Bitcoin Hits All-Time High at $122,000 Today — What’s Driving This Massive Surge?

Jakarta, Pintu News – Bitcoin (BTC) has set a new all-time high of $122,000, after stabilizing around $120,500. The price of BTC is currently up 3.6% (7/14), continuing the strong trend that started earlier this month.

But will this rally continue, or is it approaching a slowdown point? Leading indicators suggest that this trend may not end anytime soon.

Bitcoin Price Records New All-Time High at $122,131

Bitcoin price is showing its fangs again by setting a new all-time high record! Based on the latest data from CoinGecko as of July 14, 2025, the price of BTC managed to break $122,131 or the equivalent of IDR 1,975,024,392, recording a daily increase of 3.6%.

Read also: Bitcoin Price Breaks a New Record High Today (7/14/25): BTC Can Still Rise Another 50%?

In the past 24 hours, Bitcoin price moved in the range of $117,766 to $122,105, with the chart trend showing a sharp rise towards the end of the session.

With a market capitalization of $2.42 trillion, Bitcoin remains firmly established as the number one crypto asset in the world. The trading volume over the last 24 hours also recorded a fantastic figure of more than $42.2 billion, signaling renewed investor interest in the asset.

Holders Not (Yet) Taking Advantage

Reporting from BeInCrypto (14/7), the Adjusted Spent Output Profit Ratio(aSOPR) is currently at 1.03, well below the level of early July 2025, when aggressive profit-taking pushed this ratio much higher.

This time, despite Bitcoin setting a new record, traders seem to be choosing to hold their assets rather than sell them.

This means that most of the coins moved on-chain are not being sold for huge profits, indicating that this rally is not yet at overheating point.

SOPR indicates whether BTC moved on-chain was sold at a profit (> 1) or loss (< 1).

Adjusted SOPR refines this metric by filtering out short-term internal transactions, to give an idea of whether BTC moved on-chain was sold at a profit or loss.

Volume Supports Rally

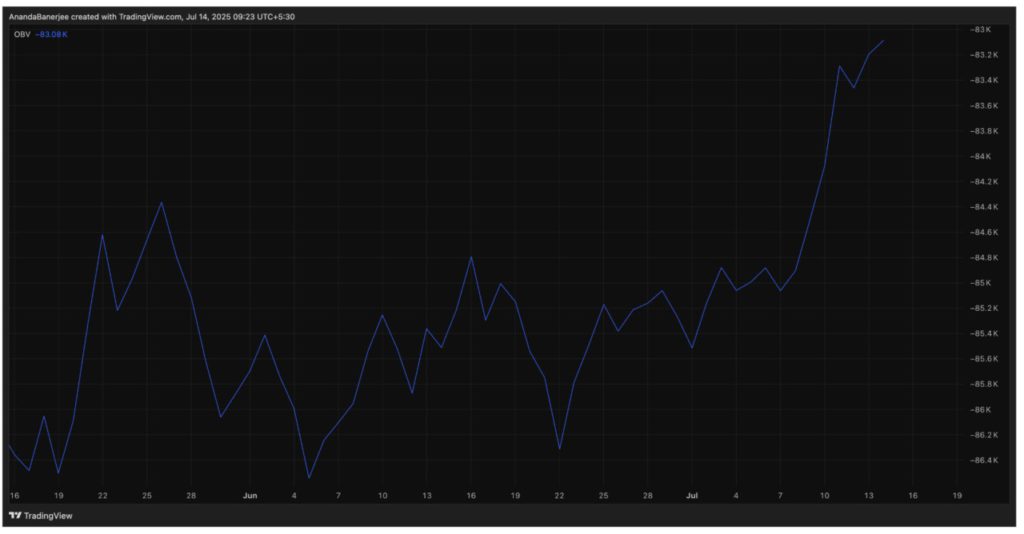

In addition, the On-Balance Volume(OBV) is moving up along with the Bitcoin price – an important signal that buying volume is following the rally.

Nodivergence is seen, and there are no signs of weakening momentum.

Read also: 3 Crypto Trending Today (7/14/25): Number 1 Altcoin Surges 32%!

In simple terms: BTC goes up, and volumes go up with it – not in the opposite direction.

OBV measures cumulative buying/selling pressure based on the direction of daily volume. When the OBV follows a positive price trend, it is a bullish or positive signal.

Steady BTC Network Activity Reinforces Bullish Signals

Bitcoin analyst Axel Adler Jr. stated that the use of the Bitcoin network is increasing gradually without any signs of profit-taking or panic.

Average daily transactions rose from 340,000 to 364,000 in the past two days, although still below the peak of 530,000-666,000 transactions recorded when the market hit previous highs.

Adler explained that this reflected calm and controlled market conditions, saying:

“There are no signs of active coin selling in the market. This strengthens the bullish signal both fundamentally and technically.”

Meanwhile, Cointelegraph reported that the addresses of accumulators – wallets that consistently accumulate BTC without making large outflows – increased significantly in the past month.

Data from CryptoQuant shows that these wallets now hold 250,000 BTC, the highest number so far in 2024.

The 30-day demand jumped 71%, from 148,000 BTC at the end of June to 250,000 BTC, reflecting renewed confidence among long-term buyers.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. New Day, New Bitcoin All-Time High: What’s Next For BTC Price? Accessed on July 14, 2025

- Cointelegraph. Bitcoin taps new all-time high at $120K on Coinbase. Accessed on July 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.