PEPE Coin Price Breaks Wedge Pattern, Ready to Jump 50%? Here’s the Chart Prediction!

Jakarta, Pintu News – Like other cryptos in the market, the frog-themed meme coin, Pepe (PEPE), has experienced a price surge in the past 24 hours. As of July 10, the price of PEPE increased by 6.58% in that period and is currently trading at $0.000011.

While some altcoins and meme coins may lose their bullish momentum, PEPE doesn’t seem to be going through the same thing anytime soon.

This analysis explains what caused the price of PEPE to rise so high and the possible next direction for the cryptocurrency.

PEPE Coin Abandons Bearish Trend

According to CCN (10/7), for several weeks, the price of PEPE has been trading in a downward trend, forming lower and lower highs and lows on the daily chart. This decline eventually formed a falling wedge pattern.

Read also: 3 Memecoins that Skyrocketed After Bitcoin Hits $116,000 Today (7/11)!

Today, the meme coin managed to break the upper trend line of the wedge pattern, signaling that the bearish phase may be over. Along with this breakout, the Chaikin Money Flow (CMF) also rose beyond the zero signal line.

This suggests there is increased buying pressure, which could push PEPE prices higher. In addition to the CMF, the Bollinger Bands (BB) also started to widen.

This BB position indicates that PEPE may soon experience high volatility. If buying pressure continues to increase amid this increase in volatility, PEPE price could break the resistance levels at $0.000013 and $0.000015.

Token Gets Support

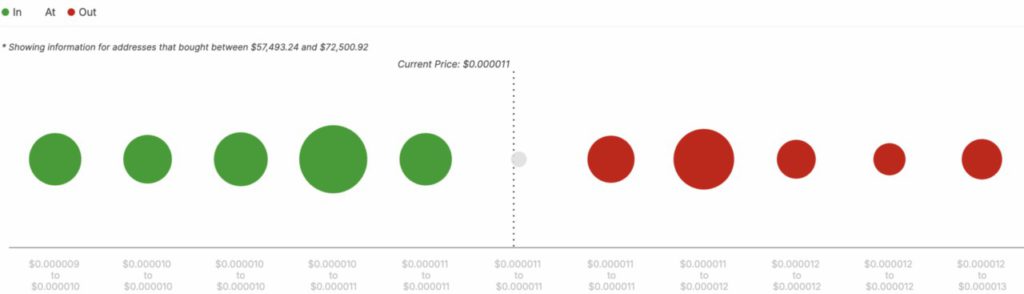

On-chain metrics continue to support PEPE’s bullish outlook, with IntoTheBlock’s In/Out of the Money Around Price (IOMAP) analysis highlighting a significant support zone near the $0.000011 level.

At this level, approximately 5,850 addresses hold approximately 34.29 trillion PEPE tokens in unrealized gains, forming a strong cushion against downward pressure.

This group of holders in profit significantly outweighed the volume near the upper resistance area, indicating limited selling pressure.

In the absence of a large buy wall above current levels, PEPE could find a more open path to break the $0.000013 and $0.000015 levels previously identified as key targets.

Read also: Ripple Price Prediction: Can XRP Reach $3.30 by the End of the Month?

PEPE Price Analysis

Looking back at the daily chart, CCN observed that PEPE has risen past its 20-period Exponential Moving Average (EMA ) (blue line), which reinforces the signal from IOMAP that this meme coin has strong support to push the price higher.

In addition, the trading volume also increased, which suggests there is enough strength to keep PEPE’s uptrend afloat. If this volume continues to increase, PEPE may be able to avoid a significant correction.

Conversely, the value of theseecoins could break the resistance at $0.000015. In that scenario, the price could potentially increase by 50% and reach $0.000017.

If buying pressure continues to increase, the price of PEPE might touch $0.000020. However, if selling pressure rises and demand decreases, this projection could be invalidated.

In such a situation, the price of this cryptocurrency could drop to $0.0000088. If market conditions turn tighter(hawkish), the price could even fall to $0.0000052.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. PEPE Price Breaks Falling Wedge as Charts Predict 50% Pump. Accessed on July 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.