Hyperliquid Skyrockets: TVL Soars 147% as It Overtakes Ethereum and Solana in Daily Revenue!

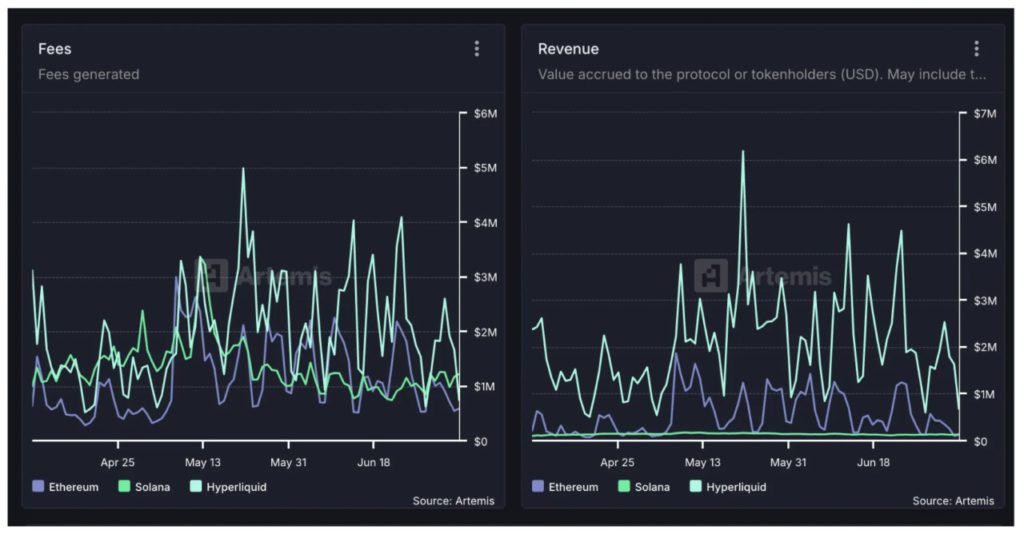

Jakarta, Pintu News – Based on on-chain data, Hyperliquid has consistently surpassed established networks such as Solana (SOL) and Ethereum (ETH) in daily revenue over the past three months.

In addition, this decentralized finance (DeFi) protocol has become a heavy competitor to both networks in terms of fees, challenging their long-held positions.

Hyperliquid surpasses Ethereum and Solana in daily revenue

Read also: Crypto Analyst Says PEPE Coin Could Skyrocket 20x — Is the Next Big Meme Rally Her

Data from Artemis revealed that Hyperliquid (LIQUID) took the top spot in daily revenue, while Solana lagged behind over the past three months.

Impressively, this achievement was not just a momentary success. The protocol has also maintained higher weekly revenue since February.

Moreover, fees from Hyperliquid have largely surpassed Ethereum and Solana in the past three months, despite some dips. In fact, yesterday, the fees generated by this platform jumped to $1.7 million.

“Hyperliquid generated $1.7 million in fees in 24 hours, surpassing Solana, Ethereum, and Bitcoin in daily transaction fees,” highlighted analyst Mario Nawfal.

TVL Hyperliquid Surges 147% and Hits $370 Million

Along with success in terms of revenue, Hyperliquid also saw a significant increase in total value locked (TVL) over the same period.

TVL jumped by 147.6%, reaching $370.7 million. This growth further confirms the platform’s appeal to users.

One of the main factors behind Hyperliquid’s success is the increased attention from whale activity on the platform. Notable traders such as James Wynn and Qwatio came into the spotlight thanks to their highly leveraged trading.

Read also: Solana Price Prediction This Week: ETF Approval Potential to Push SOL Price to $200?

Their trades have yielded huge profits, but the losses have been equally huge. Even influencer Andrew Tate once recorded a loss while trading on this platform.

While these examples serve as important lessons about the risks of high-leverage trading, they have indirectly pushed Hyperliquid into the limelight.

This increased visibility has also played a major role in Hyperliquid capturing around 81.09% mindshare in the crypto derivatives sector over the past three months.

In addition, Hyperliquid’s hybrid model is also a key factor that gives it an edge over other protocols and is driving increased adoption from investors.

While Hyperliquid continues to attract users, its native token is also gaining momentum. Institutional investors, including Lion Group and Eyenova, have adopted this altcoin as a reserve asset, further strengthening its credibility in the market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. HyperLiquid vs Solana, Ethereum Revenue. Accessed on July 9, 2025

- Tron Weekly. HyperLiquid Revenue Fees Beat Solana, Ethereum. Accessed on July 9, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.