The Great FARTCOIN Movement: Potential Price Explosion Awaits in July 2025?

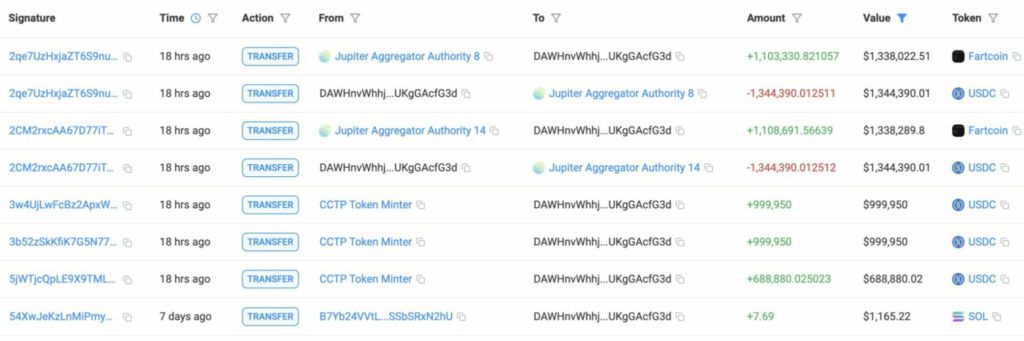

Jakarta, Pintu News – Two “whales” have recently made massive purchases of FARTCOIN, signaling a potential price explosion that may occur. Within 24 hours, they had invested a total of $8.7 million to buy more than 7.2 million FARTCOIN, at an average price of $1.20 to $1.22 per token. Although the price is currently hovering around $1.17, a 2.46% drop in a day, this large-scale buying spree is indicative of increased confidence from savvy investors.

Will FARTCOIN Experience a Breakout?

FARTCOIN’s daily chart shows a well-formed cup and handle pattern, a classic bullish reversal signal. The neckline of the pattern is around the $1.2575 resistance level, which has been a key barrier in recent weeks. Currently, the price is consolidating below the downtrend line, forming the “handle” of the structure. If the price manages to break above $1.26, the pattern will be confirmed and will likely trigger a rally towards $1.60.

However, if FARTCOIN fails to reclaim this level in the near term, bearish pressure may return towards the $1.00 psychological support. Failure to break could keep the token in further consolidation, so it is important for traders to watch for volume spikes and funding spikes as breakout confirmation signals.

Also Read: Can XRP Soar 35,000%? Check out the Supporting Factors!

Why does FARTCOIN Keep Dropping Out of Exchanges?

Despite the latest whale activity, Spot Exchange Netflow on July 6 showed a figure of -112.67K according to CoinGlass. This means that more FARTCOIN is exiting exchanges than entering, suggesting that investor behavior broadly still prefers to hold rather than sell. This trend continues to support the supply shortage narrative. Although whales have injected new liquidity, the lack of significant inflows suggests that sellers are not dominating.

The continuation of this trend could be a strong indicator that FARTCOIN may experience an increase in price if demand continues to increase while supply decreases. Investors and traders should pay attention to this indicator as an important signal of market sentiment that may not be directly visible from daily price movements.

Is Trader Sentiment Starting to Turn Bullish?

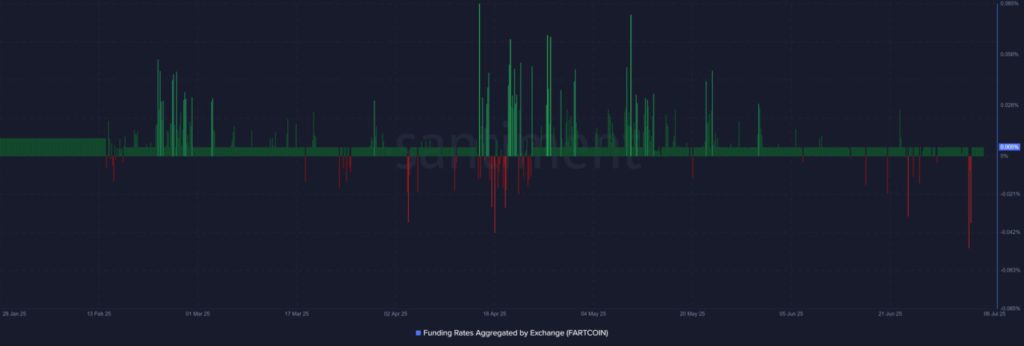

The funding rate on Binance recently turned positive at 0.005%-a subtle but important change. While this rate is still moderate, it marks a critical sentiment turning point after a long period of negative or neutral positions. This increase is in line with the recent price consolidation near resistance, implying that traders are expecting a breakout.

However, until funding levels increase significantly, confidence remains cautious. Traders should remain alert to these sudden changes in funding levels as one of the early indicators of changes in broader market sentiment towards FARTCOIN.

Conclusion

FARTCOIN is at a critical technical junction, supported by massive whale buying, a bullish chart structure, and slightly improved trader sentiment. However, continued negative sentiment and declining network growth suggest that cautious optimism is still needed. A confirmed breakout above $1.26 could change the course completely, but failure to do so will probably keep the token in further consolidation.

Also Read: Michael Saylor and a New Strategy Towards 600K Bitcoin (BTC), Can It Be Replicated?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Fartcoin: Major Group Makes $8.7 Mln Move, This Will Lead To…. Accessed on July 7, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.