Sidechain makes blockchain faster and cheaper – a little-known crypto innovation

Jakarta, Pintu News – Sidechain technology has become a hot topic of conversation in the cryptocurrency world. Starting from a simple concept, sidechain is now the main solution to overcome the scalability limitations of blockchains such as Bitcoin (BTC) and Ethereum (ETH). They offer a wide range of innovative features, from low transaction fees, confirmation speed, to a high level of privacy. This article reviews the important role of sidechains as well as their challenges and opportunities in the future.

Origin and Basic Concept of Sidechain

When Bitcoin (BTC) launched in 2009 and Ethereum (ETH) followed in 2015, both faced immediate scalability issues. Each node was required to process all transactions, so blockchain speeds were limited to a few tens of transactions per second. As global adoption increased, transaction fees (gas fees) soared and users demanded new solutions without compromising the network’s core security.

In 2014, researchers introduced the idea of a sidechain: a secondary blockchain connected to the mainchain via a two-way peg. This is where digital assets can move freely, allowing the testing of new features without disrupting the main consensus. Sidechains are considered a safe sandbox for crypto technology innovation and can be a practical solution to many blockchain problems.

Also Read: Ethereum Transformation Secrets – How Big of an Impact on Cryptocurrency Prices?

How Sidechains Work in the Crypto World

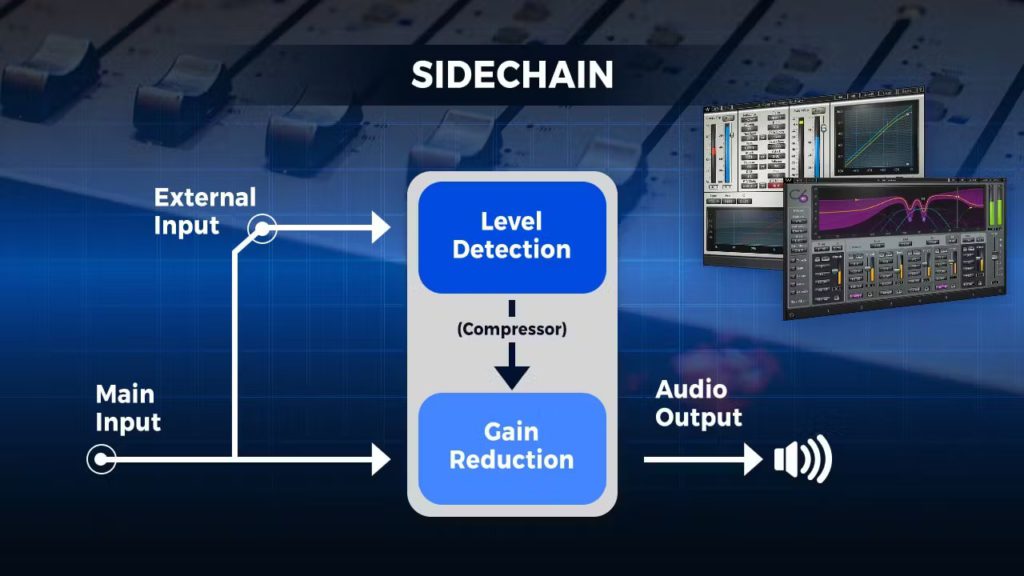

At the core of a sidechain is a bridge that moves assets between networks. There are three popular models: federated multisig, SPV (Simplified Payment Verification), and light-client bridge. Each model has a different level of decentralization and speed, for example Liquid Network uses federation, Polygon zkEVM relies on a decentralized relayer, and PowPeg RSK combines federation and PoW.

Each sidechain has its own consensus. Many sidechains use Proof-of-Stake (PoS) for energy efficiency, while others adopt Delegated PoS or Byzantine Fault Tolerance (pBFT). The advantage is that innovations can be made without changing the rules of the main blockchain, so core security is maintained.

Safety, Cost, and Incentive Structure

One of the biggest challenges of sidechains is maintaining security without sacrificing speed. The risk of attacks can come from fewer validators, bugs in the bridge software, or potential collusion in the federated system. Therefore, developers often limit the total locked value (TVL) during the early stages of launch and regularly conduct formal audits.

In general, transaction fees on sidechains are much lower than on the main blockchain, but transfer fees (especially withdrawals back to the mainchain) can spike when the main network is congested. Sidechain validators are usually incentivized with new tokens, a portion of transaction fees, or even rebates from the main asset. This can create a parallel economy that attracts crypto investors.

Sidechain Implementations Popular in the Crypto World

Rootstock (RSK) is a sidechain for Bitcoin that supports EVM smart contracts and processes blocks every 30 seconds. Polygon PoS Chain for Ethereum is known for its high throughput of up to 7,000 TPS (transactions per second) and a locked value of over Rp97.26 trillion (USD 6 billion). Blockstream’s Liquid Network provides large-scale Bitcoin transactions with fast confirmations and high privacy features.

Gnosis Chain also connects Ethereum with a light-client bridge mechanism and xDai PoS consensus. These networks prove that sidechains can meet a variety of needs, from DeFi, gaming, supply chain, to tokenization of digital assets such as stablecoins and NFTs.

Crypto Interaction and User Experience

From the user’s perspective, a deposit to the sidechain is made by locking an asset on the mainchain and waiting for confirmation. After that, an equivalent token (wrapped token) is issued on the sidechain. If you wish to withdraw, the token on the sidechain is burned and the main asset is released on the mainchain. This process is simple on the surface, but behind the scenes there is a complex exchange of cryptographic messages.

Sidechains also open up opportunities for blockchain developers to test new features directly without the risk of breaking the mainchain. Development tools like Truffle, Hardhat, and the Polygon SDK make sidechain implementation easier and friendlier for the developer community.

Conclusion

Sidechain offers a revolutionary solution to the scalability and cost issues on major blockchain networks. With a flexible design, sidechains are able to support innovation without compromising security, even adding utility to major crypto assets like BTC and ETH. While security challenges are still a concern, sidechain adoption will continue to grow as the demand for fast, cheap, and secure transactions increases in the cryptocurrency ecosystem.

Also Read: Here are the Shocking Facts Behind Altcoins: Can it really be more profitable than Bitcoin?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News Flash. What Are Sidechains? Architecture, Security & Real-World Blockchain Use Cases (2025). Accessed July 10, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.