3 Altcoins at Risk of Massive Liquidations — Time to Sell Now?

Jakarta, Pintu News – Reporting from BeInCrypto, Investors will most likely remember the market event in July 2025, where Bitcoin (BTC) surged to a new record high above $120,000. Many patient Bitcoin holders became millionaires this month.

However, July also recorded the largest liquidation loss in history. Open Interest (OI) volume reached an all-time high.

In addition to BTC and Ethereum (ETH), several altcoins now pose significant liquidation risks to derivatives traders, as price volatility increases.

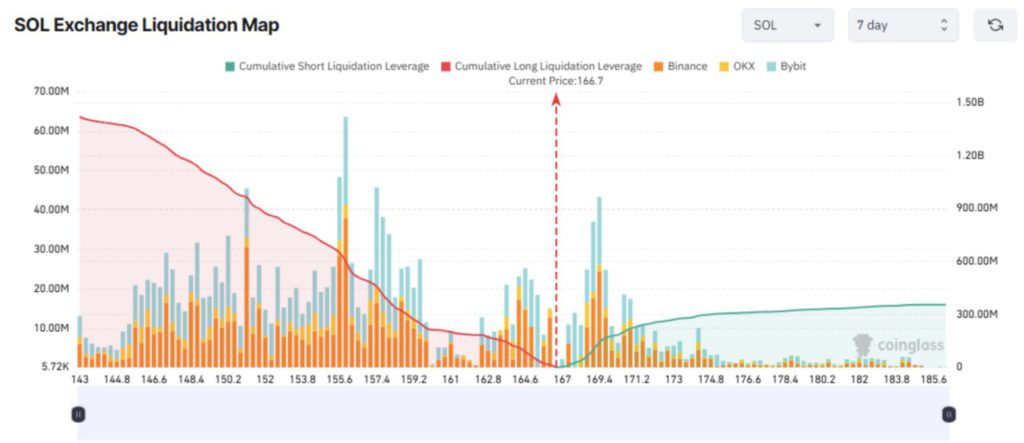

Solana

Data from Coinglass shows that Solana Open Interest (SOL) in July reached $7.9 billion, the highest figure since January 2025, when SOL prices peaked at $294.

Read also: Crypto Trending Today: Bitcoin Creator, Satoshi Nakamoto, Becomes the 11th Richest Billionaire!

The liquidation map for SOL reveals a clear imbalance between long and short positions. The majority of traders are betting on further short-term price increases, allocating capital and leverage to long positions.

As a result, the total liquidation volume accumulated on the long side could reach $1 billion if the SOL price drops below $150. This would represent a drop of more than 10% from the current price of $167 at the time of writing.

Despite Solana’s five-year bullish signal, it was recently reported that FTX had cashed out nearly 190,000 SOLs, worth approximately $31 million.

The move comes amid mounting pressure from creditors, which has sparked concerns about the impact on the market.

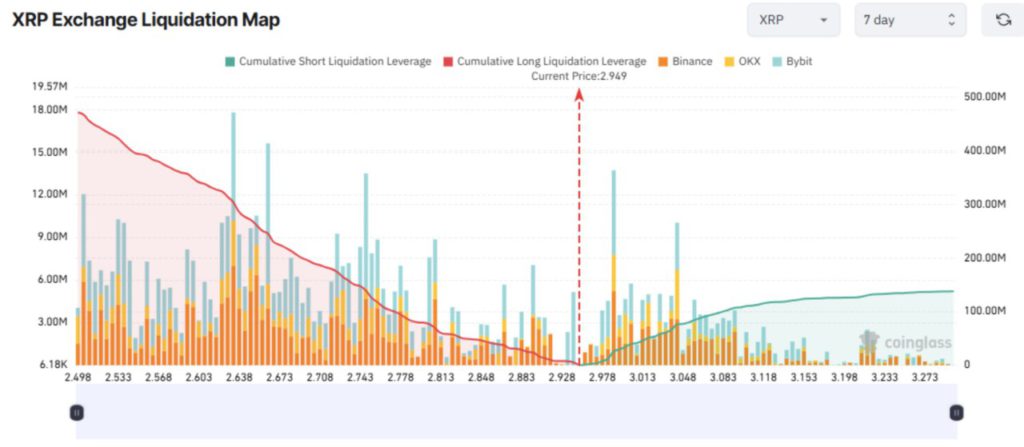

XRP

XRP (XRP) Open Interest reached $7.6 billion entering the third week of July. This is only $250 million away from its highest OI level in January.

The liquidation map for XRP also shows that short-term traders believe prices will continue to rise. This can be seen from the imbalance between the accumulated liquidation of long and short positions.

Data shows that up to $500 million in long positions are at risk of liquidation if the price of XRP falls below $2.5. Historical price movements of XRP show that the asset often experiences large daily fluctuations, with swings of 20% to 30%.

Additionally, recent analysis indicates that the XRP rally may be starting to lose momentum, as some traders seem to be preparing to take profits.

Read also: XRP Price Set to Skyrocket to $6? Crypto Analyst Reveals What Needs to Happen First!

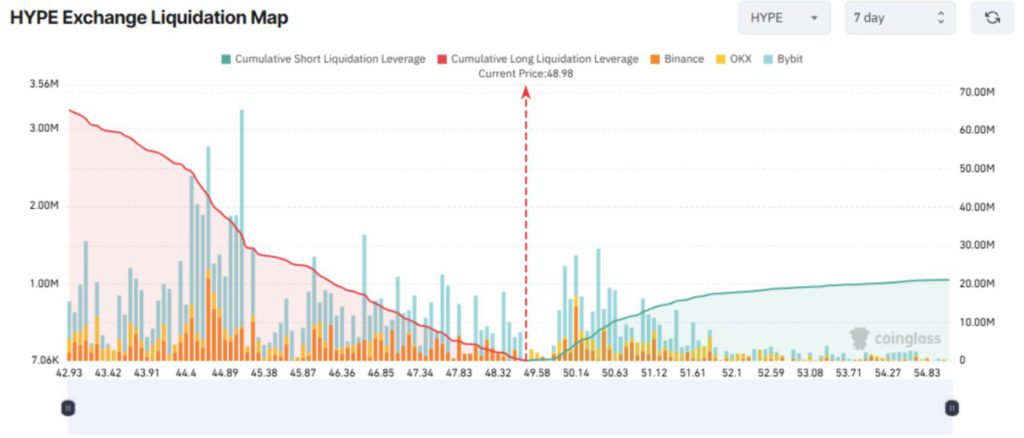

Hypeliquid

In July, Hypeliquid (HYPE) recorded a new record high in Open Interest of $2.1 billion. The Long/Short volume ratio – as well as the Long/Short ratio among top accounts on Binance and OKX – exceeded 1, signaling short-term bullish sentiment.

Meanwhile, HYPE prices have risen for six consecutive days and today hit a new record at $49.8. Traders are still aggressively opening long positions, which increases the risk of liquidation in the event of a price correction.

The liquidation map shows that more than $60 million of long positions could potentially be liquidated if HYPE’s price falls below $43.

During July, HYPE’s price movements closely mirrored those of Bitcoin. With the price of BTC now surpassing $122,000, a correction in Bitcoin could trigger a deeper drop in HYPE, potentially leading to large-scale liquidation.

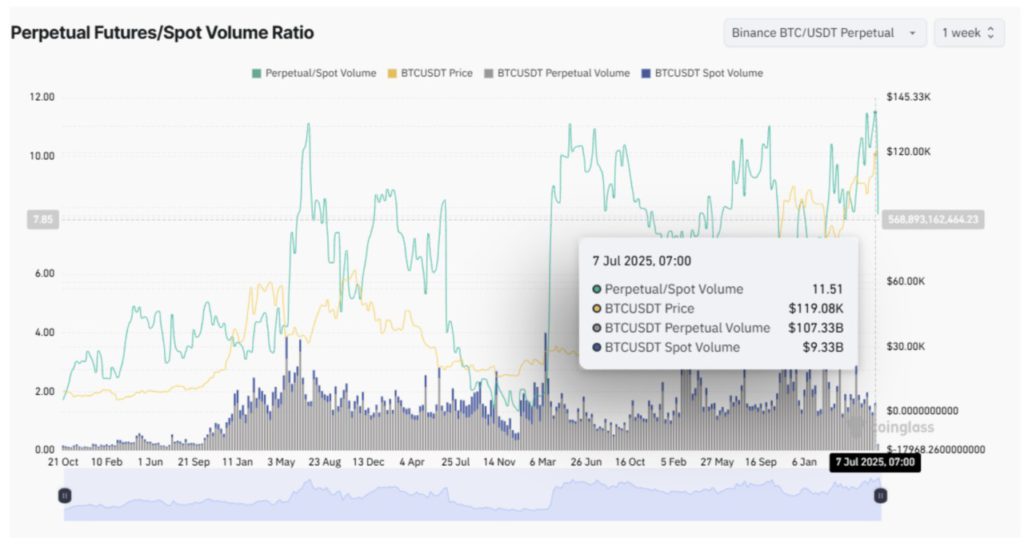

Crypto Derivatives Market Gets Hotter

According to Coinglass, Bitcoin futures trading volume last week was more than 10 times that of its spot trading volume. The Perpetual Futures/Spot Volume ratio reached 11.5 – the highest in history.

In addition, the total Open Interest in the overall crypto market reached a new record of over $187 billion on July 14. Open Interest reflects the total number of open and unsettled contracts.

Read also: Bitcoin Crashes to $117K After Smashing Record High — Here’s What Triggered the Drop

This figure shows the high level of investor participation in both altcoins and Bitcoin today.

The data indicates that traders are now more active in the derivatives market than the spot market, despite being in a bull market. This is a warning sign that a potential major liquidation event could happen in the near future.

“In the last 24 hours, 127,894 traders have been liquidated. The total liquidation amounted to $732.59 million,” Coinglass reported.

As of July 14, the liquidation volume in the last 24 hours has exceeded $700 million, and most of the losses are still being borne by short positions.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins at Risk of Major Liquidations in July. Accessed on July 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.