Bitcoin (BTC) strengthens after CPI data, what impact will it have on miners?

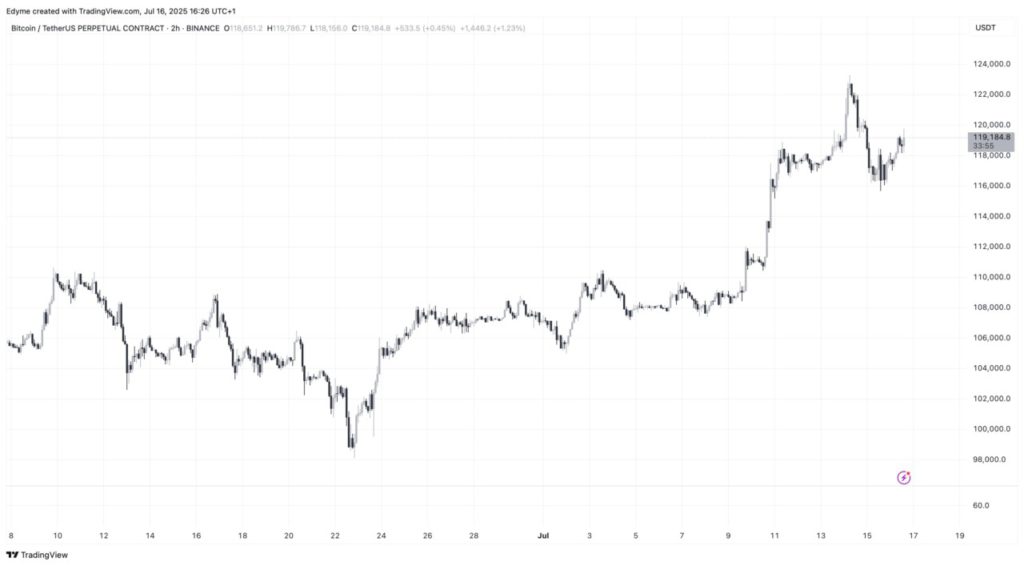

Jakarta, Pintu News – Bitcoin (BTC) seems to be recovering after suffering a dip due to the latest US Consumer Price Index (CPI) update. The cryptocurrency briefly slipped to a low near $116,000, but has now bounced back, reaching $119,248 earlier today and trading at $119,187 currently, just 3.1% below its previous record high of $123,000.

Bitcoin Miners’ Behavior Indicates Short-Term Pressure

An analyst from CryptoQuant, Avocado Onchain, recently highlighted that the Miners Position Index (MPI) has jumped to 2.7. This index measures the amount of Bitcoin (BTC) moved by miners to exchanges compared to a one-year historical average. A high MPI reading usually indicates increased selling intentions, as miners move assets onto trading platforms.

Avocado noted that the current reading may indicate mild selling pressure, which could lead to a short-term correction or sideways trading pattern. However, the analyst also emphasized that the current MPI value is still far from the high levels usually seen at the peak of market cycles. This activity may be part of a recurring intra-cycle trend where a short correction is followed by further upward movement.

Also Read: Bitcoin Price Has Skyrocketed, Here Are 5 Tips to Choose a Safe and Reliable Crypto Exchange!

Network Flow Supports Data Trends

In a separate analysis, another CryptoQuant contributor, Arab Chain, examined the implications of increased miner activity. According to its findings, network data shows a significant increase in miner-related movements, a level last seen in November 2024. Arab Chain explained that although miner activity on the blockchain is increasing, this does not automatically confirm a sale unless Bitcoin (BTC) is transferred to an exchange.

To further validate the view, Arab Chain analyzed the platform’s flow data. They observed a correlation between BTC transfers to exchanges and Bitcoin’s (BTC) recent rise above $116,000. This movement may indicate that miners find the current price favorable to sell, perhaps to cover operational costs or secure liquidity.

Further Implications of Miners’ Activities

The data also suggests that miners may be anticipating a potential correction, which could prompt more transfers and further market fluctuations. Arab Chain concluded that the extent of any correction will largely depend on whether this wave of miner activity continues. While this activity might affect short-term volatility, it doesn’t necessarily affect the long-term trajectory of Bitcoin (BTC).

Conclusion

Despite potential selling pressure from miners, the long-term outlook for Bitcoin (BTC) remains unchanged. Investors and market watchers should stay alert to these indicators, as they can provide important insights into current market dynamics.

Also Read: Bitcoin Price Breaks ATH, 5 Smart Investment Strategies to Deal with Market Volatility

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Miner Position Index Rises as Bitcoin Rebounds Post CPI Data – Here’s What It Means. Accessed on July 18, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.