Dogecoin Surges 13% Today — Is a $0.25 Breakout Imminent This Month?

Jakarta, Pintu News – The price of Dogecoin (DOGE) experienced a sharp spike after a significant increase in accumulation by whales.

In the past 48 hours, large holders have purchased more than 1.2 billion DOGE tokens, driving increased on-chain activity and reigniting upward momentum.

As DOGE breaks back through the important technical zone around $0.21, a number of questions arise: Will this whale-driven momentum push Dogecoin towards the $0.25 threshold?

Can DOGE sustain this breakout, or is this just a short accumulation phase before profit taking begins?

Dogecoin Price Rises 13.26% in 24 Hours

On July 18, 2025, Dogecoin saw a sharp 13.26% jump within 24 hours, trading at $0.2331, or around IDR 3,827. During the day, DOGE hit a low of IDR 3,379 before climbing to a high of IDR 3,827.

At the time of writing, Dogecoin’s market cap stands at around $35.31 billion, with trading volume rising 36% to $4.23 billion within 24 hours.

Read also: Ethereum Explodes to $3,500 — Is a Massive Run to $4,500 Just Getting Started?

Whale Activity Signals Strategic Accumulation

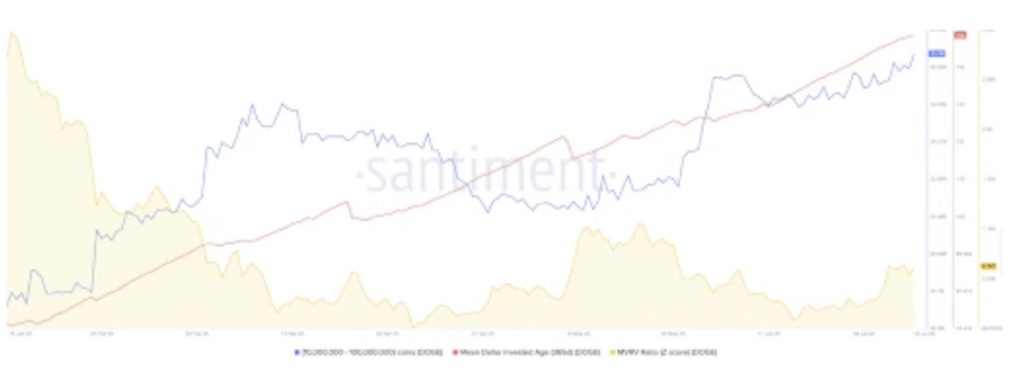

Dogecoin’s latest price surge seems to be heavily influenced by a new wave of accumulation by whales. On-chain data shows that wallets holding between 10 million and 100 million DOGE have added more than 2.3 billion tokens in just 72 hours.

These large inflows are in line with DOGE’s sharp rise from $0.197 to over $0.214, indicating strategic positioning by large holders anticipating a potential breakout.

Historically, this kind of accumulation pattern by whales often precedes significant upward momentum in Dogecoin’s price movement.

In addition, trading volumes surged well above the daily average, and derivatives data recorded a 12.7% increase in open interest, indicating growing market confidence. This behavior indicates that institutional players and large financiers are actively building positions.

If these wallets continue to absorb supply and DOGE is able to hold above the $0.212-$0.218 support range, then there is a strong technical foundation for a potential rally towards the $0.225 to $0.25 resistance zone in the short term.

Dogecoin Price Prediction: Will it Reach $0.25 This Month?

After experiencing a sharp correction in the first half of the month, the Dogecoin price has shown positive developments since the beginning of the month.

Read also: Why is XRP Going Up Today (July 18)?

The upside movement seems to be dominated by the bulls, which caused the price trend to form higher highs and higher lows consecutively-signaling the growing strength in this rally.

Currently, buying pressure continues to strengthen, which suggests that the token is preparing to test one of the important resistance zones.

The latest breakout has pushed the price to break above the previously bearish Gaussian channel. Therefore, various technical indicators are expected to turn bullish soon, which could confirm a trend reversal.

On the other hand, CMF (Chaikin Money Flow) showed a sharp rise, indicating a significant increase in fund flows into the market.

After being rejected several times in the range between $0.2430 and $0.2473, this topecoin seems ready to test the area again.

Nevertheless, the bulls need to show additional strength to help Dogecoin price break out of this crucial price range. If successful, the token could break out of the bearish pressure and reach $0.25-which in turn could activate higher price targets above it.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Dogecoin Whale Accumulation Surges, Will DOGE Price Rally Toward $0.25. Accessed on July 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.