Bitcoin Soars to $120,000 — Is the Road to $250K Just Beginning?

Jakarta, Pintu News – Bitcoin (BTC) is attracting attention again after setting a new record high price of $123,091.61 on July 14. At the time of this report (7/18), the price has declined slightly to $120,000 – down about 2% from its recent peak.

This mild decline hasn’t shaken market confidence, but it does raise the question: What’s Bitcoin’s next move?

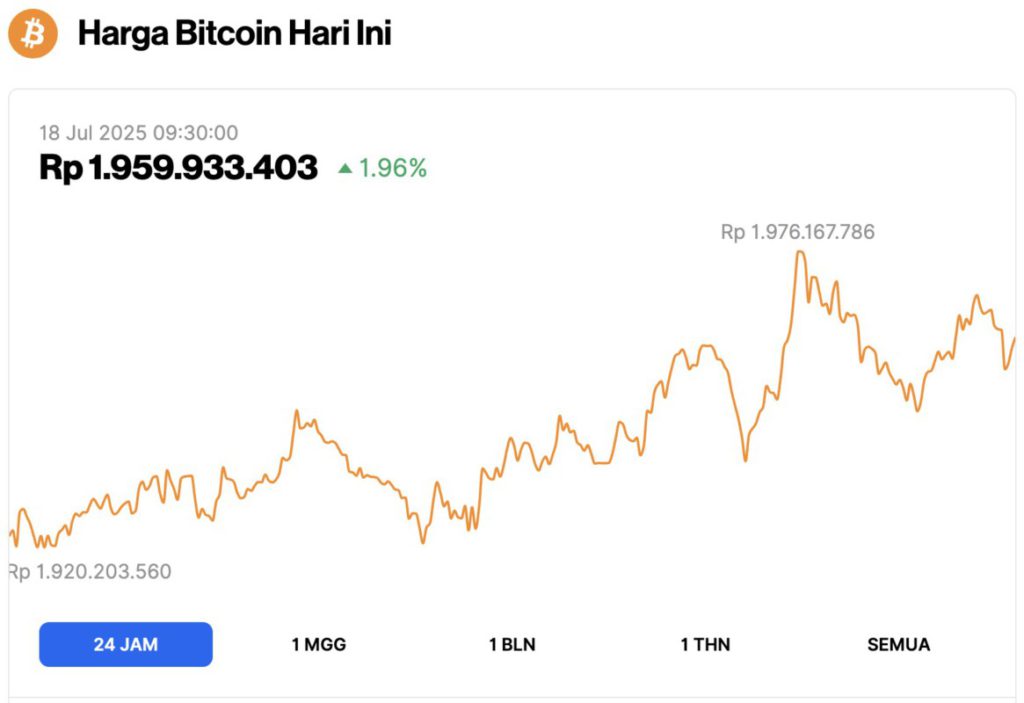

Bitcoin Price Rises 1.96% in 24 Hours

On July 18, 2025, Bitcoin was trading at $120,442, equivalent to IDR 1,959,933,403 — marking a 1.96% gain over the past 24 hours. During this time, BTC dipped to a low of IDR 1,920,203,560 and reached a high of IDR 1,976,167,786.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.39 trillion, with trading volume in the last 24 hours rising 2% to $72.4 billion.

Read also: Analysts Say Solana Could Skyrocket to $2,700 — With ETF Approval Now Almost Certain!

Bitcoin Remains Very Bullish

On the weekly chart, Bitcoin is still showing stability above the $115K zone. This zone was previously an importantsupport area during the last consolidation phase.

The high and low ranges of the week were at $122,056 and $115,701, forming an area of major concern for traders.

The short-term bias for Bitcoin remains very bullish. After moving flat for several weeks, BTC managed to break out of the resistance area and formed a strong green candle without any significant resistance.

This shows that buyers are still dominating the market, and sentiment remains upbeat.

Indicators Paint a Bullish Outlook in the Short Term

Technically, the fact that Bitcoin price remains above all major exponential moving averages is significant.

The 20-week EMA is currently at $102,555, while the longer-term EMAs are much lower: 50-week EMA at $89,887, 100-week EMA at $74,473, and 200-week EMA at $58,432. The price being well above these levels confirms a continueduptrend.

Also, the RSI is currently at 70.54 – which means it is in the overbought zone. This indicates that there will be at least a pause, or a minor correction in the near future.

However, in a strong bullish trend, the RSI can remain high for quite a long period of time before a major correction actually occurs.

Read also: XRP Price Set for a 20% Drop Before Its Next Big Surge, On-Chain Data Warns!

Volume is also starting to pick up. Although not quite a blowout, the 24-hour volume of $39.68 million shows that more and more participants are coming into the market. Typically, this leads toprice discovery.

The support and resistance areas are also clearly visible. If Bitcoin manages to break the resistance at $122K, the next target is in the range of $125K to $130K.

On the downside, it is crucial to hold above $115K. If prices fall below this level, there could be a deeper correction towards $102K – which is the position of the 20-week EMA.

Bitcoin’s Long-Term Outlook Remains Positive

Despite a slight price setback in the short term, the overall outlook for Bitcoin remains optimistic. Long-term predictions from major websites point to continued high growth potential.

According to predictions from the Changelly website, the price of Bitcoin in 2025 is expected to drop to $100,164.58, while the average price is projected to be at $135,307.03.

The highest prediction stands at $117,735.81 – indicating a relatively narrow price range but still reflecting a positive market attitude. This projection is based on previous price movements, the strength of the price trend, and the potential direction of the market in the next year.

In contrast, Digitalcoinprice expressed a much more optimistic view. They predict the price of Bitcoin could reach $256,284.22 by 2025.

They also estimate the potential ROI (Return on Investment) to be almost 104% of the current price, which puts BTC as one of the most watched assets for long-term gains.

This prediction is not just based on technical analysis alone. Demand from institutions, inflows from ETF products, tight supply, and a growing adoption rate are also major factors supporting BTC’s long-term potential.

As more investors see Bitcoin as digital gold or aninflation hedge, potential demand could outstrip supply – especially with fewer new coins entering circulation after the recent halving.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Can Bitcoin Reach $250K in 2025? Latest Data Points to Explosive Growth. Accessed on July 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.