Ethereum Holds Firm at $2,500 — But On-Chain Data Reveals the Road to $5K Won’t Be Easy!

Jakarta, Pintu News – While the price of Ethereum (ETH) is trading at around $2,590, up 3.57% compared to last week, talk of a potential return to $5,000 is gaining traction.

However, on-chain and volume indicators are not yet giving very supportive signals. ETH price reached a record high of $4,891 in November 2021.

Now, almost four years later, many signals suggest that the next hike may not be as close as the bulls had hoped.

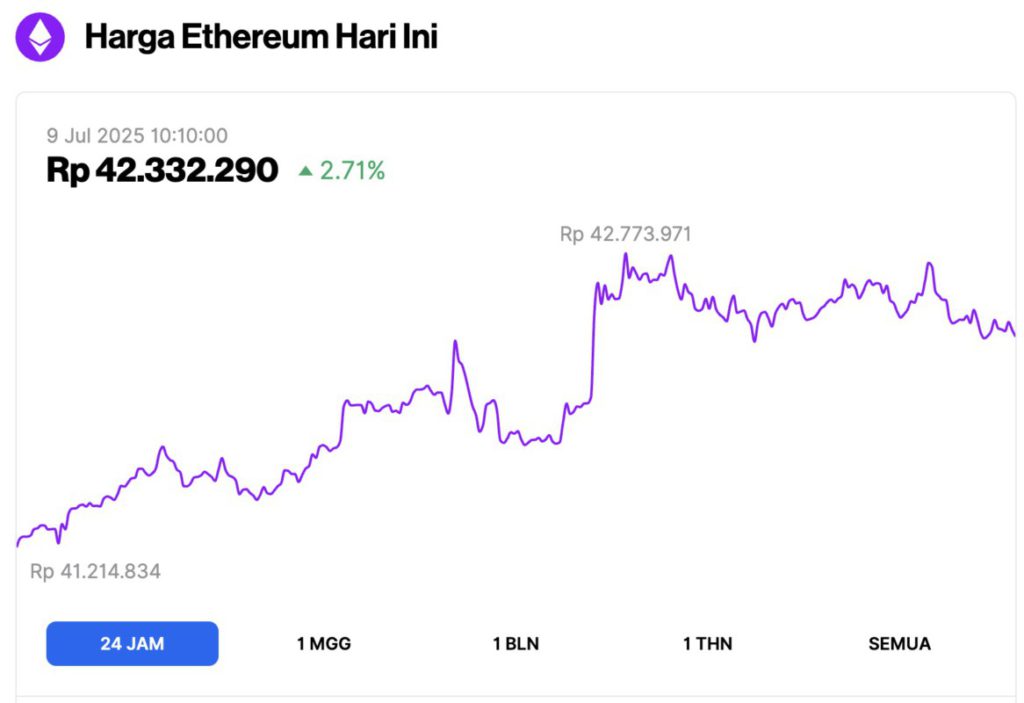

Ethereum Price Rises 2.71% in 24 Hours

As of July 9, 2025, Ethereum was trading at approximately $2,597, or around IDR 42,332,290 — marking a 2.71% gain over the past 24 hours. Within that time frame, ETH dipped to a low of IDR 41,214,834 and climbed as high as IDR 42,773,971.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $313.51 billion, with daily trading volume falling 0.77% to $17.25 billion in the last 24 hours.

Read also: Bitcoin Holds Strong at $108,000 — Is a Massive Breakout Just One Move Away?

Developer Activity No Longer Supports $5,000 Hype

As reported by BeInCrypto (8/7), since mid-May, Ethereum developer contributions-tracked through the number of code commits and updates in the main repository-have dropped from 71 to only around 25, according to data from Sentiment.

This represents a nearly 65% drop in direct developer engagement, despite the continued rise in price. This divergence in direction is often a signal that innovation on core protocols and on-chain growth is lagging behind market hype.

Interestingly, a similar surge in developer activity in December 2024 also failed to trigger a price rally, further reinforcing the cautious attitude.

If Ethereum’s foundation layer doesn’t expand aggressively, this will limit price justification in the long term and cast doubt on short-term optimism towards $5,000.

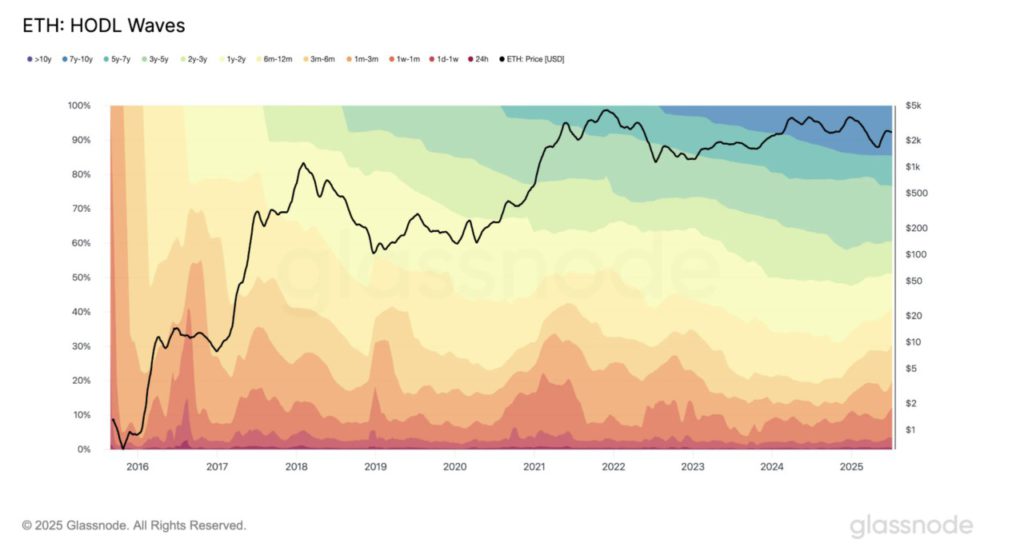

HODL Waves Show Erosion of Long-term Confidence

HODL Waves, which categorizes wallet holdings based on storage duration, shows an alarming trend.

The proportion of ETH stored in long-term addresses (with storage periods of 6 months or more) has decreased, even as the price has rallied recently.

Read also: Why SOL, ETH, and XRP Could Be Your Best Bets Before the Next Big Crypto Surge!

Most ETH is now in the storage bracket between 1 month and 6 months, indicating ownership by new investors and potential swing traders.

Compared to previous moments of price increases, where the 1-year and above holder group dominated the waves, the current structure reflects weaker conviction – a signal that many ETH holders may exit if the price fails to break the resistance level.

CMF confirms that Smart Money is still holding back

Chaikin Money Flow(CMF), a metric used to track volume-weighted accumulation, was flat after spiking in April-May, which coincided with Ethereum’s price rise from $1,300 to $2,700.

Since then, the CMF has struggled to break the 0.10 mark, signaling the cessation of significant buying pressure.

As of July 8, Ethereum is stuck below the key resistance level at $2,647. If the momentum continues to weaken, the support areas are at $2,491 and $2,467. In case of a break below $2,467, the price could drop further to around $2,376.

Meanwhile, On-Balance Volume(OBV), which adds or subtracts volume based on price direction, remained stuck in a narrow range below -2.12 million.

The lack of large-volume participation from whales (not one-off transactions) and large wallets casts doubt on whether the current price level – let alone $5,000 – has a strong enough support structure.

Without strong OBV or CMF readings to support a potential breakout, the $2,861 level is likely to be a strong rejection zone. This makes the $5,000 target seem more like a psychological headline than a realistic goal in the near term.

However, if Ethereum manages to turn $2,647 into a support level – which is clearly visible on the current chart – the bearish outlook may fall. This could pave the way for ETH prices to break $2,800.

However, the invalidation of this bearish signal should be accompanied by renewed momentum, especially if supported by increased developer activity and a stronger CMF recovery.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum (ETH) is Rising; But On-Chain Indicators Say $5,000 Can Wait. Accessed on July 9, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.