XRP Ledger Shines in the Real Asset Market, Will the Trend Continue?

Jakarta, Pintu News – With strong growth and rumors of an ETF, XRP Ledger (XRPL) is starting to position itself as a real alternative to Ethereum (ETH).

XRP Ledger’s Momentum in the Real Asset Market

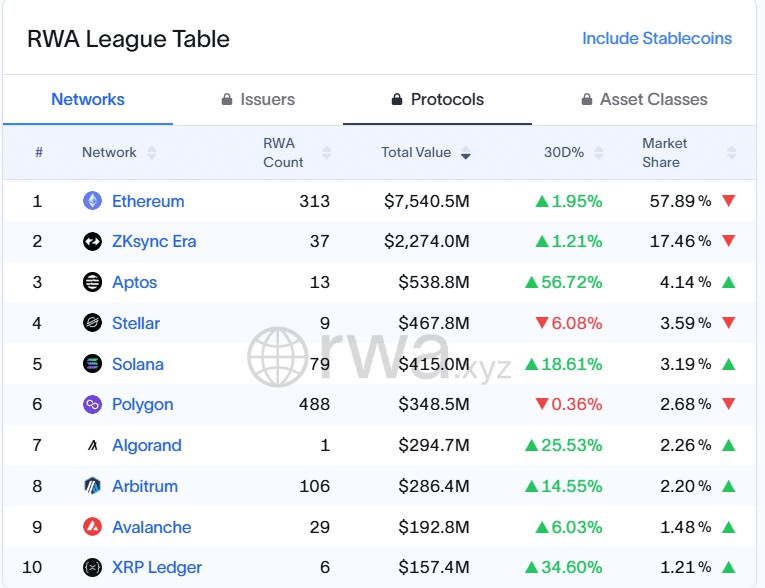

XRP Ledger (XRPL) is now starting to show its mettle in the real asset market (RWA). With total tokenized assets of over $157 million, XRPL is now in a strong position to compete with Ethereum (ETH). According to the RWA League Table, XRPL is ranked 10th with a total RWA value of $157.4 million, recording a growth of 34.60% in the last 30 days, which is the third highest growth among all listed networks.

Despite having only six RWA issuers, XRPL’s growth rate outperforms many other big players, including Ethereum (ETH). The graph presented shows a consistent distribution of assets across tokens such as MGL, AAULF, and OUSG, signaling an initial but steady diversification. With increasing institutional interest, this data indicates that XRPL could become a serious contender in the RWA market sooner than expected.

Also Read: Can XRP Soar 35,000%? Check out the Supporting Factors!

Institutional Trust Increases as Development Improves

Institutional confidence in the XRP Ledger (XRPL) is increasing. For example, Mercado Bitcoin plans to tokenize over $200 million of RWA assets on XRPL, which is one of the largest blockchain tokenization efforts in Latin America. This move shows high confidence in XRPL’s infrastructure to host regulated and licensed financial products in the global market.

On the other hand, data from Santiment shows an increase in XRP development activity, particularly in late June, which is in line with the price recovery and institutional news cycle. As the project progresses, increased activity on the XRP Ledger suggests that the network is becoming a more active part of the wider tokenization landscape.

Mixed Picture

Speculation regarding the approval of a Ripple ETF fueled optimism, with Polymarket estimating an 88% chance of approval by the end of 2025. Although this confidence has dipped slightly, it remains strong among traders waiting for the green light from regulators.

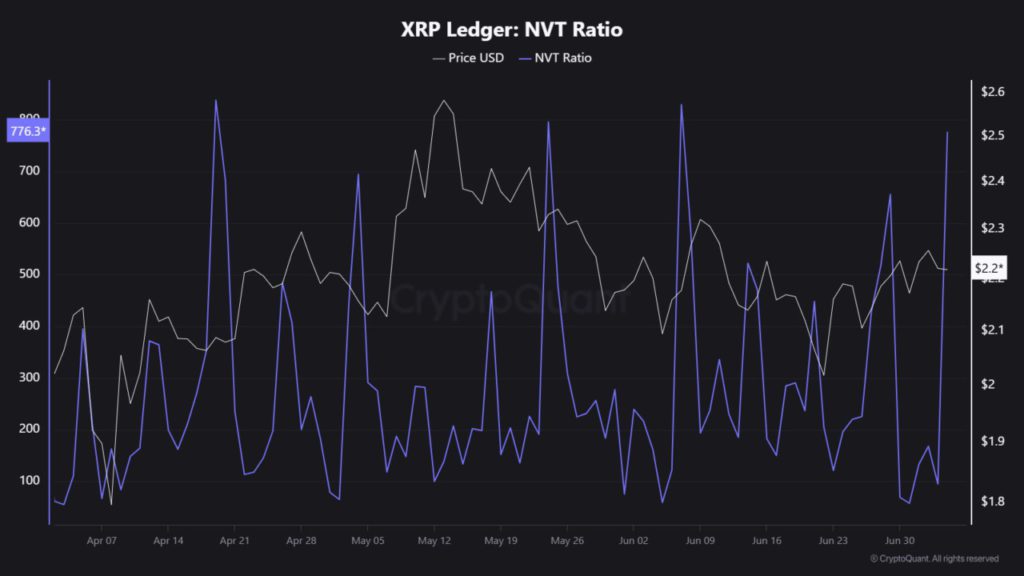

On the other hand, XRP’s NVT ratio shows a more volatile narrative. Spikes in the NVT ratio are often considered a sign of overvaluation, which contrasts with the relatively stable price action around $2.2. This suggests that market value may be outpacing transaction utility on some occasions. Although ETF speculation boosts sentiment, continued growth in the chain will be key to supporting valuations with real network activity.

Conclusion

XRP Ledger (XRPL) shows significant potential in the real asset market with rapid growth and steady asset diversification. Growing confidence from institutions and increased development activity confirms XRPL’s position as a viable contender in the global arena. However, to maintain this momentum, XRPL needs to continue to demonstrate sustainable and steady growth in all aspects of its operations.

Also Read: Michael Saylor and a New Strategy Towards 600K Bitcoin (BTC), Can It Be Replicated?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP Ledger gains ground in RWA market, but can it sustain the hype?. Accessed on July 7, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.