Bitcoin Breaks Records, Fueled by US Deficit Concerns: Analysts Predict Rp2.6 Billion per BTC!

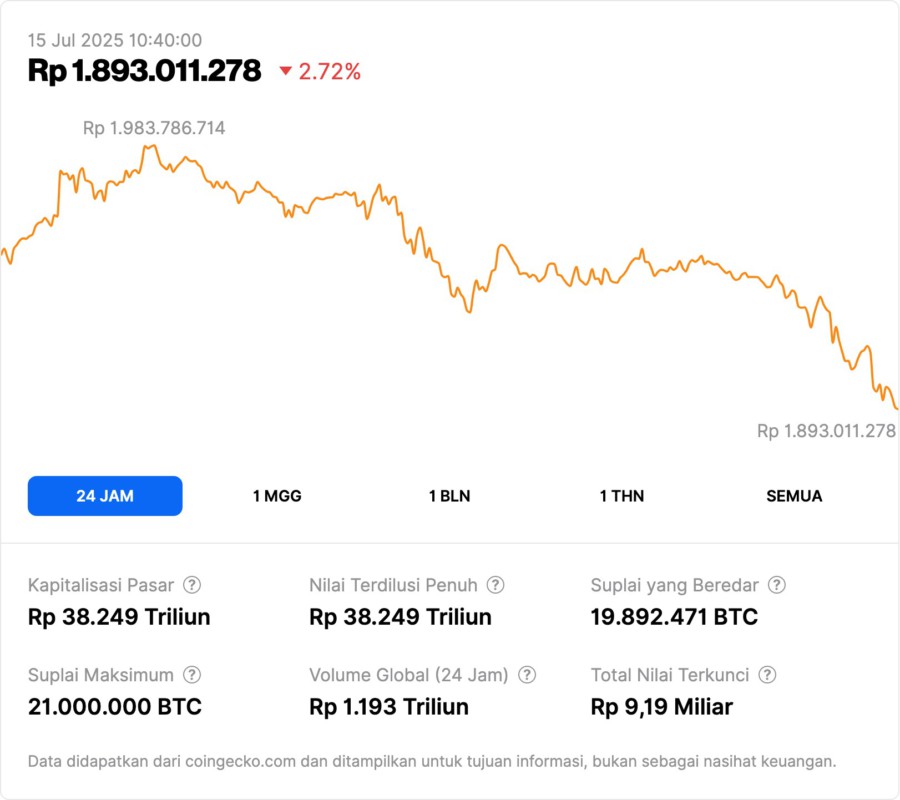

Jakarta, Pintu News – Bitcoin ‘s (BTC) price rally that broke a new record of more than $121,000 (around Rp1.97 billion, exchange rate 1 USD = Rp16,287) is not just driven by hype, but by a deeper fundamental factor: concerns about the United States (US) fiscal deficit. According to analysts, Bitcoin is now positioned as the “primary defense” against the risk of a US financial crisis, alongside gold.

Bitcoin is now a macro asset, no longer just a tech story

Markus Thielen, Head of Research at 10x Research, asserts that the narrative about Bitcoin has shifted. In the past, the conversation around Bitcoin was always about blockchain innovation or crypto technology, but now it’s more often referred to as a macro asset – meaning it’s a hedge against the US government’s out-of-control spending.

US fiscal policy, especially since the passage of the “One Big Beautiful Bill Act” (OBBBA) that raised the country’s debt ceiling by $5 trillion (IDR81,435 trillion), has sparked uncertainty. Instead of reducing the deficit, the bill has the potential to increase the deficit by $5 trillion within a decade. The combination of widening deficits and possible interest rate cuts has global investors looking for alternatives such as Bitcoin and gold.

Bitcoin Price Catalyst Factors: From Crypto Legislation to Fed Policy

Beyond fiscal uncertainty, this week is being called “Crypto Week” in Washington D.C., with a number of important pieces of legislation being discussed: CLARITY Act (crypto market regulation), GENIUS Act (stablecoin regulation), and Anti-CBDC Surveillance State Act. In addition, Trump’s Digital Asset Team will also release a crypto policy report, which will reportedly discuss the Bitcoin Strategic Reserve proposal for the country.

Another important agenda item is the Federal Reserve meeting on July 30, which could potentially discuss interest rate cuts. However, the CME futures market forecasts a 93% chance of a fixed rate, so market volatility is still high.

Price Prediction: Bitcoin Headed for Rp2.6 Billion per Coin?

Based on 10x Research’s analysis, Bitcoin’s target price for 2025 is in the range of $140,000 to $160,000 (Rp2.28 billion-Rp2.60 billion). Rachael Lucas of BTC Markets highlighted that the $120,000 price break is proof that digital assets are already part of large institutional portfolios.

Meanwhile, OSL’s Eugene Cheung projects Bitcoin could reach $130,000 to $150,000 (Rp2.11 billion-Rp2.44 billion) by the end of this year. Analysts also note that Bitcoin’s current rally is also attracting altcoins, as traders expand their portfolio diversification amid global uncertainty and volatile stock markets.

Conclusion

Bitcoin’s rally to record prices is not just speculation, but is driven by global macroeconomic dynamics, particularly the US fiscal crisis and potential monetary policy changes. With the “Crypto Week” agenda and important legislation on the horizon, the crypto ecosystem, including Bitcoin, is increasingly integrated into the global financial system. Investors are reminded to remain vigilant for future volatility and regulatory changes.

Also Read: Big Drama: Coinbase and Binance Deny Each Other Over Media Leaks and Market Grab!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin rally fueled by US deficit, fiscal concerns. Accessed July 15, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.