4 Key US Economic Signals That Could Rock Bitcoin This Week – Is a Major Price Swing Coming?

Jakarta, Pintu News – With the crypto market entering the second week of July, traders and investors should monitor some signals or indicators of the United States economy.

These data can affect their portfolios, potentially causing a spike or drop in the price of Bitcoin (BTC).

The influence of US economic indicators on the Bitcoin price proved to be significant in 2025, after fading in 2024.

While there are several United States economic signals being released this week, only a few of them are expected to significantly affect Bitcoin and crypto market sentiment.

Consumer Credit

The first US economic indicator to watch will be released on Tuesday, which will track lending trends while reflecting the level of consumer confidence and their purchasing power.

Read also: Drake Just Dropped a New Song — And He Name-Drops Bitcoin!

After US consumer credit rose by $17.87 billion in April, economists expect a $10 billion increase in May. If this prediction is correct, then the figure is almost in line with March’s data of $10.85 billion.

As declining credit levels indicate a lack of optimism in the market, a drop in US consumer credit could encourage a shift of capital from traditional markets to speculative assets such as Bitcoin, with consumers remaining the driver of economic growth.

More specifically, credit stagnation or downturns often signal caution, with Bitcoin becoming a top investment choice to protect against economic slowdowns or fiat instability.

FOMC

The Fed’s May FOMC meeting minutes are one of the US economic signals likely to cause Bitcoin price volatility. This data will be released on Wednesday, following the Federal Open Market Committee ‘s (FOMC) decision to keep interest rates on hold in May.

Following the decision, the US Bureau of Labor Statistics (BLS) revealed that inflation accelerated at an annualized pace of 2.4% in May, up from 2.3% Year-on-Year (YoY) in April.

For the first time since January 2025, headline CPI inflation rose again in May. Inflation in the United States remains above the Fed’s 2% target and the mandate to achieve maximum employment levels.

“The Committee aims to achieve maximum employment and inflation of 2% over the long run. Uncertainty about the economic outlook has increased,” the Federal Reserve stated in its May release.

Wednesday’s report gives traders and investors insight into the direction of Federal Reserve (Fed) monetary policy. The minutes detail discussions around interest rates, inflation and economic growth, which are likely to influence market sentiment.

A hawkish tone would indicate tighter policy or fewer interest rate cuts, which could put downward pressure on Bitcoin. A strengthening US dollar could also potentially push down the price of Bitcoin.

Conversely, if the FOMC gives a dovish signal, it will indicate a possible interest rate cut ahead, which could increase risk appetite. This move could encourage capital flows into crypto, as cheaper borrowing costs encourage investment in high-risk, high-growth assets.

Read also: 3 Altcoins to Watch This Week: Bonk, Aptos, and Pi Network Ready to Rocket?

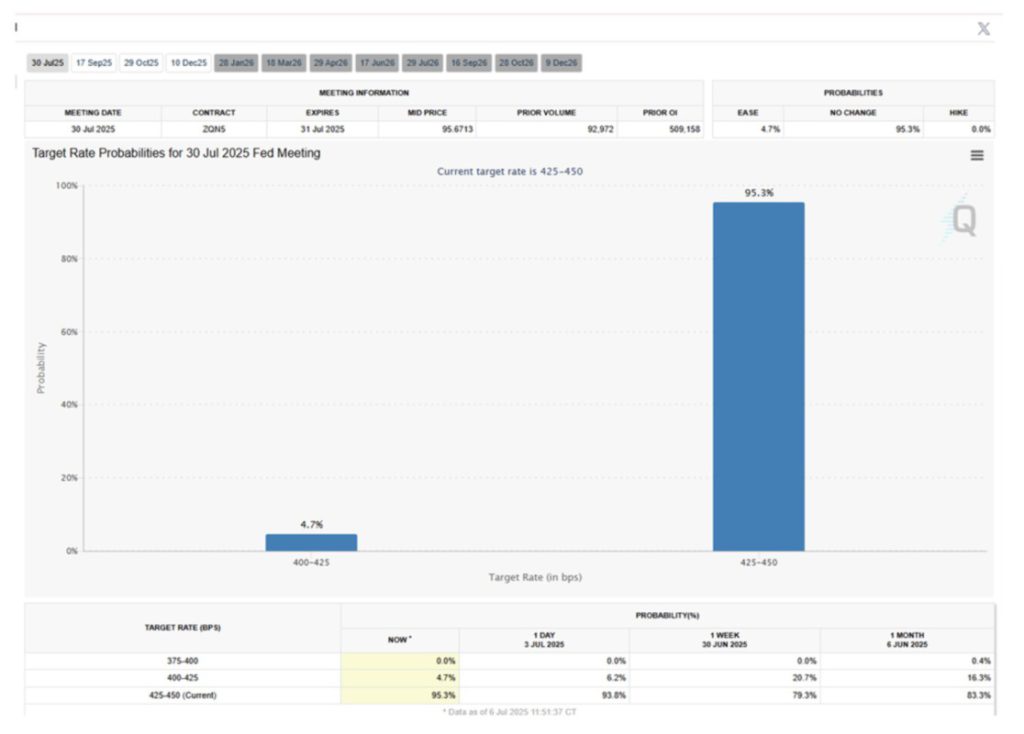

According to the CME FedWatch Tool, market participants assess there is a 95.3% chance that the Fed will keep rates on hold at its next meeting on July 30.

However, Fed Chair Jerome Powell may reiterate his previous statement to reject premature interest rate cuts, despite political pressure from President Trump.

Given Bitcoin’s sensitivity to liquidity, unexpected policy changes could trigger major volatility.

Meanwhile, Powell continues to blame President Trump’s trade tariffs as the main reason for his refusal to lower interest rates.

He defended the FOMC’s unanimous decision to hold the Federal Funds Rate, and cited inflation expectations triggered by trade policy. The tariff is a form of external tax on imported goods and services.

Initial Jobless Claims

Initial claims for unemployment benefits are also on the watch list for US economic signals this week. This data will show the number of US citizens who applied for unemployment insurance for the first time last week.

Economists expected a modest increase to 235,000 claims last week, up from 233,000 claims reported for the week ended June 28.

This US economic indicator could affect market sentiment as US labor market data is increasingly considered the next macro benchmark for Bitcoin.

Although the expected increase is mild, the rising number of claims could signal an economic slowdown. This could boost the price of Bitcoin as traders start anticipating an interest rate cut by the Fed by the end of the year.

Conversely, if the number of claims decreases, it could strengthen the value of the US dollar and put pressure on crypto prices.

Read also: XRP Ready to Break $2.35? Smart Money Triggers Big Bullish Spike!

Digital Asset Tax Policy

One more piece of data that could potentially affect sentiment towards Bitcoin is the digital asset tax policy hearing scheduled for Wednesday, July 9.

On that day, the House Ways & Means Oversight Subcommittee will hold a hearing titled “Making America the Crypto Capital of the World.” The main focus will be on establishing a 21st century tax policy framework for digital assets.

The general discussion focused on the concrete steps needed to establish a clear and modern tax policy framework for digital assets.

“No capital gains tax for crypto is the only way to make America the crypto capital of the world,” joked one user.

Meanwhile, amid the ongoing string of US economic signals, Bitcoin is trading at $109,150 at the time of writing-up more than 1% in the last 24 hours.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 4US Economic Signals That Could Move Bitcoin This Week. Accessed on July 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.