisions.

Also Read: Michael Saylor and a New Strategy Towards 600K Bitcoin (BTC), Can It Be Replicated?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. 3 Signs Ethereum is Gaining Momentum; How Long Can It Last?. Accessed on July 7, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.