MicroStrategy Breaks Market Capitalization Record! Michael Saylor Adds Bitcoin!

Jakarta, Pintu News – Michael Saylor’s MicroStrategy (MSTR) technology company made history once again after its shares closed at an all-time high market capitalization. This surge in MSTR’s stock price occurred alongside Bitcoin’s (BTC) price movement which also approached its new record high, marking a new chapter in crypto accumulation strategies by large public companies.

MicroStrategy Shares “Gearing Up” to an All Time High

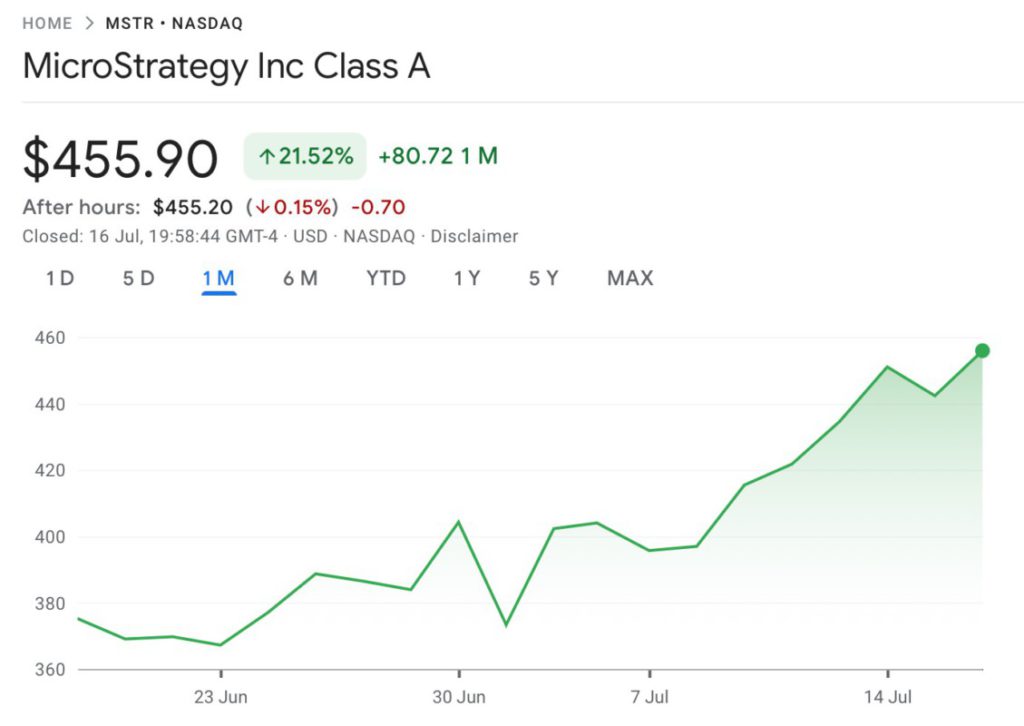

On Wednesday, MicroStrategy closed the day at US$455.90 (around Rp7.4 million per share), up 21.5% over the past month. At the same time, the price of Bitcoin (BTC) rose 10% in the past month, briefly touching the level of US$122,884 (Rp2 billion) before a slight correction to around US$118,413 (Rp1.93 billion).

Options analysts such as Sean Trades mentioned that MSTR stock is currently “preparing” to move towards new highs. However, MSTR’s share price is still 19% below its all-time record high of US$543 per share reached on November 20.

MicroStrategy’s Bitcoin accumulation strategy continues, one of which is by issuing new shares to increase their crypto reserves. This move proved to have a domino effect on the company’s stock price, which has now become a kind of proxy for Bitcoin’s movement on US exchanges.

Also Read: XRP Price Surges Again: Momentum Rising, Eyeing Key Resistance

MicroStrategy, the S&P 500, and the Latest Bitcoin Buyout

MicroStrategy has now entered its 11th day as an S&P 500 qualifying candidate, according to Jeff Walton of Strive Funds Bitcoin Strategy. This comes on the heels of the company’s latest Bitcoin buying spree, which saw the purchase of 4,225 BTC worth US$472.5 million (Rp7.7 trillion) in just the past week.

In an interview, Walton even predicted MicroStrategy could become “the number one public stock in the market” due to the future financial strength driven by the Bitcoin strategy. It should be noted, however, that in the last three quarters, MicroStrategy has still recorded net losses-signaling that investment risk remains high.

The company is scheduled to release its latest financial report on August 5, and the public is waiting to see if their crypto accumulation strategy is able to generate real profits amid market volatility.

Conclusion: MSTR and Bitcoin, Two “Nearly Inseparable” Assets

The phenomenon of MicroStrategy buying up Bitcoin and driving its stock price up shows how crypto and capital markets are now influencing each other. With a record-breaking market capitalization, a BTC buyout worth hundreds of millions of dollars, and a strategic position in the S&P 500, MicroStrategy is asserting itself as a pioneering public company that is putting its financial future in cryptocurrency.

However, investors are reminded that high risk is inherent in Bitcoin’s volatility and the company’s financial performance has not been entirely positive. Doing your own research and exercising caution is still required before making an investment decision.

Also Read: $2 Billion Fresh Money Injection, Bitcoin Ready to Fly Again? Analyst: Big Crypto Rally Signals!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Michael Saylor’s Strategy All-Time High Market Cap as Bitcoin Surges. Accessed July 17, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.