PEPE Surpasses 463K Holders: Is an Epic Rally About to Explode?

Jakarta, Pintu News – Pepe (PEPE) has now surpassed 463,000 holders, indicating a surge in user acquisition and retail enthusiasm.

This important milestone comes at a time when memecoin is again gaining momentum across the Ethereum (ETH) ecosystem.

While the market remains cautiously optimistic, the increasing number of PEPE holders reflects growing confidence in its long-term potential.

Amidst this on-chain growth, PEPE is trading around $0.00001252, with a gain of 1.68% as of July 15.

This increase in the number of holders indicates renewed retail participation, which often precedes speculative rallies and heightened volatility.

Is a Bullish PEPE Breakout Forming?

A clear cup-and-handle pattern has emerged on the daily chart of PEPE, signaling a possible bullish continuation. The handle part is almost complete, with the price just below the $0.00001580 resistance zone.

Read also: 3 Meme Coins That Skyrocketed While Bitcoin Crashed!

If this neckline is broken, a rally towards $0.000030 could occur. The Directional Movement Index favors a bullish scenario, with the +DI at 35.3 well above the -DI at 12.7, indicating strong buyer dominance.

Meanwhile, the ADX stands at 23.0, signaling a developing trend that still has room to strengthen. Therefore, a confirmed breakout could trigger an acceleration of the upward momentum.

How Confident are PEPE Traders?

The derivatives market is showing increasing bullish conviction. Trading volume has surged more than 60%, reaching $3.67B, while Open Interest rose 8.20% to $705.27M.

This metric confirms increased speculative demand, as traders bet on further upside potential.

Additionally, the OI-Weighted Funding Rate remained positive at 0.0107%, indicating that long positions dominated sentiment.

This persistent positive rate indicates that the bulls are willing to pay a premium to maintain their positions, which is in line with the bullish chart pattern.

Overall, PEPE Futures activity reflected traders’ increased optimism and commitment to upward price movement.

User Activity and Demand from Whale

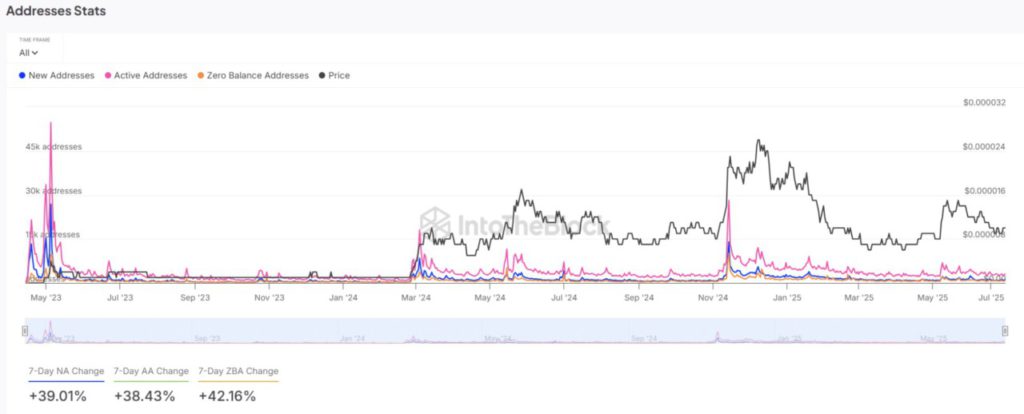

PEPE’s on-chain growth has further accelerated, with the number of new addresses increasing 39.01% and active addresses up 38.43% in the past week.

Zero-balance wallets also jumped 42.41%, reflecting increased wallet turnover and higher speculation.

Read also: Solana Price Takes a Dive, But These 3 Key Indicators Show the Uptrend is Far from Over!

This user expansion demonstrates the growing trust and growing utility of the token, potentially adding to organic buying pressure.

Meanwhile, whale interest also increased, with large transactions up 6.63%-a strong sign of strategic accumulation.

Historically, coordinated growth between retail adoption and whale inflows often precedes major rallies. If this trend continues, PEPE could gain the necessary momentum to convincingly break through key resistance levels.

Will PEPE Break Resistance or Stall Below $0.00001580?

PEPE’s bullish outlook is supported by retail growth, chart breakout patterns, strong derivatives demand, and increased whale activity.

However, the token must close above $0.00001580 decisively to validate the cup-and-handle pattern.

Without such breakouts , momentum may fade. Traders should watch for increasing volume and continued growth of the holder as confirmation signals.

A successful breakout could open up opportunities towards $0.000030, while failure could lead to short-term consolidation.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. PEPE surges past 463K holders: Is a rally underway? Accessed on July 16, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.