BTC is predicted to hit Rp1.7 billion before rising sharply again, read crypto expert’s explanation!

Jakarta, Pintu News – The cryptocurrency market is again characterized by predictions of high volatility. Analysts predict that the price of Bitcoin (BTC) will fall below US$107,000 or around Rp1,734,470,000 before rising to new highs. This correction is considered as part of the “smart money” strategy to accumulate assets before the next bullish trend begins. What are the details? Here’s the full review.

Bitcoin ready for correction before next rally

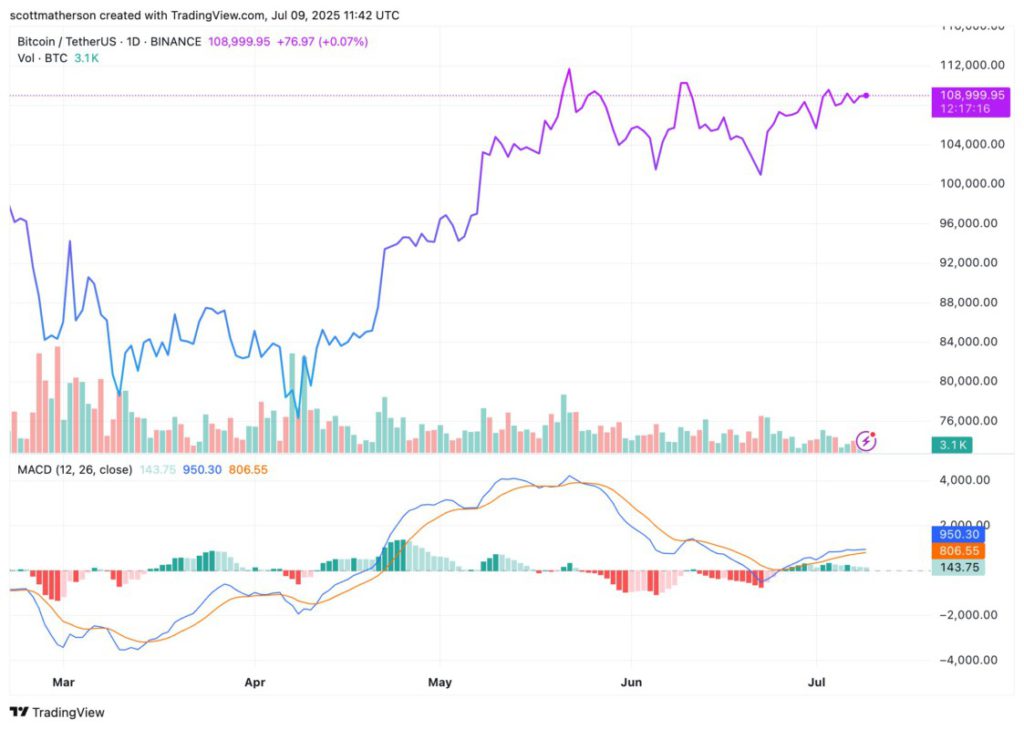

According to crypto market analyst Tehi Thomas, Bitcoin’s current price structure shows a short-term correction pattern amid a larger bullish trend. Through chart analysis on TradingView, Thomas identified short-term bearish pressure with a pattern of lower highs and price drops that respect the descending trendline.

The critical area around US$107,800 (around Rp1,745,338,000) is the main correction target. If this area is breached, Bitcoin price is expected to drop to the US$106,500-US$106,200 zone (Rp1,726,365,000-Rp1,721,202,000). This zone coincides with the Fair Value Gap (FVG) and important Fibonacci levels, which are believed to be strategic entry points for institutions and large crypto investors.

Also Read: Ethereum Transformation Secrets – How Big of an Impact on Cryptocurrency Prices?

Correction Called a Buying Opportunity by Institutions

Thomas stated that this correction is not a signal of a market crash, but rather a “liquidity grab” or price adjustment to fill the gap from the previous rally. The US$106,200 (Rp1,721,202,000) area is a high-probability buy zone, where institutions are expected to start buying back large amounts of Bitcoin.

As long as the price remains above the US$106,000 (Rp1,718,260,000) level and the order flow remains bullish, this correction phase will complete the accumulation phase before the price rises again. This means that this decline is actually considered as an opportunity for crypto investors to enter before the price breaks a new record.

Next Reversal Scenario Towards ATH Bitcoin

After a correction to the FVG area, Bitcoin is predicted to form a reversal structure that will initiate the next big rally. Despite the downturn, the macro trend remains bullish and the opportunity for an increase is still very wide open.

Thomas marked the US$110,500 (IDR1,790,705,000) zone as the next ATH target. At this level there is a lot of untapped liquidity. Once the selling pressure is reduced and there is a directional shift, Bitcoin has the opportunity to return to “price discovery” mode or an increase towards historical highs.

Current Market Conditions and Upside Potential

Currently, the Bitcoin price is listed at around US$108,744 (Rp1,763,634,040), with a potential rise to US$110,500 (Rp1,790,705,000) representing a gain of around 1.61%. With the market structure still bullish, many crypto analysts believe this drop is just a temporary phase before the big rally restarts.

Conclusion

Bitcoin’s predicted correction below Rp1.7 billion is a major concern for crypto market participants. However, many analysts see this drop not as a permanent bearish signal, but rather an opportunity for accumulation before the next uptrend. Investors are reminded to remain cautious and manage risks amidst the high volatility of the cryptocurrency market.

Also Read: Here are the Shocking Facts Behind Altcoins: Can it really be more profitable than Bitcoin?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Last Crash Before The Surge: Why Bitcoin Is Set To Drop Below $107,000. Accessed July 10, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.