Is a Liquidity Explosion Awaiting? Big Changes in Bitcoin and Stablecoin Reserves on Binance

Jakarta, Pintu News – Recent monitoring of Binance’s reserves shows a stark difference between Bitcoin (BTC) and stablecoins. This phenomenon may provide an important signal for the cryptocurrency market.

Separation of Bitcoin and Stablecoin Reserves on Binance

Recent on-chain data from Binance shows a divergence between Bitcoin (BTC) and stablecoin reserves. On-exchange reserves, which measure the total amount of assets stored in wallets associated with an exchange, provide an important indication of investor behavior. A rise in this metric usually signals that more assets are being deposited on the platform, which often corresponds to an increase in trading activity.

For Bitcoin (BTC), an increase in reserves on exchanges can have a bearish impact on the price as it indicates potential selling. However, this isn’t the case for stablecoins, whose exchange rates are always stable and aligned with the fiat currencies they’re based on. Investors often use stablecoins to avoid market volatility while waiting for an opportunity to reinvest in more volatile assets like Bitcoin (BTC).

Also Read: Ethereum Transformation Secrets – How Big of an Impact on Cryptocurrency Prices?

Reserve Trends on Binance and Their Implications

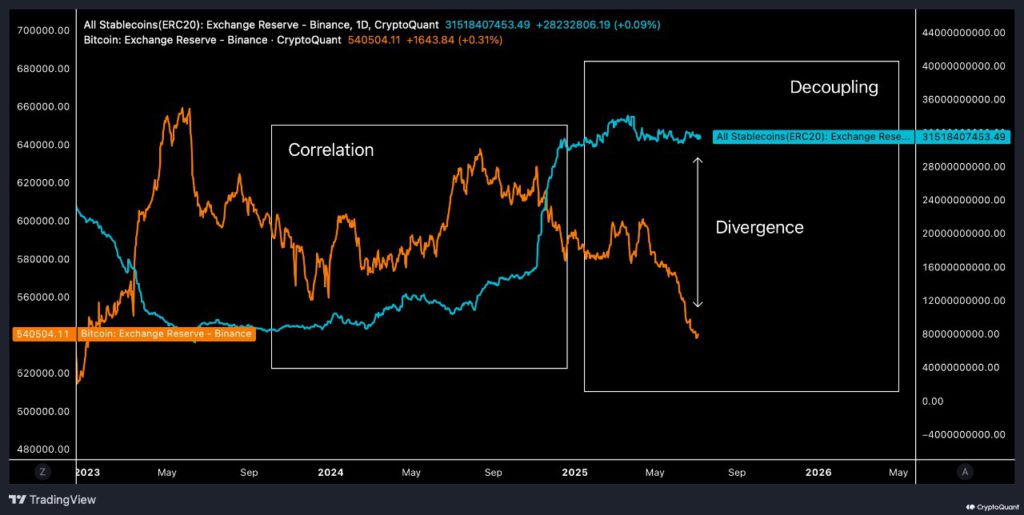

Trend analysis shows that in 2024, Bitcoin (BTC) and stablecoin reserves on Binance were correlated, but towards the end of the year there was a shift. Stablecoins experienced massive inflows while Bitcoin (BTC) experienced outflows. By 2025, these two trends started to move apart with stablecoins trending steady, while Bitcoin (BTC) reserves continued to decline.

This suggests that there is a significant amount of funds tied up in stablecoins that could potentially be diverted to more volatile assets. On the other hand, Bitcoin (BTC) withdrawals from exchanges may signal accumulation by investors, which could be a bullish signal for Bitcoin (BTC) prices in the future.

Bitcoin Price Outlook

Currently, the price of Bitcoin (BTC) is stable around the $108,800 level. This stability suggests that despite the significant change in reserves at Binance, the market has not responded dramatically. However, this could change quickly depending on how these funds are allocated in the future.

Observing these reserves is important as it can give an early idea of the market’s next move. If investors decide to shift funds from stablecoins to Bitcoin (BTC), there could be a significant price spike.

Conclusion

With a clear divergence between Bitcoin (BTC) and stablecoin reserves on Binance, the market may be preparing for a major change. Investors and traders should monitor this indicator closely to make the right investment decision at the right time.

Also Read: Here are the Shocking Facts Behind Altcoins: Can it really be more profitable than Bitcoin?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin and Stablecoins Diverge as Binance Sees Explosion in BTC Holdings. Accessed on July 10, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.