Tether Keeps $8 Billion Worth of Gold in a Private Swiss Vault, What’s the Purpose?

Jakarta, Pintu News – Tether Holdings, the issuing company of the Tether stablecoin (USDT), recently announced that it holds $8 billion worth of gold in a private vault in Switzerland.

This move marks Tether’s significant efforts in securing valuable assets to back the value of USDT that is widely circulated in the global market.

With USDT emissions totaling $159 billion, the presence of this large amount of gold is an important highlight in Tether’s financial strategy.

Check out the full information in this article!

Tether Personal Gold Vault

Tether has chosen to consolidate its gold reserves in one highly secure location in Switzerland, which is managed and controlled by the company itself. This decision not only reduces storage costs but also increases the security of these valuable assets.

Tether CEO Paolo Ardoinio emphasized that having a private vault allows the company to be more efficient in terms of cost and security. With nearly $8 billion worth of gold stored, Tether is now one of the largest gold holders in the world, on par with major banks and governments.

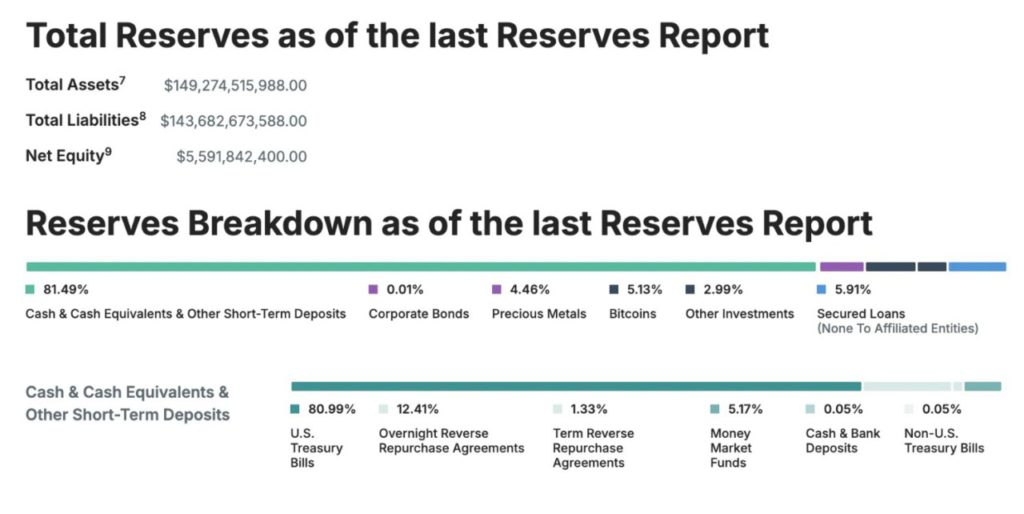

This shows how serious Tether is about managing the assets that guarantee the value of USDT, although there are still questions about the overall audit of their reserves.

Read also: Ethereum (ETH) 2025 Prediction: Potential to Jump 160%?

Gold-based Products and Regulation

In addition to USDT, Tether also offers the XAUT product, a digital token backed by real gold. Each XAUT token represents one ounce of gold that can be claimed in Switzerland. To date, Tether has issued tokens backed by 7.7 tons of gold.

They offer an attractive investment alternative for cryptocurrency users looking for a resilient asset amid market fluctuations. However, new regulations in the European Union and the United States demand that stablecoins should only be backed by cash or short-term government bonds, not gold or other assets.

This may force Tether to adjust their backup strategy if they want to continue operating in the region. These regulatory changes demonstrate the complex dynamics between financial innovation and regulatory compliance.

Also read: Gold Jewelry Price Today, Wednesday July 9, 2025

Community Reaction and the Future of Tether

While the announcement of the gold vault has been received with praise for Tether’s public achievement, some community members feel that this only distracts from the more pressing issue of a full audit of Tether’s reserves.

These concerns arise because Tether has yet to conduct the long-promised audit, despite the urging of the US legal system. Tether’s future in global dollar dominance is likely to be heavily influenced by how they handle these questions.

With substantial assets and profitable operations, Tether remains a key player in the cryptocurrency market. However, transparency and regulatory compliance will be critical factors in maintaining user confidence and USDT value stability.

Conclusion

Tether’s consolidation of gold in Switzerland is not only a security measure, but also a smart financial strategy. However, regulatory challenges and the need for comprehensive audits remain important issues to be addressed to ensure sustainability and trust in their operations.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Tether Stores $8 Billion in Gold in Its Own Swiss Vault. Accessed on July 9, 2025

- CryptoTimes. Tether Stores $8 Billion in Gold in Its Own Swiss Vault. Accessed on July 9, 2025

- Featured Image: Medium

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.