Pi Network Drops 3% Today — Is a Massive Breakout or Major Breakdown Coming Next for PI Coin?

Jakarta, Pintu News – Pi coin is in quite a dangerous position as it approaches a key support level after experiencing a sluggish trading week.

As of July 14, the PI price was at $0.4725 and is struggling to stay above the $0.4452 level. Although the on-chain metrics are yet to show strong conviction in either direction, some signs of weakening bearish momentum are starting to show.

Then, how is Pi Network’s current price movement?

Pi Network Price Drops 3.9% in 24 Hours

On July 15, 2025, the price of Pi Network was recorded at $0.4508, a decrease of 3.9% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,295), then 1 Pi Network is IDR 7,346.

In the last 24 hours, the PI price moved between $0.4492 and $0.474.

Read also: Dogecoin Plunges 6% Today — But Experts Say a Massive Comeback Could Be Next!

Despite the price drop, trading volume remained active with a total transaction of $107,640,279, indicating that the market still has high interest in this asset.

Currently, Pi Network’s market capitalization stands at $3.47 billion, while its fully diluted valuation stands at $5.34 billion.

Open Interest and Funding Rate Show Signal of Pause

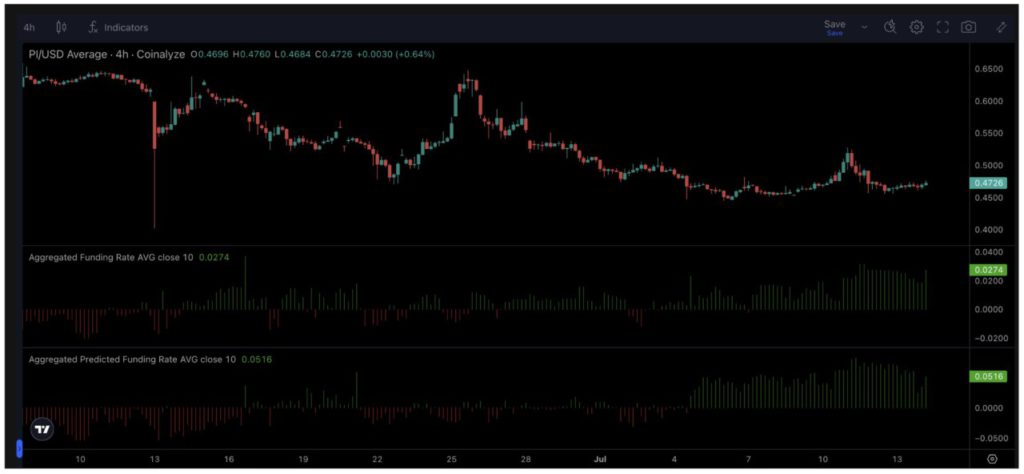

PI price is showing signs of indecision. The Aggregated Open Interest on Coinalyze (in the 4-hour time frame) stands at around $10.09 million and has shown no clear direction in recent days. This means traders are not aggressively opening new long or short positions, signaling uncertainty.

Meanwhile, the Aggregated Funding Rate rose to +0.0274, and the Predicted Funding Rate jumped even higher to +0.0516. In simple terms, this shows that long positions on Pi Coin are slightly more dominant and traders are willing to pay additional fees to maintain those positions – which is usually a bullish sign.

Open Interest refers to the total number of unsettled open contracts in the market. An increase in Open Interest generally confirms that more traders are entering the market and supports the current trend.

The Funding Rate is the periodic fee paid between long and short traders. Positive values indicate long dominance, while negative values indicate short control.

Overall, a flat Open Interest accompanied by a rising Funding Rate suggests a mild long tendency, but in the case of Pi Coin, the tendency is not accompanied by strong conviction.

Read also: 3 Big Token Unlocks to Watch This Week!

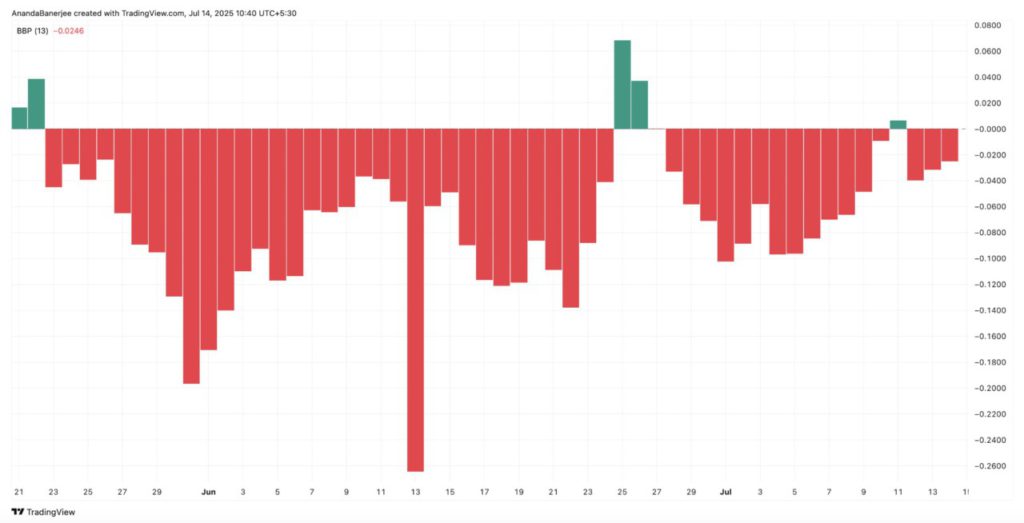

Bear Power Begins to Weaken

With the Funding Rate increasing and Open Interest remaining flat, the market is showing a tendency towards longs albeit without strong conviction. This hesitation is also reflected in the Bull Bear Power indicator, part of the Elder Ray Index, which measures the strength of buyers and sellers in the market.

As of July 14, the Bear Power continued to weaken, which is a signal that the bearish momentum is starting to fade.

Pi Coin (PI) briefly traded at $0.4725, slightly above the important support level of $0.4452. This level was obtained using the Fibonacci retracement tool, which is drawn from the highest price at the end of June to the lowest price on July 6.

Fibonacci retracement is a technical analysis tool that traders use to identify potential support and resistance levels by measuring how far the price has fallen from its previous movement.

So far, the support level is still holding despite PI being in an overall downtrend.

If the price breaks below $0.4452, Pi Coin could face a sharper correction towards $0.4001, which is the next major support.

Conversely, if momentum strengthens, the next resistance is at $0.4974 – a level that has rejected the PI price several times.

If the price is able to close daily above $0.4974, the market structure could turn bullish in the short term and invalidate the bearish scenario.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. PI Price Clings to A Key Support Level: Bounce or Break? Accessed on July 15, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.