Bitcoin Hits $118K Today (July 21) — 43% Social Buzz Hints It’s the Perfect Time to Buy!

Jakarta, Pintu News – According to Cointelegraph, almost half of all crypto-related discussions on social media this week focused on Bitcoin (BTC), as it reached new highs.

This level of dominance could be a sign that Bitcoin has reached a local peak and may be due for a short-term decline, according to sentiment analysis platform Santiment.

“When Bitcoin’s market value passed the $123.1K mark for the first time in its 17-plus year history, there was a historic surge in social dominance,” Santiment analyst Brian Quinlivan said in a report.

Then, how is the current Bitcoin price movement?

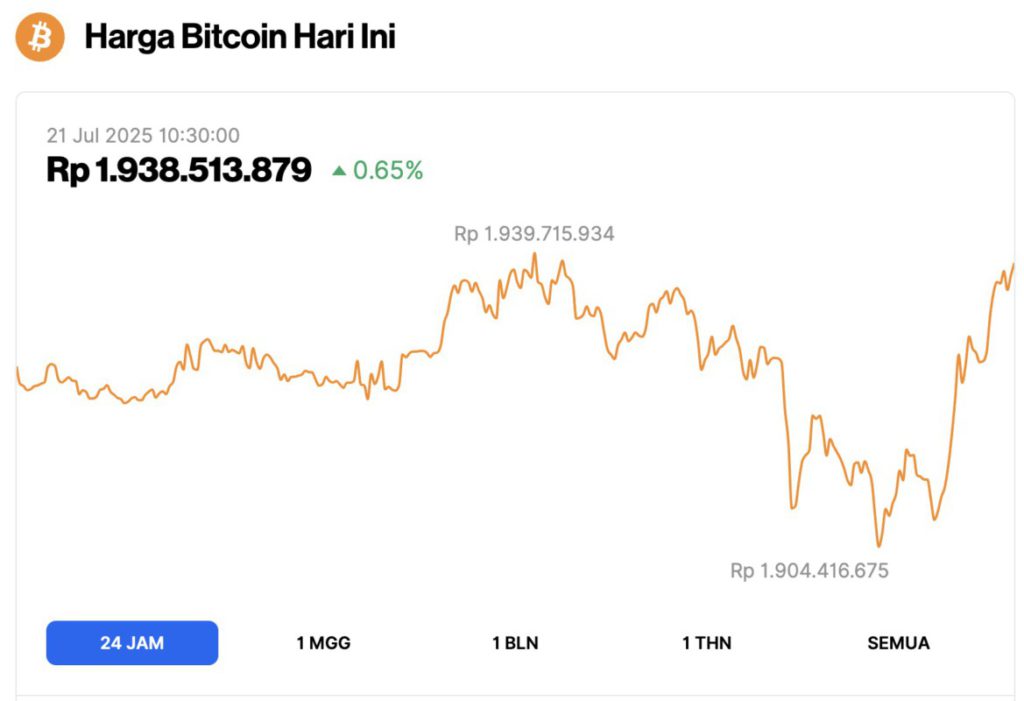

Bitcoin Price Up 0.65% in 24 Hours

On July 21, 2025, Bitcoin was trading at $118,610, equivalent to IDR 1,938,513,879 — marking a modest 0.65% gain over the past 24 hours. During this timeframe, BTC dipped to a low of IDR 1,904,416,675 and peaked at IDR 1,939,715,934.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.36 trillion, with trading volume in the last 24 hours up 33% to $61.11 billion.

Read also: Dogecoin Rockets 7% on July 21 — Is a Mind-Blowing 380% Surge to $1 Next?

Spike in Bitcoin Conversations Triggers Price Drop

“43.06% of all crypto discussions were about $BTC right when the coin’s market value peaked,” Quinlivan said.

He added that the sudden spike shows that many retail traders are experiencing FOMO (fear of missing out), which contradicts the view of some other industry players that retail investors have not really entered the market.

On July 11, Bitwise’s Head of Research, André Dragosch, stated that despite Bitcoin reaching an all-time high, retail investor engagement is still “barely visible.”

Three days later, on Monday, Bitcoin hit a record high of $123,100 on the Binance platform, before falling back to $117,011 at the time of writing, according to data from Nansen.

Quinlivan emphasizes that while the increased sentiment may seem positive, history shows that spikes in Bitcoin conversations on social media are often followed by price drops.

“Wait for the euphoria to die down, and you’ll most likely find the next important entry point,” he says.

This statement follows Quinlivan’s previous warning, which noted that similar spikes in trader optimism on June 11 and July 7 were also followed by Bitcoin price drops.

Read also: These 3 Ethereum L2 Tokens Just Skyrocketed Nearly 100% — Are They About to Explode Again?

Analysts Still Optimistic that Bitcoin Price Increase Will Continue

Despite concerns about a potential short-term decline, some analysts believe Bitcoin’s uptrend is likely to continue.

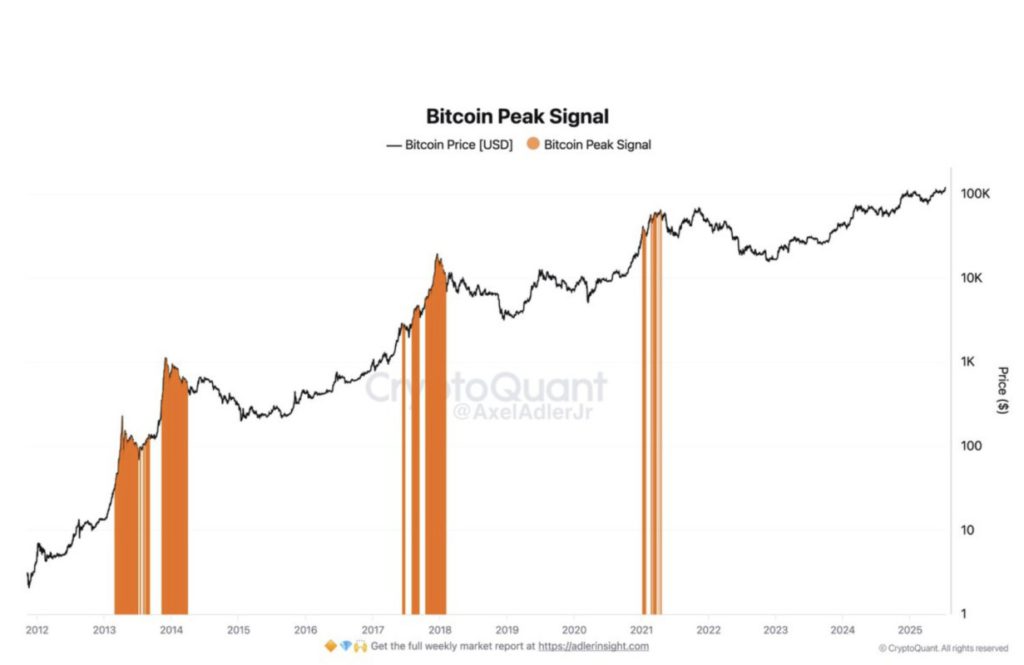

On Wednesday, CryptoQuant analyst Axel Adler Jr. pointed out that the absence of a Bitcoin peak signal – a metric that usually signals the market is overheating – suggests that “we haven’t reached the top yet.”

Meanwhile, Head of Franchise Trading at Galaxy Digital, Michael Harvey, said that after the surge to an all-time high, Bitcoin may go through a brief consolidation phase.

However, he also thinks there is still a chance for Bitcoin prices to rise again before the end of July.

“Consolidation around current prices is my baseline scenario, given the huge rally and new record highs,” Harvey told Cointelegraph.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin 43% social chat dominance suggests ‘key entry point’ ahead. Accessed on July 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.