Bitcoin Shatters $122K Record — Could $127K Be Just Around the Corner?

Jakarta, Pintu News – The price of Bitcoin (BTC) has surpassed the $122,000 (IDR 1.98 billion) mark and set a new record high in recent weeks after previously moving sideways in the $118,000 range.

This upward trend has the potential to continue, driven by an influx of funds from ETFs, increased on-chain activity, as well as ongoing geopolitical tensions.

What is driving the current Bitcoin price increase?

Trump’s Tariff Announcement Boosts Bitcoin

According to TronWeekly, uncertainty in traditional markets, caused by US President Donald Trump’s announcement of 30% tariffs on imported goods from the European Union and Mexico, has driven greater fund flows into Bitcoin (BTC).

Read also: Bitcoin Hits All-Time High at $122,000 Today — What’s Driving This Massive Surge?

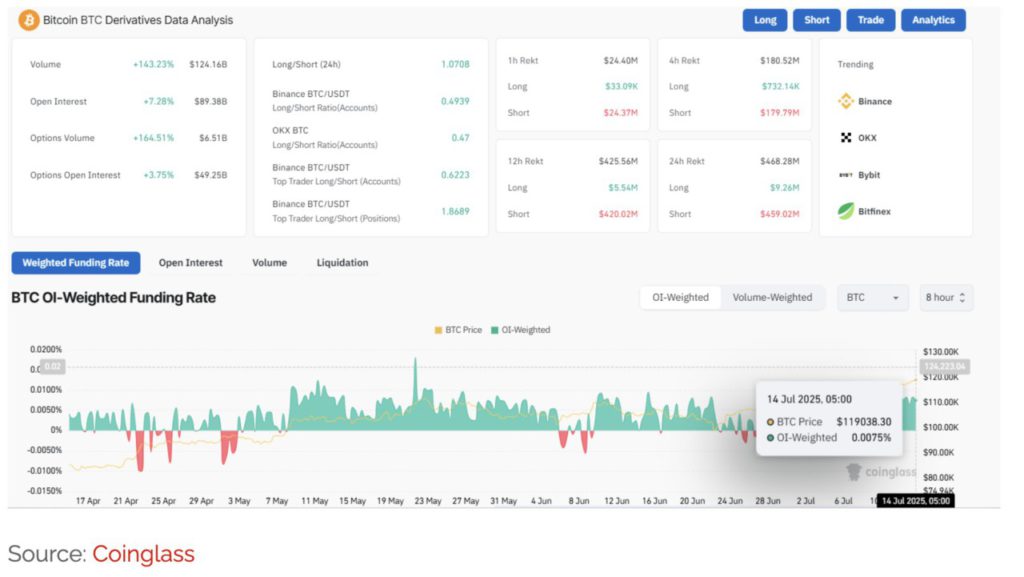

In the last 24 hours (14/7), the market experienced significant changes. Based on data from Coinglass, $459.02 million worth of short positions have been liquidated. This panic was also accompanied by a 143.23% spike in trading volume.

Open interest also increased by 7.28% and now stands at $89.38 billion, reflecting high trader participation and confidence in the uptrend.

Despite the vigorous buying, prices have remained relatively stable. The interest-weighted funding rate for BTC was recorded at just 0.0075%, indicating that this rally is not yet overheating.

Traders seem to be playing with measured risk, giving more room for the market to continue moving up.

Bitcoin Rally Eyes $127,000 Level (IDR 2 Billion)

Analyst Ali Martinez refers to the MVRV pricing bands that were previously strong zones for local price peaks. Based on this analysis, the second major resistance area is likely to appear around $127,000 (IDR 2.067 billion).

Martinez cautioned that prices tend to test this upper limit, but each rally is usually followed by a moderate price correction.

Technically, the current momentum is very strong. The MACD indicator shows a clear bullish crossover, as the MACD line is above the signal line, and the histogram is moving up. The Relative Strength Index (RSI) stands at 85.86, which signals overbought market conditions.

While this confirms the strength of momentum, it could also indicate a potential temporary pause or short-term price drop.

Increased volume also strengthens the potential for breakouts. Greater involvement from market participants also supports more sustainable price movements. The current increase in volume reflects the confidence of both retail and institutional parties in the ongoing trend.

Read also: FET, AAVE, DOGE Accumulation Soars—Is the Next Altcoin Explosion Just Ahead?

Bitcoin joins the list of the world’s top five assets

Bitcoin has made another milestone. The digital asset is now the fifth largest asset in the world by market capitalization today, surpassing giants like Amazon, Silver, and Alphabet (Google). This boosts investor confidence and further puts Bitcoin in the limelight.

Accumulation from institutions continued to increase. Large investors started making new purchases, even though their unrealized profits were already high. This pattern is reminiscent of previous bull markets, where large price spikes were driven mainly by institutional buying.

Bitcoin’s rally is likely to continue as long as the price stays above $120,000. The next target is the next big gap in the range of $125,000-$130,000. The market is now waiting to see whether Bitcoin will continue to rise or experience a temporary correction before taking off again.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tron Weekly. Bitcoin Smashes All-Time High at $123,000; Is $127,000 Next? Accessed on July 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.