Dogecoin Surges 9% Today — Is ETF Approval Slipping Away at Just 75%?

Jakarta, Pintu News – Dogecoin (DOGE) is at a make-or-break point after entering a key demand zone, indicating that buyer-side activity is likely to pick up again despite the decreased chances of DOGE ETF approval.

This mixed sentiment came about when the Dogecoin price was trading at $0.19 on July 11, having risen by 9% in the last 24 hours.

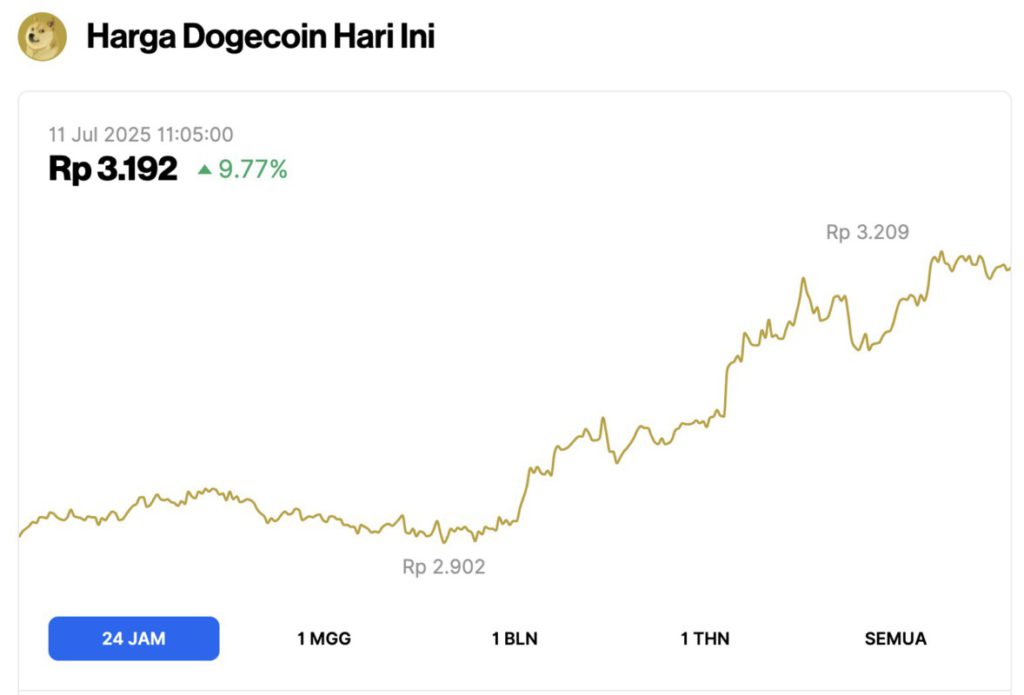

Dogecoin price rises 9.77% in 24 hours

On July 11, 2025, Dogecoin saw a notable 9.77% surge in just 24 hours, trading at $0.1980, or approximately IDR 3,192. During the day, DOGE hit a low of IDR 2,902 and climbed as high as IDR 3,209.

At the time of writing, Dogecoin’s market cap stands at around $29.71 billion, with trading volume rising 14% to $1.96 billion within 24 hours.

Read also: 3 Memecoins that Skyrocketed after Bitcoin Hits $116,000 Today (11/7)!

Dogecoin price enters key demand zone

DOGE prices have entered the demand zone, and this could be a major factor driving the next upward rally.

Based on historical data, this demand zone has consistently attracted buying activity, and if the previous move is repeated, there could be a strong upside rally or even another rejection.

The demand zone in question is at $0.17, and Dogecoin needs to close above this level for the top meme coin to confirm an upside rally.

However, the only way to ensure that bullish traders regain control of the market is if the price is able to reach the Point of Control (PoC) line at $0.224.

The PoC line indicates an area with very high trading activity beforehand, and as long as the position is above the current price, it serves as a strong resistance.

To confirm the shift from bearish to bullish Dogecoin price prediction, DOGE needs to close convincingly above $0.224.

The probability of such a rally is quite high given two factors: the rising parallel channel and the upward-pointing RSI indicator.

The channel shows that Dogecoin is in an uptrend, while the RSI at 51 also shows a bullish signal, as it continues to slope upwards.

However, Dogecoin price faces strong resistance in the demand zone, which makes it a make-or-break point.

Read also: These 3 Memecoins Explode After Bitcoin Breaks $112,000!

If the price fails to break this resistance level again, DOGE will likely drop to $0.15 and consolidate there before continuing its next move.

DOGE ETF Approval Chance Drops to 75% After Trump Ignores Coin Meme

The chances of a Dogecoin ETF being approved in the United States have dropped to 75% according to data from Polymarket.

Earlier this week, the odds were still at 81%, indicating that some traders were becoming less confident that the SEC would give its approval to the product.

This decline in opportunity comes after President Donald Trump ignored meme coins in his blue-chip crypto ETF, which instead includes various types of altcoins. Citing Coingape’s report, the reason why meme coins were not included in Trump’s ETF is because of the high volatility that these tokens have.

As institutional interest in gaining exposure to Dogecoin’s price movements waned, bearish sentiment began to build – as evidenced by the closing of long positions.

Data from CoinGlass shows that on the Binance exchange, the long/short ratio for DOGE has dropped to its lowest level in the past month.

In conclusion, the Dogecoin price seems to be approaching a strong potential breakout. However, the direction in which the meme token will move is still uncertain and largely depends on whether the current demand zone is able to attract buyers.

While a rally to $0.22 may be in the making, the decreased chances of ETF approval signal that DOGE could face challenges ahead.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGape. Dogecoin Price at Make-or-Break Level as ETF Approval Odds Drop to 75%. Accessed on July 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.