Bitcoin Hits $107,000 Today — Is This the Calm Before a Massive BTC Surge? Here Are 2 Signs You Can’t Ignore!

Jakarta, Pintu News – Bitcoin (BTC) is trading at $107K as of this report, with the price trying to break the $110K level.

Despite remaining stable above $100K, BTC faces mixed developments regarding future price movements. While the price remains high, the volume-a key factor in trading-has decreased.

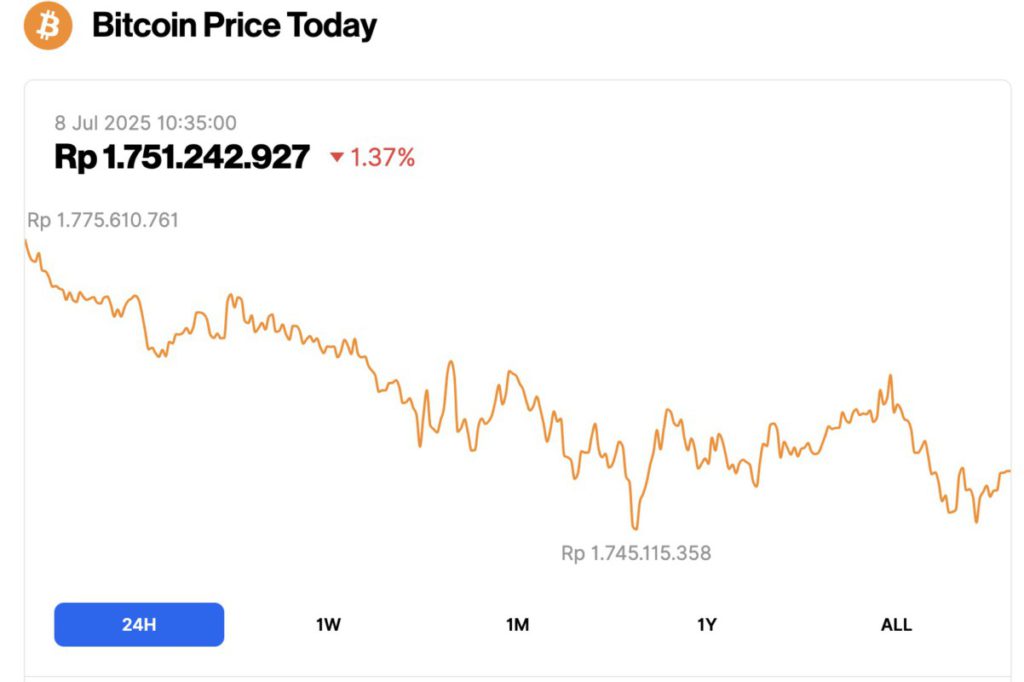

Bitcoin Price Drops 1.37% in 24 Hours

As of July 8, 2025, Bitcoin was trading at $107,898, or approximately IDR 1,751,242,927 — marking a 1.37% decline over the past 24 hours. Within that timeframe, BTC reached a low of IDR 1,745,115,358 and climbed as high as IDR 1,775,610,761.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.14 trillion, with trading volume in the last 24 hours up 16% to $44.26 billion.

Read also: 4 Key US Economic Signals That Could Rock Bitcoin This Week – Is a Major Price Swing Coming?

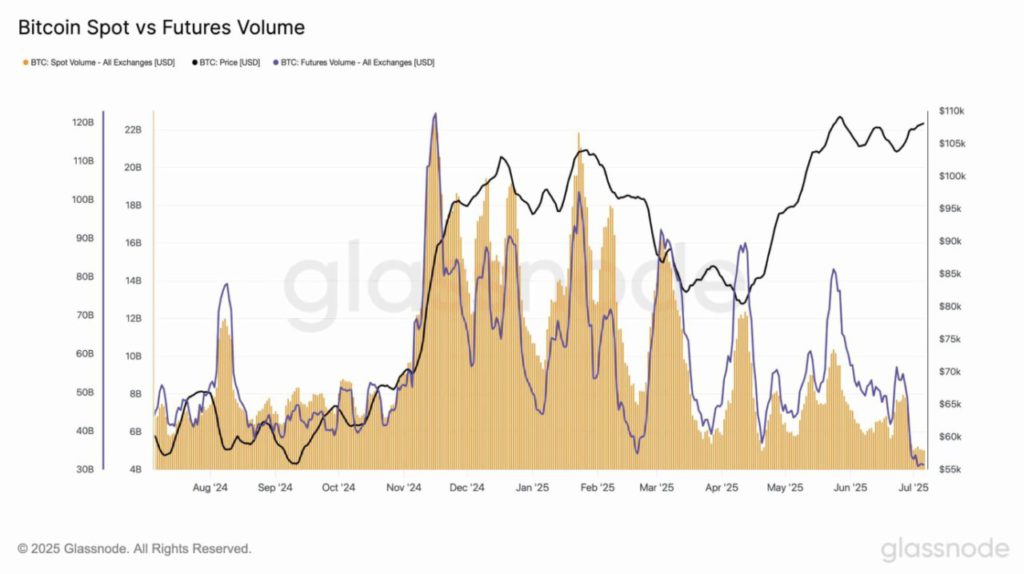

Why is BTC Volume Declining?

Data from Glassnode reported that Bitcoin Spot and Futures volumes plummeted to $5.02 billion and $31.2 billion respectively. This is the lowest level in over a year.

Peak volumes were recorded at the end of 2024 and the first quarter of 2025, and then there was a steep decline starting in April.

Although the price of BTC continues to move up, this divergence indicates a slowdown. This could be due to recent market tensions and fears of a reversal after the price stayed in the upper $100K range.

However, this waning activity could be seasonal, caused by a lack of market conviction, or profit-taking. When volume declines while prices rise, the potential for a pullback becomes higher.

In the context of the bull side, for the price increase to be more durable, stronger volume support is needed to confirm the possibility of rally sustainability.

Retail Fatigue vs. Whale Accumulation

A sharp drop in retail investor activity caused wallets with 0-10K holdings to experience a 10% drop in demand in the last 30 days – the lowest level in a year. This difference indicates reduced flows from the retail side, as reported by IT Tech at X.

Read also: Ethereum Steady at $2,500 — But Why Are Users Vanishing as Addresses Surge?

Historically, retail is usually most active during market turning points. Their absence at this time could be a signal that there won’t be massive sales or a surge in demand.

Meanwhile, the low retail activity indicates that capital flows are likely to go to bigger wallets. This suggests passive accumulation by whales.

This scenario is similar to that of mid-2023, where the decline in retail demand is followed by a 10% correction, followed by a larger breakout.

Retail disappointment and whales ‘ hunger could be the deciding factors for Bitcoin’s next big move.

LTH Accumulates as OTC Balance Declines

Reinforcing the whale accumulation signal, Bitcoin’s MVRV ratio stood at 2.26, indicating long-term accumulation. Historically, this level often precedes a major rally.

It is worth noting that in previous peaks, when this ratio exceeded 2.5,cycle tops usually occurred. The last time this happened was at the end of 2021.

The current pattern, based on recent data, resembles the initial phase of a bullish move as seen in early 2023. As such, there is still room for further upside.

BTC’s price strength seems to be maintained as long as the MVRV ratio is above the trendline.

On the other hand, OTC balances have also decreased, which hints at a potentialsupply squeeze as scarcity increases. A drastic reduction in supply usually triggers a rally, provided it is accompanied by demand.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin holds above $100K despite low volume: 2 signs point to more upside. Accessed on July 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.