GameStop Considers Crypto Payments After $500 Million Investment in Bitcoin!

Jakarta, Pintu News – GameStop, a well-known electronic retail company, recently announced a massive investment in Bitcoin (BTC) and is considering accepting payments in crypto.

The move is part of their strategy to reduce reliance on hardware sales and move into more diversified products such as trading cards and collectibles.

GameStop to Accept Crypto Payments

Bitcoin’s appeal as a hedge against inflation and the falling value of the dollar continues to attract more parties, with GameStop now signaling that it’s next in line.

Read also: Bitcoin Holds Strong at $118K — Is a Break Above $150K Coming If the GENIUS Act Passes?

In an interview with CNBC, GameStop CEO Ryan Cohen said that the e-retail company is considering accepting crypto payments.

“There is an opportunity to buy trading cards and do it using cryptocurrency. So, we’ll see how much real demand there is for that kind of product,” Cohen said.

The move comes as the video game retailer seeks to reduce its reliance on hardware, citing ever-increasing costs. Therefore, this change will see GameStop focus more on trading cards and collectibles, which can be paid for using crypto.

Interestingly, this purchase option will cover a wide range of crypto tokens, and is not limited to just Bitcoin.

“We’ll be looking at all kinds of cryptocurrencies… The use of crypto other than as an investment is as a hedge against inflation. I think that’s by far the biggest appeal of crypto, and the ability to actually use crypto in transactions is an opportunity, and it’s something we’re considering,” Cohen added.

The move comes less than a month after the company increased its Bitcoin reserves with a $500 million purchase. GameStop’s interest in Bitcoin has sparked speculation that the company is following the Saylorization trend.

Cohen Denies Following Saylorization Trend

However, Cohen emphasized that their move is not part of such a trend, saying that for them, it is simply a way to protect themselves from inflation and global money printing.

“We have a unique strategy, and we have a very strong balance sheet with over $9 billion in cash and marketable securities. We will use that capital wisely, just as I would use my own personal capital,” he explained.

Even so, it’s hard not to compare GameStop’s approach to that of Strategy (formerly MicroStrategy).

Documents from the SEC show that GameStop’s recent $450 million BTC purchase was facilitated through a bond issuance, which increased the total funds raised from the mid-June 2025 offering to $2.7 billion.

This mechanism resembles Strategy‘s convertible bond issuance scheme, where GameStop’s interest-free bonds will mature in 2032. Interestingly, at maturity, the bonds can be converted into shares.

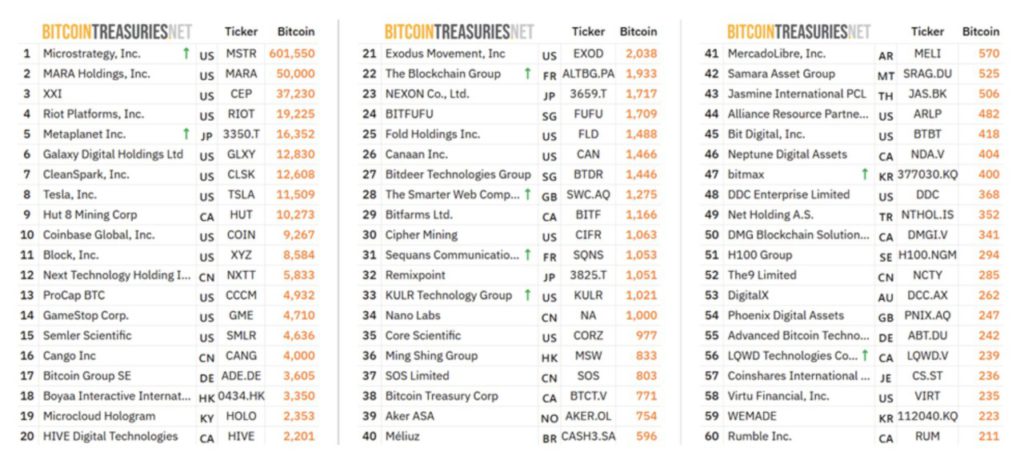

Meanwhile, data from Bitcoin Treasuries shows that GameStop now owns 4,710 BTC tokens, which are currently worth around $559 million based on current market prices.

With this amount, GameStop effectively became the 14th largest BTC-owning public company, just below Antony Pompliano’s ProCap and slightly above Semler Scientific.

Read also: 3 Crypto Trending Today (7/17/25): Number 1 Altcoin Surges 41%!

Will Bitcoin Correct Before Resuming Its Rise?

Reporting from BeInCrypto, based on the BTC/USDT trading pair on the daily timeframe (16/7), Bitcoin price is likely to experience a correction first before continuing the next increase.

This was seen after the price broke the upper limit of the Bollinger indicator at $121.388, which indicates overbought market conditions.

The RSI (Relative Strength Index) position at 69 also reinforces this view, given that an asset is considered overbought when the index hits 70.

As such, the market will likely need to experience a temporary dip before resuming the uptrend. Overall, the trend still remains bullish, as Bitcoin price is still consolidating within an ascending parallel channel pattern. As the market cools down, late bulls can capitalize on potential entry opportunities.

For starters, the 78.6% Fibonacci retracement level at $114,949 could be the initial support area, followed by the center line of the ascending parallel channel.

If these two levels fail to resist selling pressure, Bitcoin price could regain buying power around the Bollinger indicator’s center line at $111,714 or the 50-day SMA (Simple Moving Average) at $107,995.

In a more extreme scenario, the confluence of support between the lower boundary of the ascending parallel channel and the important 61.8% Fibonacci retracement level at $106,298 could be the next point of defense.

Conversely, if buying pressure increases above current levels, Bitcoin price could potentially breakout towards the next all-time high of $125,968. This would represent a jump of about 6% from the current price.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. GameStop CEO Hints at Crypto Payments, Bitcoin. Accessed on July 17, 2025

- CoinSpeaker. GameStop Hints at Crypto Payments While BTC Top Looms. Accessed on July 17, 2025

- Crypto News. GameStop May Accept Crypto Payments for Trading Card Purchases: Report. Accessed on July 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.