Bitcoin (BTC) Hits $119K: Is This the Beginning of the Next Rise?

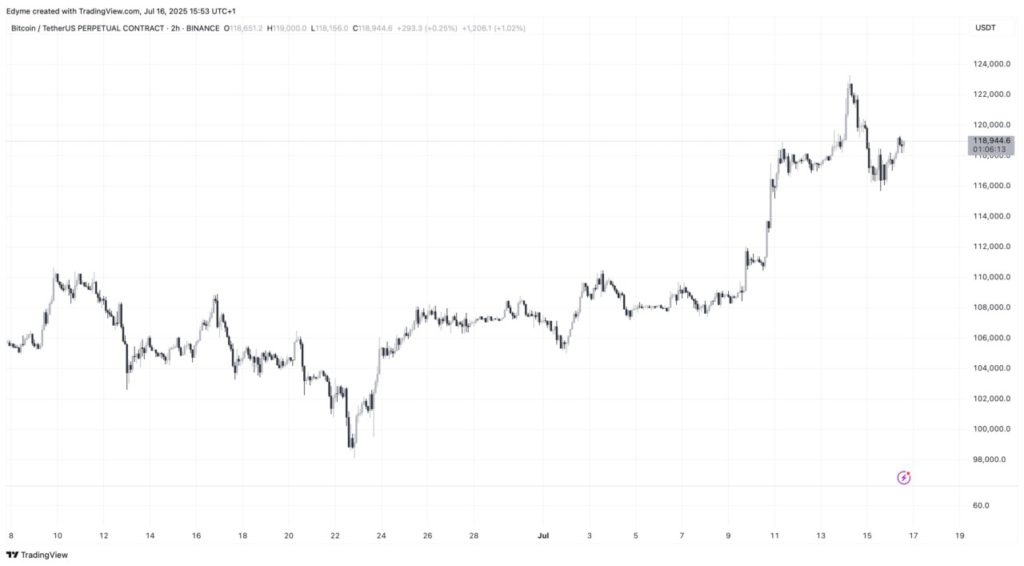

Jakarta, Pintu News – Bitcoin (BTC) has shown signs of recovery after experiencing a sharp drop in response to the latest Consumer Price Index (CPI) data from the United States. On July 15, the price of Bitcoin (BTC) had dropped to $116,000 after news of inflation rising to 2.7% in June, triggered by persistent concerns about tariffs from the Trump administration.

Currently, Bitcoin (BTC) is trading at $118,439, showing a 1.8% gain in the last 24 hours, indicating a return of investor confidence despite the recent volatility.

Bitcoin (BTC) Market Key Indicators

Trader Oasis, an analyst at CryptoQuant, has analyzed various indicators that relate to the current price movement of Bitcoin (BTC). This analysis includes open interest, the Coinbase premium index, and funding rates. Trader Oasis began by saying that when Bitcoin (BTC) managed to break the $107,000 resistance, it signaled the beginning of a potential distribution phase.

The divergence between price and open interest is an early bullish signal that precedes the asset’s price increase. Currently, with prices and open interest rising together, some see this as a sign of strengthening momentum in the market.

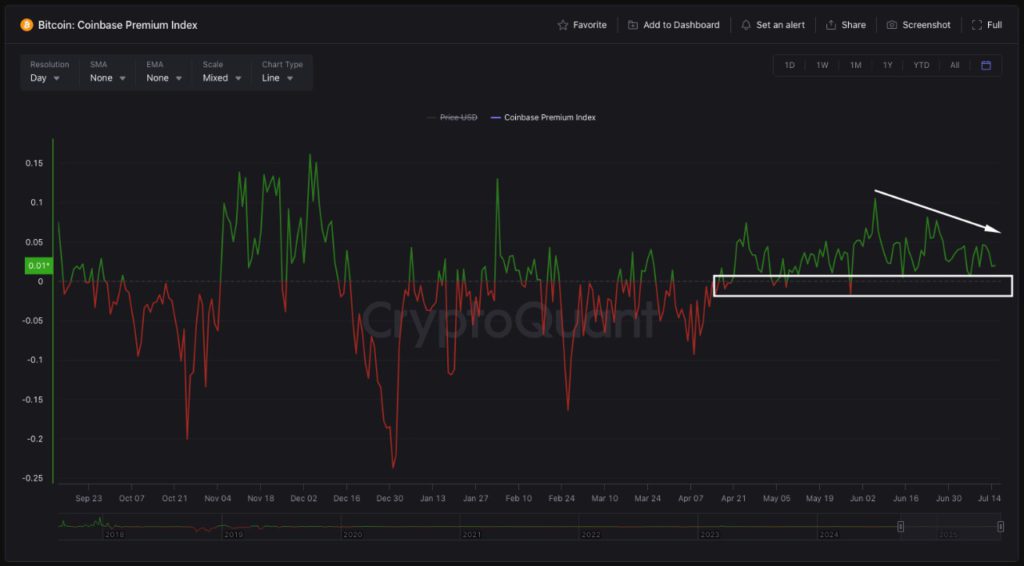

Oasis also reviewed Coinbase’s premium index, which remained above zero, usually considered an indication of institutional demand. However, the flat behavior of this indicator, despite the price increase, could imply that large entities are securing profits.

Also Read: XRP Price Surges Again: Momentum Rising, Eyeing Key Resistance

Market Dynamics and Profit Taking

Separate analysis by Crazzyblockk on CryptoQuant shows that Bitcoin (BTC) investors have realized $9.29 billion in gains in a single day, setting a record high for such flows. This surge in realized gains and losses (PnL) reflects widespread profit-taking following the recent Bitcoin (BTC) price rally, especially among short-term holders.

On Binance in particular, PnL realization is still below record highs but has seen an increase in share compared to other exchanges. Data shows that on some days, the share of profits realized by Binance has reached up to 60%, reinforcing its important role in shaping market behavior. Crazzyblockk concluded that the concentrated profit-taking, led by Binance users, could signal a shift in market dynamics.

Bitcoin (BTC) Conclusion and Future Projections

With various indicators showing mixed signals, the Bitcoin (BTC) market is currently at a crossroads. While there are signs of recovery and growing market confidence, investors should remain wary of the potential volatility that could arise from global dynamics and monetary policy. In-depth analysis and understanding of market indicators will be crucial in navigating these uncertain times.

Also Read: Bitcoin Price Breaks ATH, 5 Smart Investment Strategies to Deal with Market Volatility

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Recovers to $119K, But Key Indicators Show Mixed Signals. Accessed on July 18, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.